- United States

- /

- Auto Components

- /

- NYSE:SMP

How Much is Standard Motor Products, Inc.'s (NYSE:SMP) CEO Getting Paid?

In 2016 Eric Sills was appointed CEO of Standard Motor Products, Inc. (NYSE:SMP). First, this article will compare CEO compensation with compensation at similar sized companies. Next, we'll consider growth that the business demonstrates. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. This method should give us information to assess how appropriately the company pays the CEO.

View our latest analysis for Standard Motor Products

How Does Eric Sills's Compensation Compare With Similar Sized Companies?

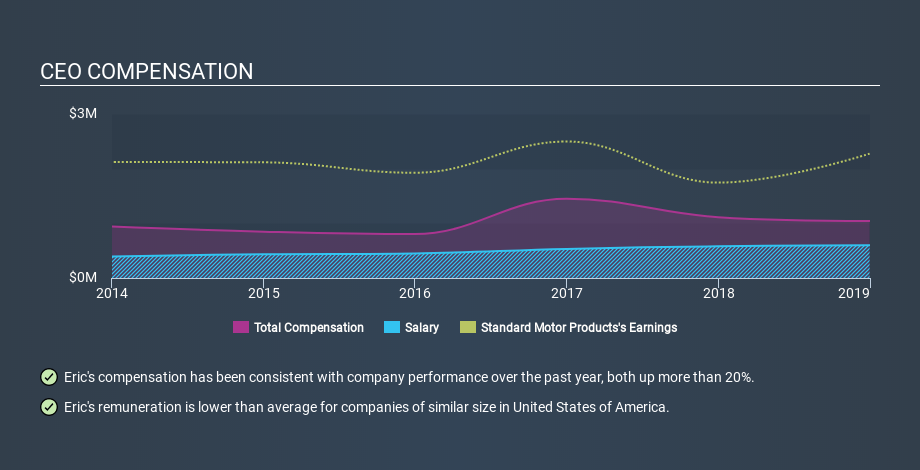

At the time of writing, our data says that Standard Motor Products, Inc. has a market cap of US$985m, and reported total annual CEO compensation of US$1.0m for the year to December 2018. While we always look at total compensation first, we note that the salary component is less, at US$600k. As part of our analysis we looked at companies in the same jurisdiction, with market capitalizations of US$400m to US$1.6b. The median total CEO compensation was US$3.1m.

Pay mix tells us a lot about how a company functions versus the wider industry, and it's no different in the case of Standard Motor Products. On an industry level, roughly 24% of total compensation represents salary and 76% is other remuneration. According to our research, Standard Motor Products has allocated a higher percentage of pay to salary in comparison to the broader sector.

This would give shareholders a good impression of the company, since most similar size companies have to pay more, leaving less for shareholders. However, before we heap on the praise, we should delve deeper to understand business performance. You can see, below, how CEO compensation at Standard Motor Products has changed over time.

Is Standard Motor Products, Inc. Growing?

Over the last three years Standard Motor Products, Inc. has seen earnings per share (EPS) move in a positive direction by an average of 4.1% per year (using a line of best fit). It achieved revenue growth of 4.2% over the last year.

I would argue that the improvement in revenue isn't particularly impressive, but the modest improvement in EPS is good. It's clear the performance has been quite decent, but it it falls short of outstanding,based on this information. It could be important to check this free visual depiction of what analysts expect for the future.

Has Standard Motor Products, Inc. Been A Good Investment?

Given the total loss of 2.0% over three years, many shareholders in Standard Motor Products, Inc. are probably rather dissatisfied, to say the least. It therefore might be upsetting for shareholders if the CEO were paid generously.

In Summary...

It appears that Standard Motor Products, Inc. remunerates its CEO below most similar sized companies.

It's well worth noting that while Eric Sills is paid less than most company leaders (at similar sized companies), performance has been somewhat uninspiring, and total returns have been lacking. I am not concerned by the CEO compensation, but it would be good to see improved performance before pay increases. On another note, we've spotted 1 warning sign for Standard Motor Products that investors should look into moving forward.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:SMP

Standard Motor Products

Manufactures and distributes replacement automotive parts in the United States and internationally.

Excellent balance sheet average dividend payer.