- United States

- /

- Banks

- /

- NasdaqGS:BANF

BancFirst (BANF) Earnings Top Five-Year Trend, Reinforcing Reliability Narrative

Reviewed by Simply Wall St

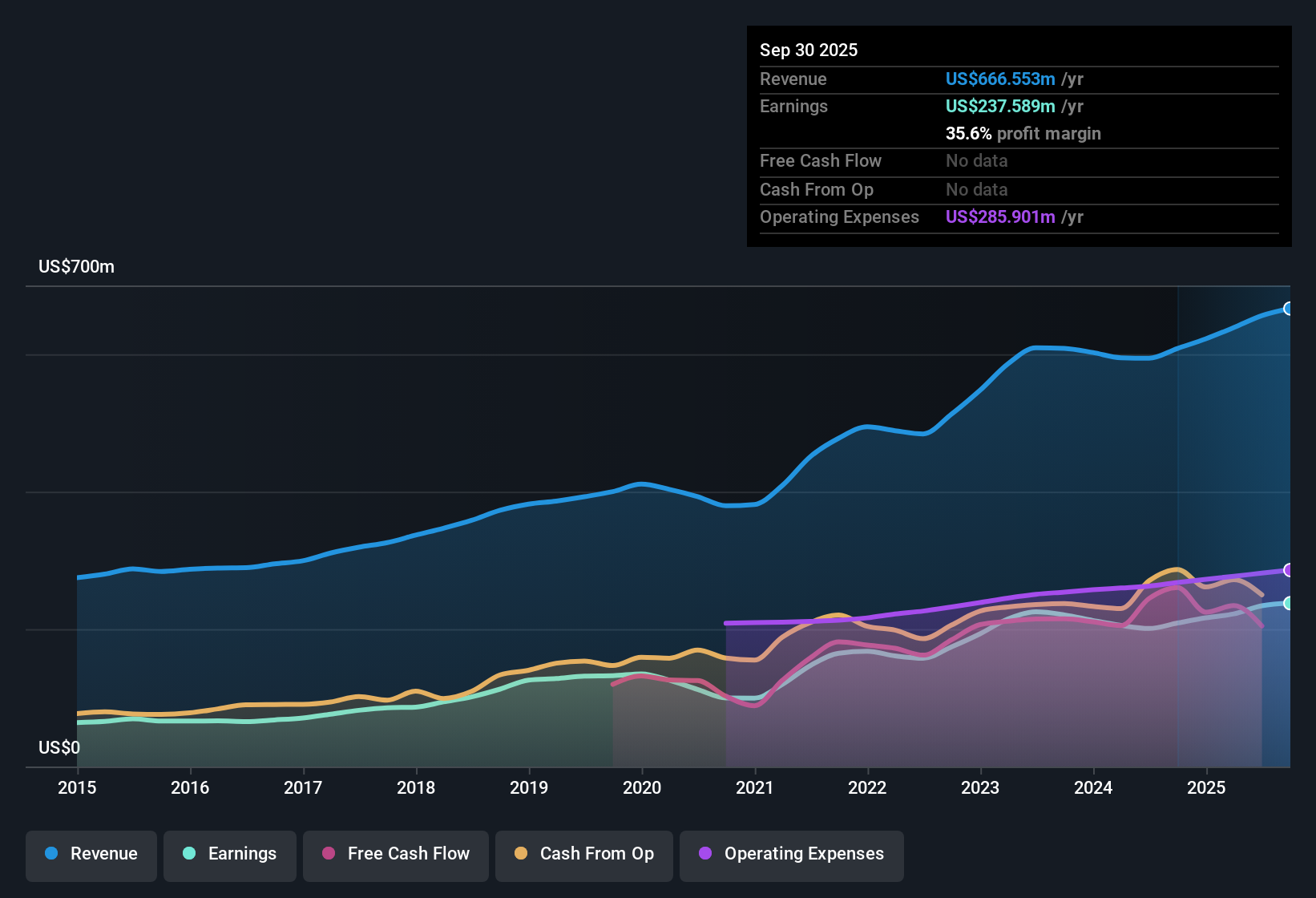

BancFirst (BANF) posted a 16.4% earnings growth over the past year, outpacing its own five-year average rate of 14.3% per year. Net profit margins improved to 35.6% from last year’s 33.8%, while shares currently trade at $112.93, below the discounted cash flow fair value estimate of $181.68. With an attractive dividend and a history of strong earnings, the company’s steady margin expansion and premium Price-To-Earnings Ratio are likely to draw both optimism and scrutiny as investors weigh future growth forecasts against current valuations.

See our full analysis for BancFirst.Next up, we will see how these headline results measure against the prevailing narratives for BancFirst. This will highlight where the numbers back up the stories and where they challenge them.

Curious how numbers become stories that shape markets? Explore Community Narratives

Dividend and Profit Quality Stand Out

- The company is distinguished by both high-quality earnings and an attractive dividend, according to the latest filing summary.

- Examining these points against the prevailing market view, steady growth in profit and dividends often draws investor focus when uncertainties rise.

- Investors watching BancFirst’s pattern of growing profit may interpret this reliability as a reason to value the stock higher than more erratic peers.

- On the flip side, an attractive dividend in a climate where slowdowns are forecast hints that BancFirst leans into stability. Its future performance may be more muted if forecasted earnings and revenue growth hold true.

Growth Projections Lag US Banks

- BancFirst’s forward earnings growth is forecast at just 2% annually and revenue growth at 4.8% per year, well below US market averages of 15.6% and 10.1% respectively.

- Market observers see this moderate outlook as a double-edged sword.

- Ambitious investors may be discouraged by expectations that BancFirst lags the overall US banking sector, suggesting less exciting returns ahead when stacked next to higher-growth peers.

- However, some may view stability and slower growth as a reasonable tradeoff for lower risk, especially if BancFirst continues to maintain high margins even as it grows less quickly than the broader market.

Premium Valuation Despite Discount to DCF

- BancFirst shares trade at $112.93, which is below the calculated DCF fair value of $181.68, but the company’s Price-To-Earnings Ratio sits at 16.1x. This is higher than both its peer group (12.4x) and the US banks industry average (11.2x).

- This pricing creates a real tension in the investment case.

- The prevailing market view notes that although the DCF estimate signals valuation upside, the premium P/E ratio suggests investors already price in some of BancFirst’s safety and reliability, making it costlier than sector peers even as its forecast growth is slower.

- The gap between the discounted cash flow fair value and the market price offers potential opportunity for those who think BancFirst’s stability deserves a premium. However, it also signals caution for buyers who prize growth over steady income and defensive qualities.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on BancFirst's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Although BancFirst demonstrates reliable profits, its muted future growth and premium valuation may limit upside when compared to faster-growing peers.

If you’re looking for more dynamic earnings potential, discover established companies with stronger growth forecasts by using our high growth potential stocks screener (50 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BancFirst might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BANF

BancFirst

Operates as the bank holding company for BancFirst that provides a range of commercial banking services to retail customers, and small to medium-sized businesses in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives