- United States

- /

- Banks

- /

- NasdaqGS:BFST

Does Business First Bancshares (NASDAQ:BFST) Deserve A Spot On Your Watchlist?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Business First Bancshares (NASDAQ:BFST), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for Business First Bancshares

How Fast Is Business First Bancshares Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Impressively, Business First Bancshares has grown EPS by 26% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

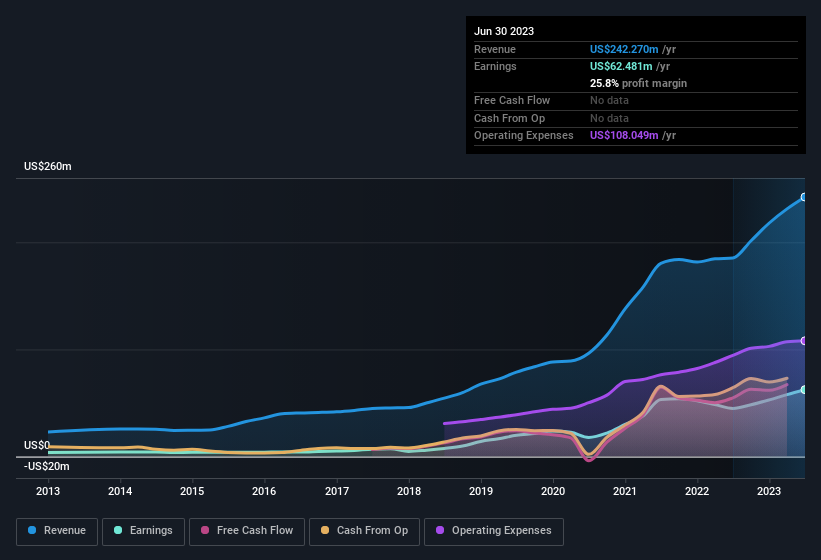

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Our analysis has highlighted that Business First Bancshares' revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. EBIT margins for Business First Bancshares remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 31% to US$242m. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Business First Bancshares' forecast profits?

Are Business First Bancshares Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Any way you look at it Business First Bancshares shareholders can gain quiet confidence from the fact that insiders shelled out US$729k to buy stock, over the last year. When you contrast that with the complete lack of sales, it's easy for shareholders to be brimming with joyful expectancy. We also note that it was the Executive VP & Chief Operations Officer, Keith Mansfield, who made the biggest single acquisition, paying US$146k for shares at about US$14.60 each.

The good news, alongside the insider buying, for Business First Bancshares bulls is that insiders (collectively) have a meaningful investment in the stock. As a matter of fact, their holding is valued at US$36m. That shows significant buy-in, and may indicate conviction in the business strategy. As a percentage, this totals to 6.8% of the shares on issue for the business, an appreciable amount considering the market cap.

Should You Add Business First Bancshares To Your Watchlist?

You can't deny that Business First Bancshares has grown its earnings per share at a very impressive rate. That's attractive. On top of that, insiders own a significant stake in the company and have been buying more shares. So it's fair to say that this stock may well deserve a spot on your watchlist. Still, you should learn about the 3 warning signs we've spotted with Business First Bancshares (including 1 which is a bit concerning).

The good news is that Business First Bancshares is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Business First Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:BFST

Business First Bancshares

Operates as the bank holding company for b1BANK that provides various banking products and services in Louisiana and Texas.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026