- United States

- /

- Auto Components

- /

- NYSE:SMP

It's Unlikely That Shareholders Will Increase Standard Motor Products, Inc.'s (NYSE:SMP) Compensation By Much This Year

Key Insights

- Standard Motor Products will host its Annual General Meeting on 15th of May

- CEO Eric Sills' total compensation includes salary of US$742.0k

- Total compensation is 79% below industry average

- Standard Motor Products' EPS declined by 16% over the past three years while total shareholder loss over the past three years was 17%

The underwhelming performance at Standard Motor Products, Inc. (NYSE:SMP) recently has probably not pleased shareholders. There is an opportunity for shareholders to influence management to turn the performance around by voting on resolutions such as executive remuneration at the AGM coming up on 15th of May. The data we gathered below shows that CEO compensation looks acceptable for now.

View our latest analysis for Standard Motor Products

Comparing Standard Motor Products, Inc.'s CEO Compensation With The Industry

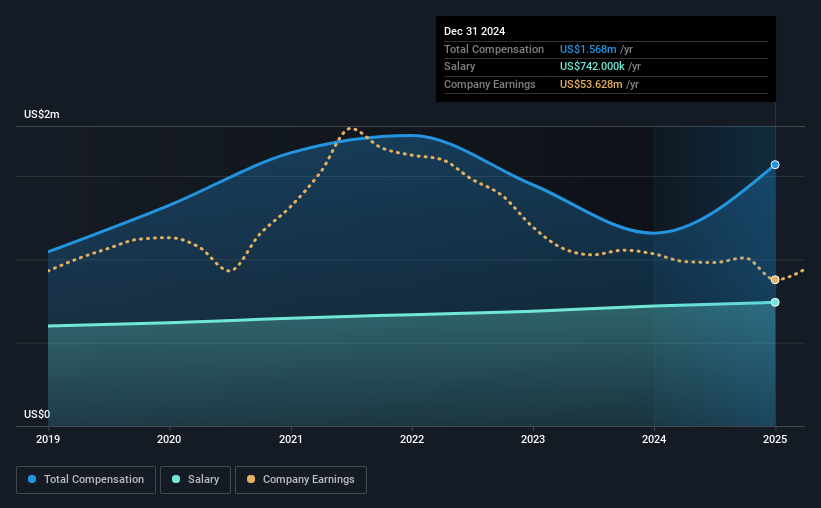

According to our data, Standard Motor Products, Inc. has a market capitalization of US$617m, and paid its CEO total annual compensation worth US$1.6m over the year to December 2024. We note that's an increase of 36% above last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$742k.

In comparison with other companies in the American Auto Components industry with market capitalizations ranging from US$400m to US$1.6b, the reported median CEO total compensation was US$7.5m. This suggests that Eric Sills is paid below the industry median. What's more, Eric Sills holds US$17m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | US$742k | US$720k | 47% |

| Other | US$826k | US$436k | 53% |

| Total Compensation | US$1.6m | US$1.2m | 100% |

Speaking on an industry level, nearly 14% of total compensation represents salary, while the remainder of 86% is other remuneration. Standard Motor Products pays out 47% of remuneration in the form of a salary, significantly higher than the industry average. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Standard Motor Products, Inc.'s Growth

Over the last three years, Standard Motor Products, Inc. has shrunk its earnings per share by 16% per year. In the last year, its revenue is up 14%.

Overall this is not a very positive result for shareholders. There's no doubt that the silver lining is that revenue is up. But it isn't sufficiently fast growth to overlook the fact that EPS has gone backwards over three years. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Standard Motor Products, Inc. Been A Good Investment?

With a three year total loss of 17% for the shareholders, Standard Motor Products, Inc. would certainly have some dissatisfied shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We identified 3 warning signs for Standard Motor Products (1 doesn't sit too well with us!) that you should be aware of before investing here.

Important note: Standard Motor Products is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:SMP

Standard Motor Products

Manufactures and distributes replacement automotive parts in the United States and internationally.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.