- United States

- /

- Auto

- /

- NYSE:XPEV

How Investors Are Reacting To XPeng (XPEV) Surpassing 800,000 EV Deliveries and Expanding in Europe

Reviewed by Simply Wall St

- In July 2025, XPeng Inc. achieved a new record by delivering 36,717 Smart EVs, bringing its cumulative sales to over 800,000 units and launching updated G6 and G9 models in Europe alongside announcing plans for the P7+ debut in the region.

- With its entrance into the UK, Italy, and Ireland, XPeng has expanded its footprint to 46 countries, while continued advancements in AI driving technology have significantly increased user engagement and technological differentiation.

- We’ll explore how XPeng’s record-setting deliveries and broader European expansion strengthen the company’s long-term investment outlook.

We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

XPeng Investment Narrative Recap

To own shares of XPeng today, you need to see continued rapid international expansion, sustained leadership in AI-driven EV tech, and a credible path to profitability as the company scales outside China. July’s record-breaking deliveries and entry into three new European markets bolster confidence in XPeng’s global growth story. However, while these milestones provide momentum, the biggest immediate risk remains high R&D and international expansion costs potentially delaying profitability; this news does not materially reduce that risk.

The recent launch of updated G6 and G9 models in Europe, coupled with strong delivery growth, underscores XPeng’s commitment to technology-driven market entry, directly addressing short-term catalysts like user adoption and sales volume. These moves align with management’s guidance for aggressive revenue growth, yet the gap to consistent earnings remains a hurdle as expansion expenses remain elevated.

Conversely, investors should also be aware that as XPeng increases spending to accelerate global rollouts, the timeline for achieving profitability could become even less predictable...

Read the full narrative on XPeng (it's free!)

XPeng's outlook anticipates CN¥132.1 billion in revenue and CN¥5.0 billion in earnings by 2028. This scenario requires 38.1% annual revenue growth and a CN¥10.1 billion earnings turnaround from the current CN¥-5.1 billion.

Uncover how XPeng's forecasts yield a $26.04 fair value, a 38% upside to its current price.

Exploring Other Perspectives

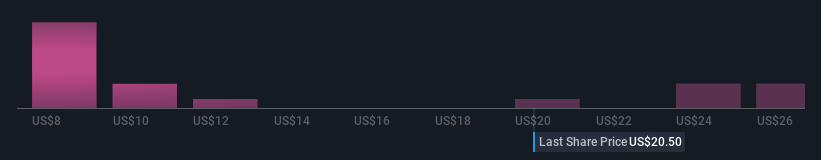

Thirteen members of the Simply Wall St Community estimate XPeng’s fair value as low as US$9.23 and as high as US$34.53, reflecting a broad spectrum of opinions. While many see room for growth with expanding market presence, surging near-term R&D and international costs may weigh on earnings outlooks, these varying views invite you to explore several alternative perspectives.

Explore 13 other fair value estimates on XPeng - why the stock might be worth less than half the current price!

Build Your Own XPeng Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your XPeng research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free XPeng research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate XPeng's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XPEV

XPeng

Designs, develops, manufactures, and markets smart electric vehicles (EVs) in the People’s Republic of China.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives