- United States

- /

- Auto

- /

- NYSE:XPEV

XPeng (NYSE:XPEV) Valuation in Focus as Analyst Upgrades Follow Strong X9 EREV Pre-Orders and Volkswagen Partnership

Reviewed by Simply Wall St

XPeng (NYSE:XPEV) has been drawing attention after recent analyst commentary pointed to a potential sales boost, thanks to strong pre-orders for its new extended-range models, such as the X9 EREV.

See our latest analysis for XPeng.

XPeng’s story this year has been one of mounting momentum. The stock’s strong run, boasting an 89% year-to-date share price return, has tracked a wave of upbeat developments from record-breaking vehicle deliveries and narrowed losses to the appointment of new board talent and a confident full-year guidance. While there have been some shorter-term dips, investors appear increasingly optimistic about XPeng’s growth prospects and improved profitability, as shown by its 81% total shareholder return over the past 12 months.

If upbeat news from the EV sector has sparked your curiosity, this could be the right moment to discover what else is happening across the space. See the full list with our See the full list for free.

This outperformance begs the question: with price targets rising and future growth factored into positive analyst sentiment, is XPeng’s stock genuinely undervalued or are investors already paying a premium for its next wave of expansion?

Most Popular Narrative: 22.7% Undervalued

XPeng’s most widely followed valuation narrative puts fair value at $28.24 per share, which is above the last close of $21.83. This positioning, if accurate, signals substantial upside driven by several major business catalysts and financial projections.

XPeng's rapid in-house development and deployment of proprietary AI hardware (Turing AI SoC) and vision-based ADAS are expected to significantly advance its vehicle autonomy and smart cockpit solutions. These efforts align with surging consumer demand for intelligent, software-centric vehicles, setting the stage for higher-margin software revenue and enhanced gross and net margins.

How do analysts get to this bullish price? The answer involves bold forecasts for future margins, earnings, and a significant step-change in revenue growth. Want to see the detailed projections that put this stock in the spotlight? Uncover the financial engine behind XPeng’s high-stakes valuation story.

Result: Fair Value of $28.24 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent net losses and intense competition in China could cloud XPeng’s path to profitability, potentially altering the bullish narrative.

Find out about the key risks to this XPeng narrative.

Another View: Multiples Comparison Paints a Different Picture

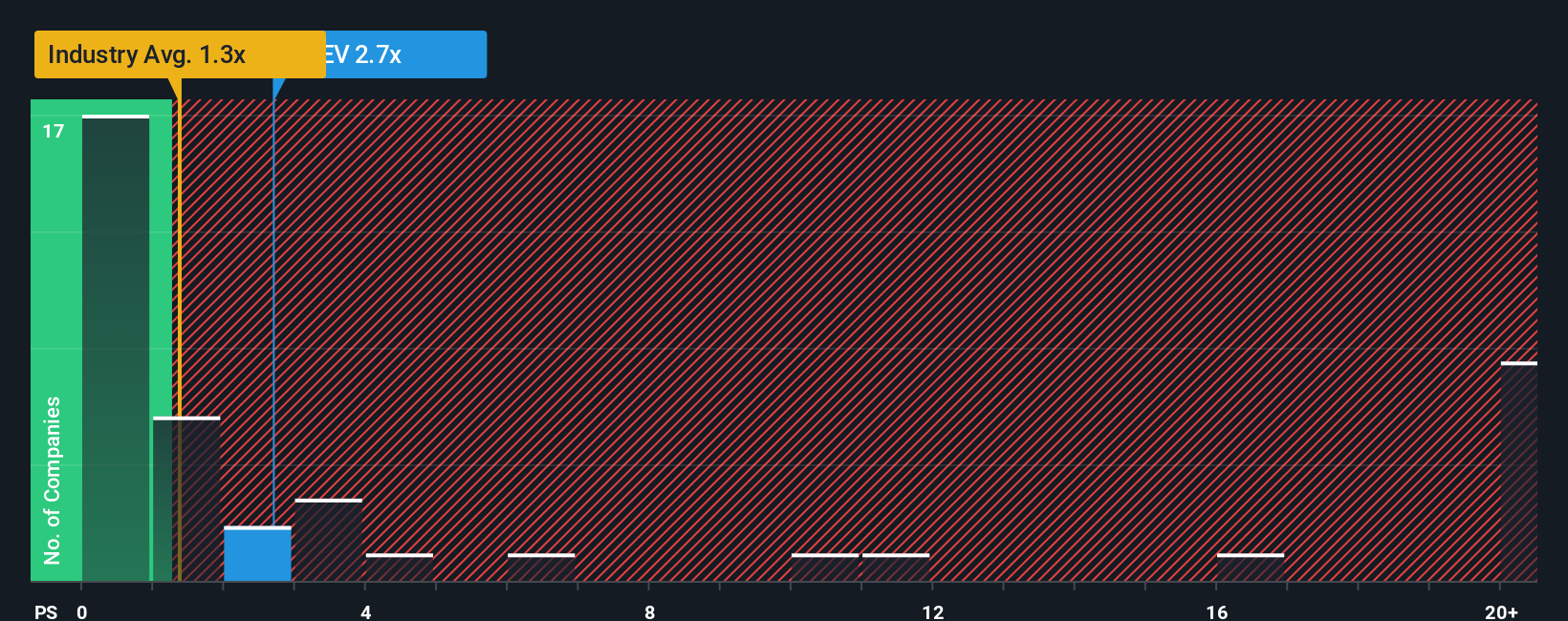

While the DCF approach points to upside, comparing XPeng’s price-to-sales ratio to its peers sparks caution. XPeng trades at 2.1x sales, which is higher than both the US Auto industry average of 0.9x and its peer average of 1.6x. The ratio is also above the fair ratio of 2x, signaling that investors may already be paying a premium for future growth.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own XPeng Narrative

Want to dig into the numbers on your own terms? It takes just a few minutes to test different assumptions and shape your own view of XPeng’s future. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding XPeng.

Looking for More Investment Ideas?

Smart investors always scan the horizon for exciting opportunities. Don’t miss your chance to see what else Simply Wall Street’s screener can uncover right now.

- Snag high-yield income potential and steady cash flow by checking out these 15 dividend stocks with yields > 3% offering attractive yields above 3%.

- Spot tomorrow’s tech leaders early by reviewing these 25 AI penny stocks fueling advancements in artificial intelligence and automation.

- Tap into rapid growth stories with these 914 undervalued stocks based on cash flows designed to spotlight compelling stocks currently trading below their intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XPEV

XPeng

Designs, develops, manufactures, and markets smart electric vehicles (EVs) in the People’s Republic of China.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026