- United States

- /

- Banks

- /

- NasdaqGS:BANF

Will Fed Rate Cuts and a Dovish Outlook Change BancFirst's (BANF) Investment Narrative?

Reviewed by Simply Wall St

- Earlier this month, the Federal Reserve reduced its benchmark interest rate by 25 basis points and indicated that further rate cuts may be on the horizon before year-end.

- This policy shift has sparked increased optimism for regional banks like BancFirst, as lower borrowing costs can support loan demand and ease financial conditions.

- We'll explore how the Federal Reserve’s dovish outlook could reshape BancFirst's investment narrative amid changing monetary policy expectations.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is BancFirst's Investment Narrative?

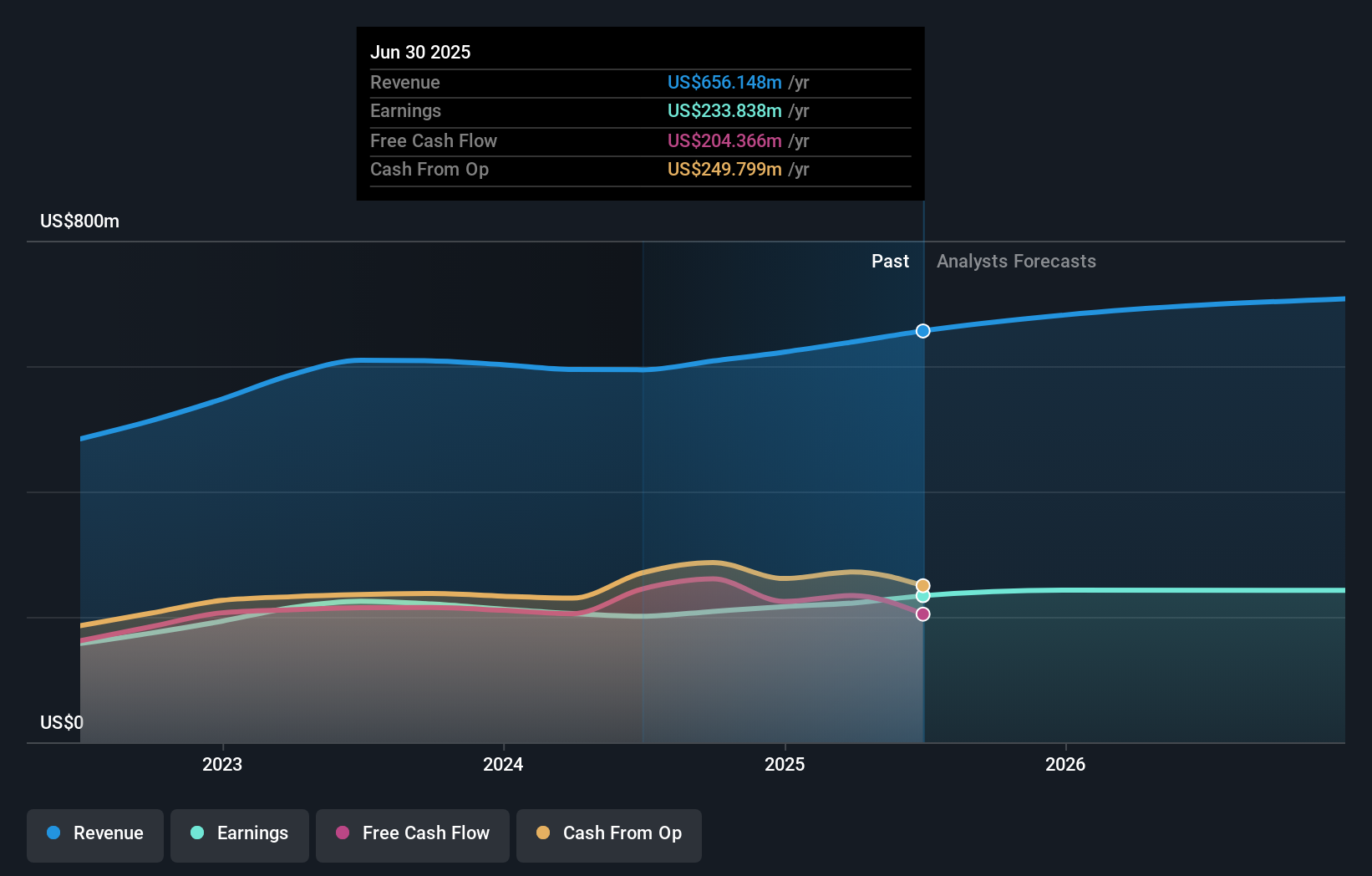

To be a shareholder in BancFirst, you’d need conviction in the bank’s ability to grow earnings steadily in a challenging regional banking environment, while maintaining disciplined risk management and rewarding shareholders with reliable dividends. The recent 25 basis point rate cut by the Federal Reserve shakes up short-term catalysts: while it improves the outlook for loan demand and can ease funding costs, it also risks compressing net interest margins, historically a key earnings driver for BancFirst. Based on market reaction, the Fed’s dovish stance is supporting sentiment and benefitted the stock price. However, investor concerns persist over real estate loan charge-offs and the pressure from an above-average price-to-earnings ratio. If lower rates persist or deepen, previously-flagged catalysts like margin strength may be less reliable and risks from credit quality could become more pronounced. But with optimism, potential margin compression is something shareholders should keep an eye on.

Despite retreating, BancFirst's shares might still be trading 29% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore another fair value estimate on BancFirst - why the stock might be worth just $132.67!

Build Your Own BancFirst Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BancFirst research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free BancFirst research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BancFirst's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BancFirst might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BANF

BancFirst

Operates as the bank holding company for BancFirst that provides a range of commercial banking services to retail customers, and small to medium-sized businesses in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives