- United States

- /

- Auto

- /

- NYSE:XPEV

XPeng (NYSE:XPEV) Valuation in Focus as Global Expansion Pushes New Growth Boundaries

Reviewed by Simply Wall St

XPeng (NYSE:XPEV) is turning heads after revealing its latest international expansion push. The company is entering Estonia, Lithuania, Latvia, and Cambodia while partnering with Magna International for manufacturing in Europe. This move could reshape the company's global footprint.

See our latest analysis for XPeng.

XPeng’s global push seems to have recharged investor optimism. While the most recent 1-day share price dipped 0.69%, the year-to-date share price return stands at an impressive 100.69%, and the total shareholder return over the last 12 months has reached 104.23%. That kind of long-term momentum, combined with high-profile model launches and AI advances, suggests sentiment is squarely on the upswing for now.

If XPeng’s global ambition has you thinking big, now is a perfect chance to explore what’s new among leading carmakers. Check out See the full list for free.

With shares up over 100 percent year-to-date and fresh growth ambitions, the key question is whether XPeng’s valuation still offers real upside or if the market has already priced in all of its future potential.

Most Popular Narrative: 12.5% Undervalued

XPeng’s most closely-followed narrative fair value sits at $26.49, noticeably higher than the last close of $23.18. This sets the stage for investors debating if the company's international ambitions and margin trajectory justify a premium over today's market price.

XPeng's rapid in-house development and deployment of proprietary AI hardware (Turing AI SoC) and vision-based ADAS are expected to significantly advance its vehicle autonomy and smart cockpit solutions. This aligns with surging consumer demand for intelligent, software-centric vehicles, setting the stage for higher-margin software revenue and enhanced gross/net margins.

You’re not seeing the entire story yet. Behind this premium, there’s a bold assumption about software-driven revenue and a leap in margin potential. Get the inside edge on how analysts connect tomorrow’s technology with today’s valuation. The real number driving this call might surprise you.

Result: Fair Value of $26.49 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued net losses and fierce domestic EV competition could quickly undermine XPeng’s momentum if margin improvements and overseas growth do not occur as forecast.

Find out about the key risks to this XPeng narrative.

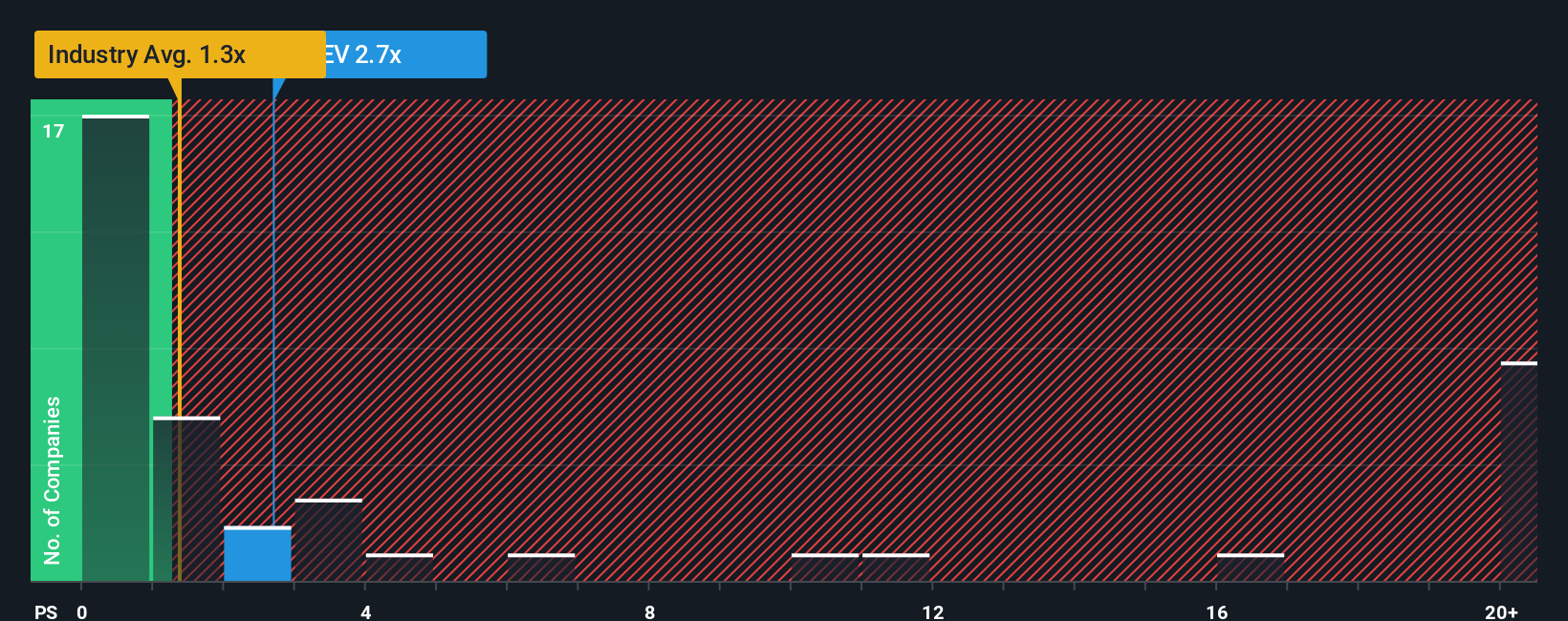

Another View: Sales Ratios Raise a Red Flag

Taking a different approach, XPeng’s price-to-sales ratio stands at 2.6x, which is substantially higher than the US auto industry average of 1.4x and the peer average of 1.7x. Compared to its fair ratio of 2.1x, this signals that XPeng shares may be getting pricey for the revenue they generate. Is the premium justified, or is the market already factoring in all the upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own XPeng Narrative

If you see things differently or want to dig into the numbers firsthand, you can shape your own XPeng story in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding XPeng.

Looking for more investment ideas?

Don’t let other incredible opportunities pass you by. Find fresh angles and start acting strategically. Your next smart move could be just a click away.

- Capitalize on under-the-radar growth by reviewing these 3583 penny stocks with strong financials with strong financials and the potential for significant gains.

- Boost your portfolio with consistent income streams by targeting these 21 dividend stocks with yields > 3% that offer attractive yields above 3%.

- Tap into the heart of innovation by backing these 26 AI penny stocks set to benefit most from the worldwide push into artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XPEV

XPeng

Designs, develops, manufactures, and markets smart electric vehicles (EVs) in the People’s Republic of China.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives