- United States

- /

- Banks

- /

- NasdaqGS:BCML

This Is Why BayCom Corp's (NASDAQ:BCML) CEO Compensation Looks Appropriate

Key Insights

- BayCom's Annual General Meeting to take place on 18th of June

- Salary of US$723.1k is part of CEO George Guarini's total remuneration

- The total compensation is similar to the average for the industry

- BayCom's EPS grew by 21% over the past three years while total shareholder return over the past three years was 9.9%

CEO George Guarini has done a decent job of delivering relatively good performance at BayCom Corp (NASDAQ:BCML) recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 18th of June. Here is our take on why we think the CEO compensation looks appropriate.

Check out our latest analysis for BayCom

Comparing BayCom Corp's CEO Compensation With The Industry

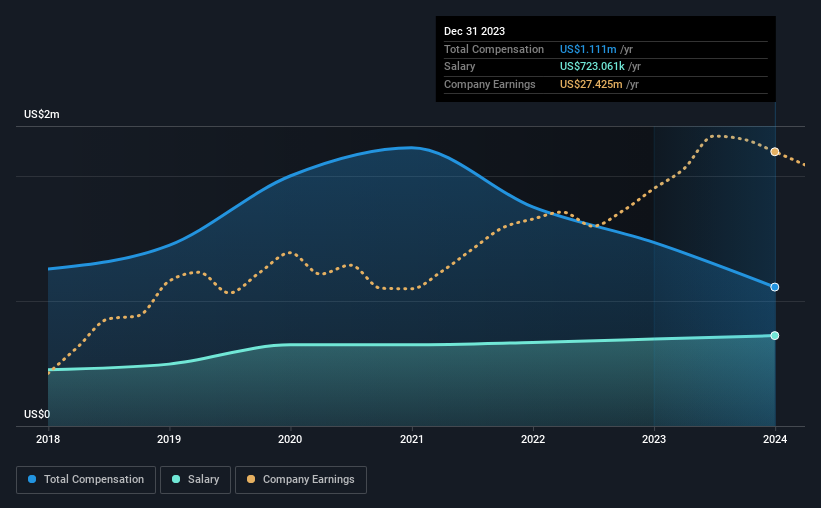

At the time of writing, our data shows that BayCom Corp has a market capitalization of US$217m, and reported total annual CEO compensation of US$1.1m for the year to December 2023. We note that's a decrease of 24% compared to last year. We note that the salary portion, which stands at US$723.1k constitutes the majority of total compensation received by the CEO.

In comparison with other companies in the American Banks industry with market capitalizations ranging from US$100m to US$400m, the reported median CEO total compensation was US$1.1m. This suggests that BayCom remunerates its CEO largely in line with the industry average. Furthermore, George Guarini directly owns US$5.1m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$723k | US$695k | 65% |

| Other | US$388k | US$773k | 35% |

| Total Compensation | US$1.1m | US$1.5m | 100% |

Talking in terms of the industry, salary represented approximately 45% of total compensation out of all the companies we analyzed, while other remuneration made up 55% of the pie. It's interesting to note that BayCom pays out a greater portion of remuneration through salary, compared to the industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

BayCom Corp's Growth

BayCom Corp's earnings per share (EPS) grew 21% per year over the last three years. Revenue was pretty flat on last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's nice to see revenue heading northwards, as this is consistent with healthy business conditions. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has BayCom Corp Been A Good Investment?

BayCom Corp has generated a total shareholder return of 9.9% over three years, so most shareholders wouldn't be too disappointed. Although, there's always room to improve. As a result, investors in the company might be reluctant about agreeing to increase CEO pay in the future, before seeing an improvement on their returns.

In Summary...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. However, we still think that any proposed increase in CEO compensation will be examined closely to make sure the compensation is appropriate and linked to performance.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We did our research and identified 2 warning signs (and 1 which doesn't sit too well with us) in BayCom we think you should know about.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if BayCom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:BCML

BayCom

Operates as the bank holding company for United Business Bank that provides various financial services to small and mid-sized businesses, service professionals, and individuals.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion