- United States

- /

- Auto

- /

- NYSE:THO

How THOR Industries' Electric RV Launch and Improved Profitability Have Changed Its Investment Story (THO)

Reviewed by Sasha Jovanovic

- THOR Industries recently reported fourth quarter and full-year results for the period ended July 31, 2025, highlighting improved quarterly profitability and the successful debut of the Embark, an electric Class A motorhome under the Entegra Coach brand.

- This milestone in electrification underscores THOR Industries' push for innovation in the RV sector, aligning product development with changing consumer expectations around sustainability and travel technology.

- We'll explore how the launch of the range-extended electric motorhome shapes THOR Industries' investment narrative and product positioning.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is THOR Industries' Investment Narrative?

THOR Industries’ latest earnings report may offer some reassurance to investors focused on short-term profitability, with net income for the fourth quarter rising to US$125.76 million despite essentially flat sales. The introduction of the Embark electric Class A motorhome is a landmark in the company’s ongoing innovation push, and positions THOR to capture shifting consumer preferences toward electrified travel, but it will not have an immediate impact on this year’s top- or bottom-line performance. The bigger picture still relies on a belief in steady US recreational vehicle demand, operational cost-control and successful execution of new product launches. Catalysts to watch include the pace of Embark’s market acceptance and ongoing share buybacks, while key risks remain around slower revenue growth projections, industry cyclicality and current valuation, which sits above both peer and market averages. At this point, recent news may improve sentiment, but the fundamental risks remain in focus.

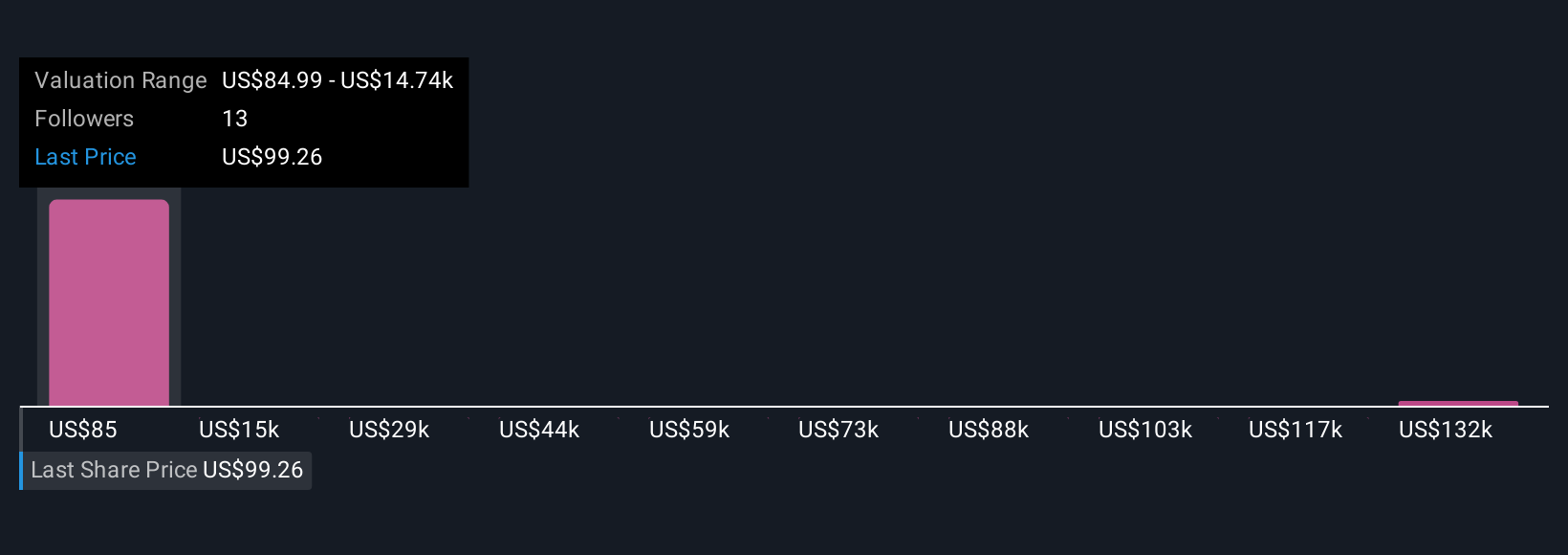

On the other hand, valuation concerns remain something investors should be careful about. THOR Industries' shares are on the way up, but they could be overextended by 27%. Uncover the fair value now.Exploring Other Perspectives

Explore 3 other fair value estimates on THOR Industries - why the stock might be a potential multi-bagger!

Build Your Own THOR Industries Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your THOR Industries research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free THOR Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate THOR Industries' overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if THOR Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:THO

THOR Industries

Designs, manufactures, and sells recreational vehicles (RVs), and related parts and accessories in the United States, Germany, rest of Europe, Canada, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives