- United States

- /

- Banks

- /

- NasdaqCM:ACNB

ACNB (ACNB) One-Off $11.7 Million Loss Drives Margin Decline, Testing Bullish Narratives

Reviewed by Simply Wall St

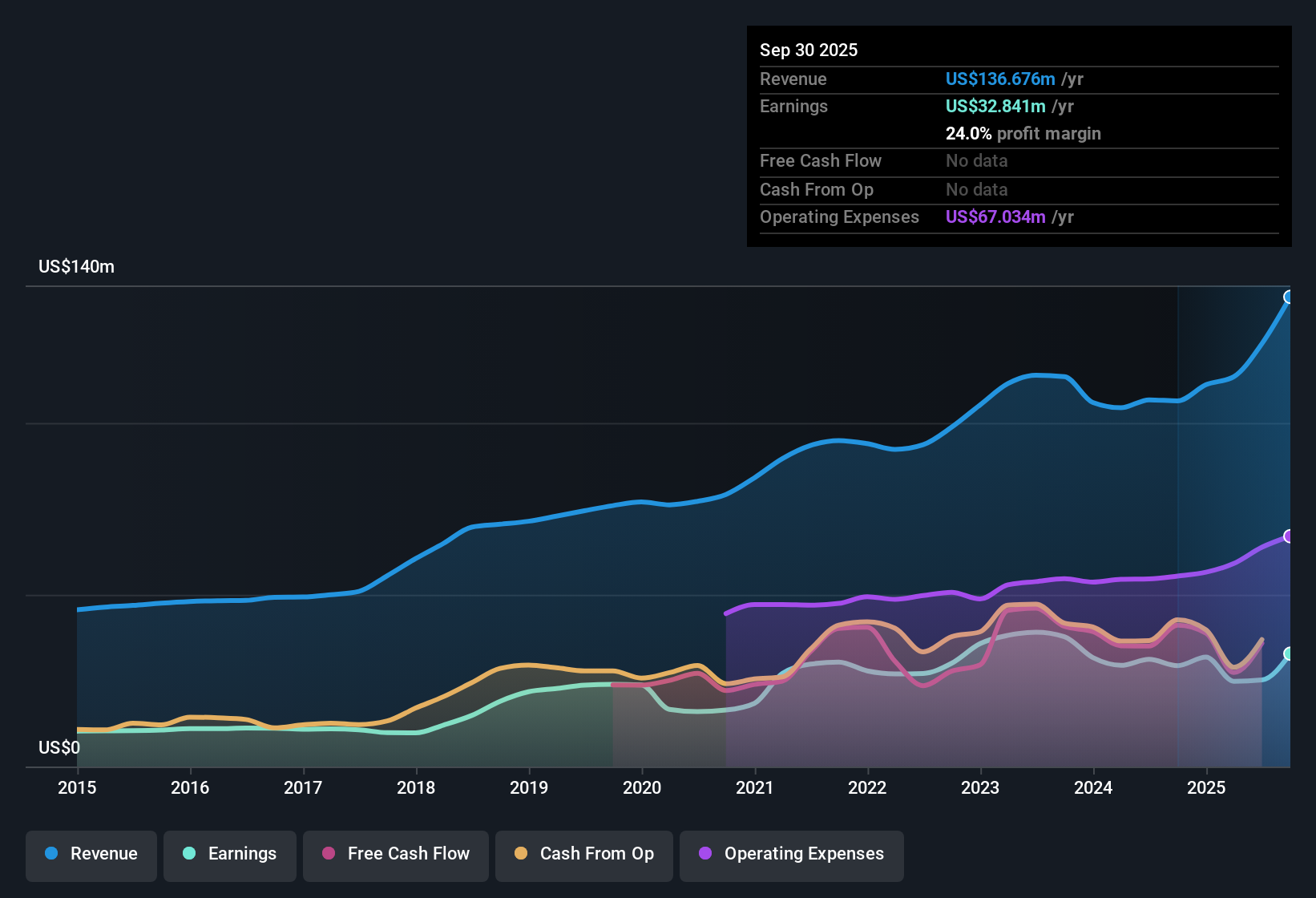

ACNB (ACNB) reported net profit margins of 20.5%, marking a drop from 29.2% in the previous year as a one-off loss of $11.7 million weighed on results through September 2025. Looking ahead, the company is expected to deliver annual earnings growth of 19.3%, outpacing the US market average of 15.5%. However, revenue growth is forecast at a more modest 3.8% per year, compared to the market's 10%. For investors, attractive dividends and a share price below the estimated fair value of $80.82 offer potential upside, even as premium valuation and margin pressures remain in focus.

See our full analysis for ACNB.Next, we’ll see how ACNB’s headline numbers compare with the most widely followed narratives. Some market views are likely to be confirmed, while others may be put to the test.

Curious how numbers become stories that shape markets? Explore Community Narratives

One-Off Loss of $11.7 Million Hits Quality Metrics

- The recent $11.7 million one-off loss drove ACNB’s net profit margins down to 20.5%, a notable slide from the prior year’s 29.2%. Management does not flag margin improvement for the coming period.

- The prevailing analysis highlights how non-recurring losses now weigh more heavily on assessments of earnings quality and stability.

- Despite the margin drop, ACNB still guides for annual earnings growth of 19.3%, outpacing the US market average of 15.5%.

- However, with net profit margins no longer improving and a major non-recurring expense in this cycle, investor focus is likely to shift from pure growth to ongoing earnings quality and operational execution.

Share Dilution Flags a Caution Amid Growth

- ACNB recorded a risk factor for share dilution over the past year. This is a red flag that can limit per-share upside even when company-wide earnings are growing.

- The current narrative assesses whether dilution poses a headwind in the context of otherwise solid dividend and growth stories.

- Share dilution may explain why revenue forecasts for the next year remain muted at an expected growth rate of 3.8% per year, compared to the 10% average for the US market.

- Investors may weigh dilution concerns against attractions like above-average dividend yields and encouraging profit growth targets.

Premium P/E Despite Discount to DCF Fair Value

- The stock trades at a 19x price-to-earnings ratio, which is much higher than the US banks industry average of 11.3x and peer group average of 12.1x. Yet it remains below its discounted cash flow (DCF) fair value of $80.82.

- The view contends valuation tension remains at the center for investors who are drawn to the relative discount versus DCF but cautious of the industry premium.

- Some may see opportunity, as the current share price of $45.77 is well below the DCF fair value and could appeal to value-driven buyers.

- Others may be deterred by the premium P/E, questioning whether future growth can support further re-rating without margin recovery or higher revenue momentum.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on ACNB's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

ACNB’s slipping profit margins, exposure to share dilution, and slow revenue growth could dampen returns if operating challenges persist.

If you’re aiming for more reliable performance, use our stable growth stocks screener (2090 results) to focus on stocks that consistently deliver steady earnings and growth year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ACNB

ACNB

A financial holding company, offers banking, insurance, and financial services to individual, business, and government customers in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives