- United States

- /

- Banks

- /

- NasdaqGS:BANF

BancFirst (BANF): Reassessing Valuation After Federal Reserve Interest Rate Cut Spurs Investor Optimism

Reviewed by Kshitija Bhandaru

If you have been weighing what to do with BancFirst (BANF) lately, the Federal Reserve's latest move may have caught your eye. The Fed just cut its benchmark interest rate by 25 basis points and suggested that more reductions could be on the horizon. With borrowing poised to become less expensive, investors have grown more optimistic about regional banks like BancFirst. This has led to a sharp uptick in bank stock valuations as markets recalibrate expectations.

For BancFirst, the positive sentiment comes on the back of an already strong year. The company’s shares are up 24% over the past twelve months, building momentum as investors anticipate the impact of looser monetary policy. While regional banks struggled earlier in the year, the Fed’s dovish turn has seemingly reignited market interest, propelling shares higher and shifting the narrative on growth potential.

With this recent rally, should investors see BancFirst as undervalued in light of changing rates, or is the market already baking in expectations for future growth?

Price-to-Earnings of 18.8x: Is it justified?

BancFirst is currently trading at a Price-to-Earnings (P/E) ratio of 18.8x, which is higher than both its industry peers and estimated fair value benchmarks. This suggests the market is assigning a premium to BancFirst’s earnings compared to typical U.S. banks.

The P/E ratio measures how much investors are willing to pay for one dollar of the company’s earnings. For banks, a higher P/E can mean the market expects stronger or more stable future profits, but it can also indicate that the shares are expensive relative to fundamentals.

In BancFirst's case, the market appears to be pricing in greater optimism than is warranted by historical growth rates, given that the company's P/E is above both the peer average and the overall industry. This premium may not be fully justified if future earnings growth slows.

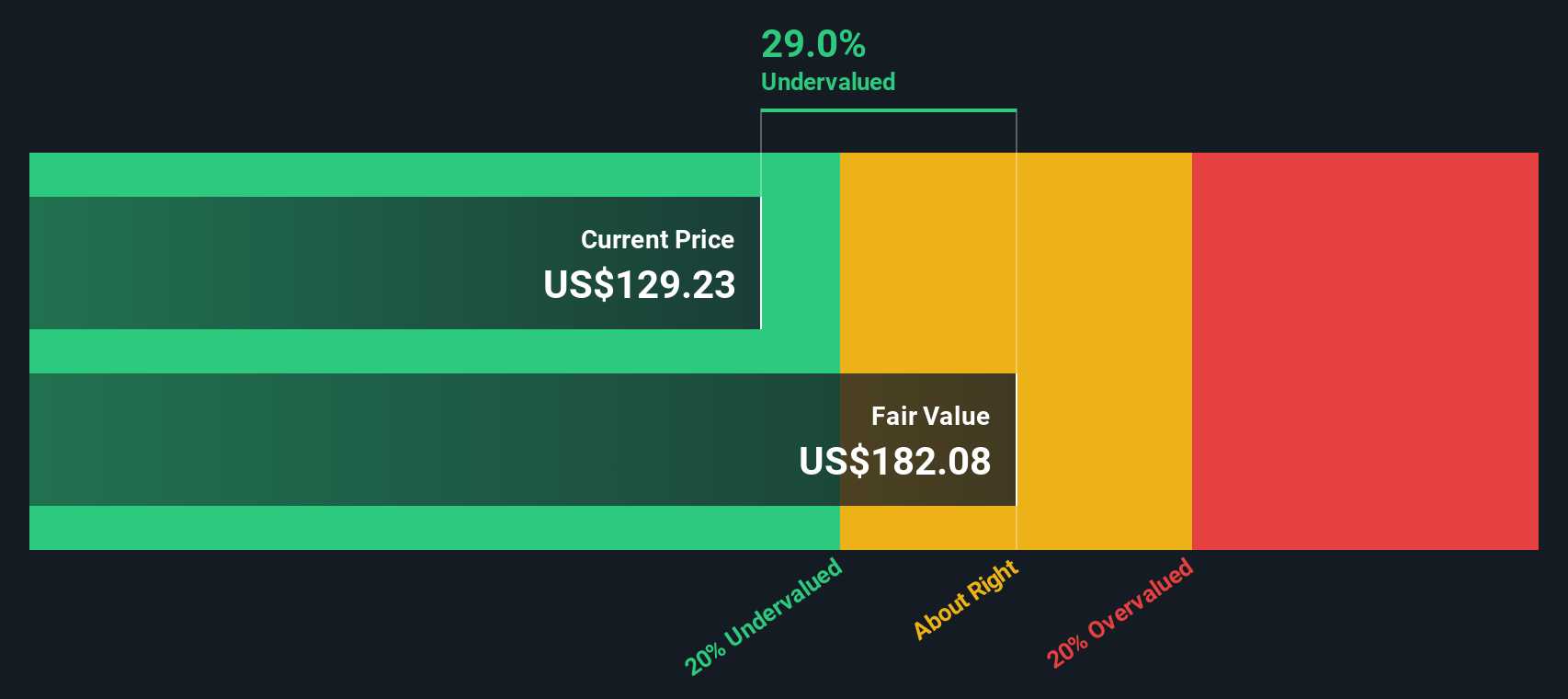

Result: Fair Value of $182.08 (UNDERVALUED)

See our latest analysis for BancFirst.However, slower revenue and profit growth, or a reversal in rate policy, could quickly dampen investor enthusiasm and lead to a market correction.

Find out about the key risks to this BancFirst narrative.Another View: What Does the SWS DCF Model Say?

While market multiples suggest BancFirst is trading at a premium, our SWS DCF model offers a different perspective. This method takes future cash flows into account and suggests BancFirst may be undervalued. So, where does the truth really lie?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own BancFirst Narrative

If you see things differently or want to dig deeper into the numbers, you can build and customize your own perspective in just a few minutes using our tools. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding BancFirst.

Looking for More Investment Ideas?

Smart investors keep expanding their horizons. Don’t wait on the sidelines while new opportunities take shape. Supercharge your watchlist with these timely stock themes and prepare yourself for what’s next.

- Unleash growth potential by backing innovators focused on artificial intelligence breakthroughs with our curated list of AI penny stocks.

- Strengthen your income strategy by tapping into companies offering consistently high yields via our exclusive dividend stocks with yields > 3%.

- Stay ahead of market trends by targeting undervalued gems primed for re-rating, all with the help of our purpose-built undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BancFirst might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BANF

BancFirst

Operates as the bank holding company for BancFirst that provides a range of commercial banking services to retail customers, and small to medium-sized businesses in the United States.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives