- United States

- /

- Auto

- /

- NYSE:XPEV

Why XPeng (XPEV) Is Up 7.3 Percent After Announcing European Expansion and Magna Partnership

Reviewed by Sasha Jovanovic

- XPeng Inc. has announced its expansion into Estonia, Lithuania, Latvia, and Cambodia, along with a new manufacturing partnership in Austria with Magna International as part of its global strategy.

- This move signals XPeng's intent to broaden its international reach and directly produce vehicles in Europe, increasing competition with global electric vehicle brands.

- We'll explore how XPeng's European manufacturing collaboration with Magna may influence its international expansion narrative and growth prospects.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

XPeng Investment Narrative Recap

To be a shareholder in XPeng, one must believe the company can translate rapid international expansion and advanced smart EV technology into sustainable profitability. The recent expansion into Northern Europe and Cambodia, coupled with the Magna International manufacturing partnership, reinforces XPeng's global ambitions but does not materially alter the short-term catalyst, continued narrowing of net losses, and the biggest risk: delayed profitability due to persistent negative margins and capital requirements.

Among recent announcements, XPeng's launch of the new XPENG P7 model in late August stands out, as it demonstrates the company's ongoing push for competitive product innovation and supports its efforts to stabilize margins. Continued new model introductions, especially with technology upgrades, remain tightly linked to XPeng's path to higher sales volumes and improved profitability abroad.

However, despite XPeng’s swift growth, investors should also consider the risk of additional share dilution as international expansion may require more capital than anticipated...

Read the full narrative on XPeng (it's free!)

XPeng's outlook anticipates CN¥137.4 billion in revenue and CN¥6.4 billion in earnings by 2028. This is based on an annual revenue growth rate of 31.6% and a CN¥10.7 billion increase in earnings from the current CN¥-4.3 billion.

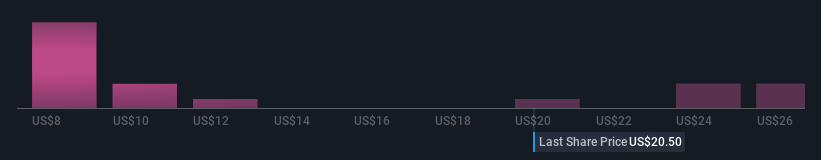

Uncover how XPeng's forecasts yield a $26.29 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Fifteen fair value estimates from the Simply Wall St Community span from CN¥9.23 to CN¥33.26, revealing a broad spectrum of individual investor expectations. While many expect significant upside, ongoing net losses and the need for further capital raises could be crucial to XPeng's financial future; explore more perspectives on how this could affect your investment view.

Explore 15 other fair value estimates on XPeng - why the stock might be worth as much as 44% more than the current price!

Build Your Own XPeng Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your XPeng research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free XPeng research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate XPeng's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XPEV

XPeng

Designs, develops, manufactures, and markets smart electric vehicles (EVs) in the People’s Republic of China.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion