- United States

- /

- Banks

- /

- NasdaqGS:BANF

Here's Why We Think BancFirst (NASDAQ:BANF) Might Deserve Your Attention Today

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like BancFirst (NASDAQ:BANF), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for BancFirst

How Fast Is BancFirst Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. Impressively, BancFirst has grown EPS by 28% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

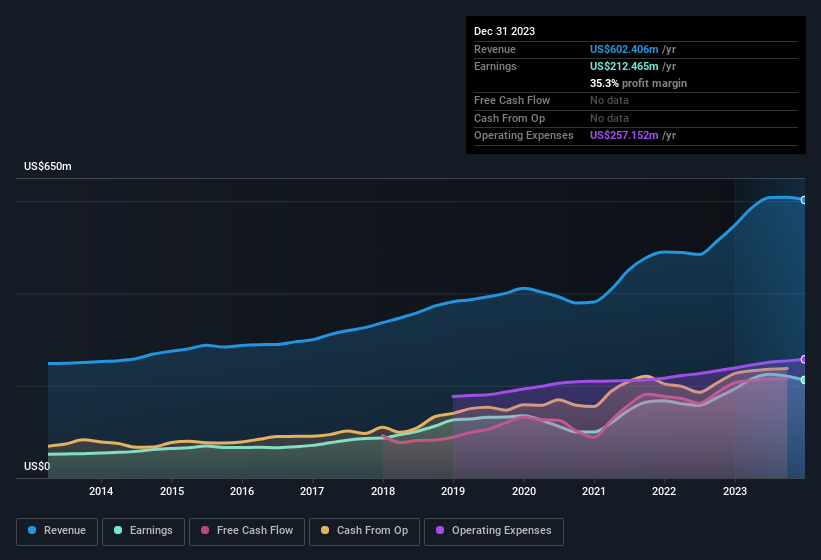

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of BancFirst's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. BancFirst maintained stable EBIT margins over the last year, all while growing revenue 10% to US$602m. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for BancFirst.

Are BancFirst Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's good to see BancFirst insiders walking the walk, by spending US$596k on shares in just twelve months. This, combined with the lack of sales from insiders, should be a great signal for shareholders in what's to come. We also note that it was the company insider, Dennis Brand, who made the biggest single acquisition, paying US$369k for shares at about US$74.00 each.

On top of the insider buying, it's good to see that BancFirst insiders have a valuable investment in the business. Notably, they have an enviable stake in the company, worth US$990m. Coming in at 34% of the business, that holding gives insiders a lot of influence, and plenty of reason to generate value for shareholders. Looking very optimistic for investors.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. The cherry on top is that the CEO, David Harlow is paid comparatively modestly to CEOs at similar sized companies. Our analysis has discovered that the median total compensation for the CEOs of companies like BancFirst with market caps between US$2.0b and US$6.4b is about US$6.4m.

The CEO of BancFirst only received US$876k in total compensation for the year ending December 2022. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Is BancFirst Worth Keeping An Eye On?

You can't deny that BancFirst has grown its earnings per share at a very impressive rate. That's attractive. On top of that, insiders own a significant stake in the company and have been buying more shares. These things considered, this is one stock worth watching. You should always think about risks though. Case in point, we've spotted 1 warning sign for BancFirst you should be aware of.

Keen growth investors love to see insider buying. Thankfully, BancFirst isn't the only one. You can see a a curated list of companies which have exhibited consistent growth accompanied by recent insider buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if BancFirst might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:BANF

BancFirst

Operates as the bank holding company for BancFirst that provides a range of commercial banking services to retail customers, and small to medium-sized businesses in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives