- United States

- /

- Auto

- /

- NYSE:XPEV

XPeng's Record Deliveries and Global Expansion Might Change the Case for Investing in XPEV

Reviewed by Sasha Jovanovic

- XPeng Inc. reported record-breaking deliveries of 42,013 Smart EVs in October 2025, achieving a 76% year-over-year increase and marking the second consecutive month exceeding 40,000 units.

- Notably, the company’s rapid rise includes achieving a production milestone for its Mona M03 sedan and entering seven new international markets in October.

- We'll explore how XPeng's surging vehicle deliveries and expanding global presence influence its investment narrative and future outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

XPeng Investment Narrative Recap

Investing in XPeng today means believing in the company's ability to turn surging EV sales and ambitious international expansion into sustainable profitability. While October’s record-breaking deliveries reinforce strong demand momentum and brand visibility, they do not materially resolve XPeng’s single largest short-term catalyst, the need to reach positive net margins and close its persistent losses; high delivery growth alone may not offset ongoing cost challenges, leaving profitability concerns at the forefront for shareholders.

Among the recent announcements, the milestone production of the Mona M03 sedan in October ties directly to XPeng’s explosive delivery numbers, highlighting operational efficiency gains that support top-line growth. However, until these gains translate to clear bottom-line improvements, the risk that heavy R&D and marketing spend continues to outweigh revenue gains remains a critical watchpoint for investors tracking progress toward profitability.

By contrast, investors should be aware that even with robust sales, XPeng’s ability to generate sustained profit margins still faces ongoing pressure from...

Read the full narrative on XPeng (it's free!)

XPeng's narrative projects CN¥137.4 billion revenue and CN¥6.4 billion earnings by 2028. This requires 31.6% yearly revenue growth and a CN¥10.7 billion earnings increase from CN¥-4.3 billion today.

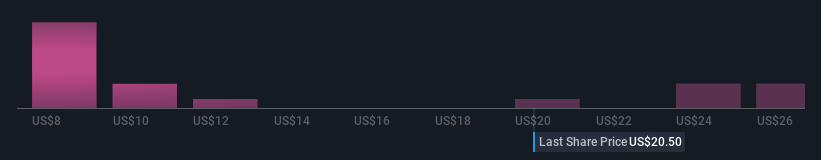

Uncover how XPeng's forecasts yield a $26.49 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Sixteen Simply Wall St Community members estimate fair value for XPeng shares anywhere from CNY9.23 to CNY33.26. With persistent net losses despite revenue growth highlighted in recent news, viewpoints vary widely on XPeng’s long-term financial trajectory, explore several of these perspectives to better understand the company’s potential outcomes.

Explore 16 other fair value estimates on XPeng - why the stock might be worth less than half the current price!

Build Your Own XPeng Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your XPeng research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free XPeng research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate XPeng's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XPEV

XPeng

Designs, develops, manufactures, and markets smart electric vehicles (EVs) in the People’s Republic of China.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion