- United States

- /

- Auto

- /

- NYSE:RACE

Is Ferrari’s Stock Still Racing Ahead After 16.5% Monthly Drop and EV News?

Reviewed by Bailey Pemberton

If you have ever wondered when or whether to buy into Ferrari, you are not alone. Investors have been watching the stock closely as it weaves through a winding road of highs and lows. Over the last week, Ferrari shares jumped 4.8%, hinting that some confidence is coming back to the luxury automaker. But zoom out a bit, and the picture is less rosy: the stock has slipped 16.5% over the past month, and is down 3.8% for the year to date. In fact, it is off by 15.7% compared to a year ago, despite posting impressive gains of over 100% in the past three years.

News swirling around Ferrari recently has focused on its bold foray into electric vehicle technology and new design partnerships, fueling speculation about the company’s long-term vision. There has also been chatter about expanding in emerging luxury markets and a growing order book in North America. While these developments offer points of intrigue, the market seems divided on whether this justifies the stock’s valuation or ramps up its risk profile.

At the moment, Ferrari’s value score sits at 0 out of 6, meaning it does not pass any of the common under-valuation checks. Still, before you throw in the towel, it is worth examining how different valuation approaches measure Ferrari’s potential, and why a smarter way to assess its true worth might be hiding in plain sight.

Ferrari scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Ferrari Discounted Cash Flow (DCF) Analysis

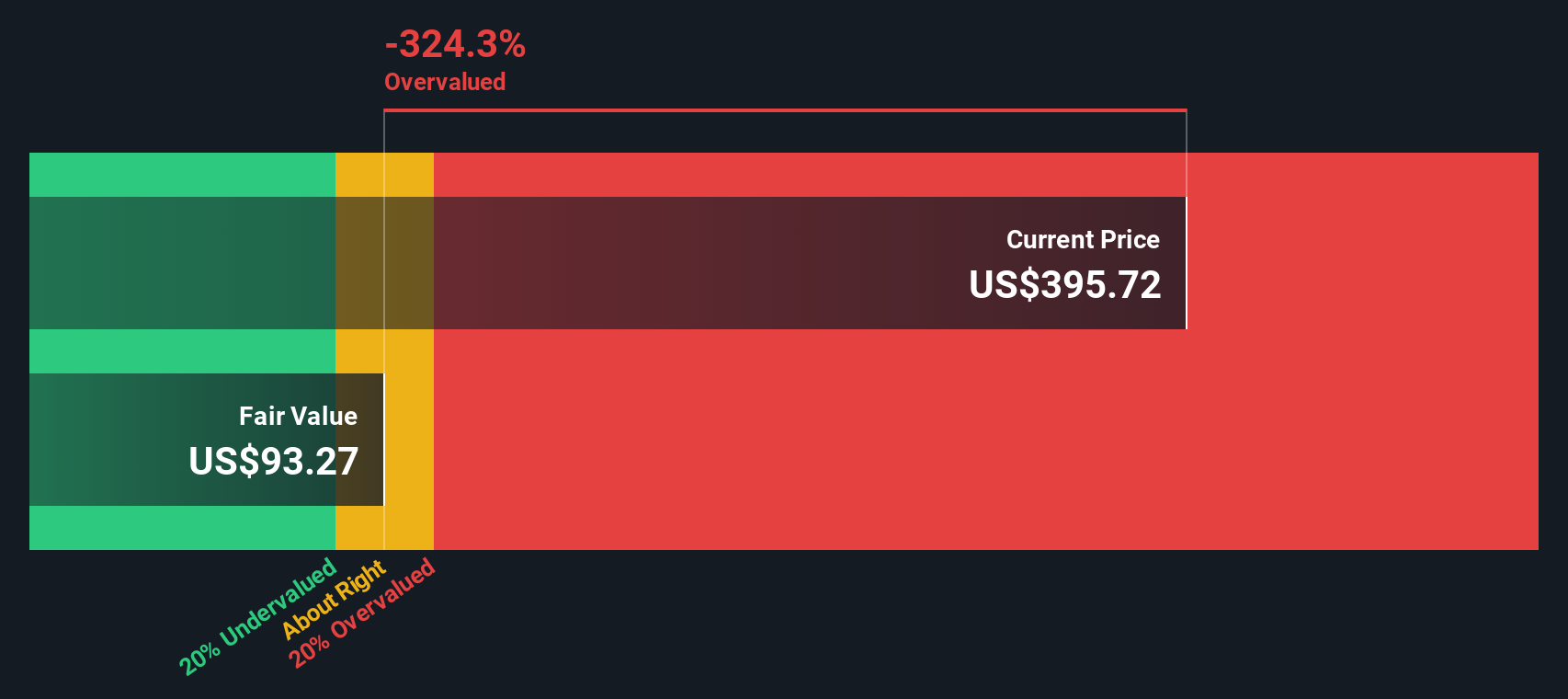

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s value. For Ferrari, this involves analyzing the current level of free cash generated by the company and considering analyst expectations for how this figure might increase in the coming years.

Currently, Ferrari’s free cash flow is €1.3 Billion, reflecting robust operations. Analyst estimates indicate steady increases through 2029, reaching €1.94 Billion by year-end. While analyst forecasts are available for just the next five years, longer-term values are calculated by extrapolating recent trends and expected growth rates through 2035. These projections serve as the foundation for the DCF’s assessment of what the business is fundamentally worth today.

The resulting DCF valuation indicates an intrinsic value of €94.84 per share. When compared to the market’s current pricing, this suggests Ferrari stock is trading 322.2% above its fundamental worth according to this model.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Ferrari may be overvalued by 322.2%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Ferrari Price vs Earnings

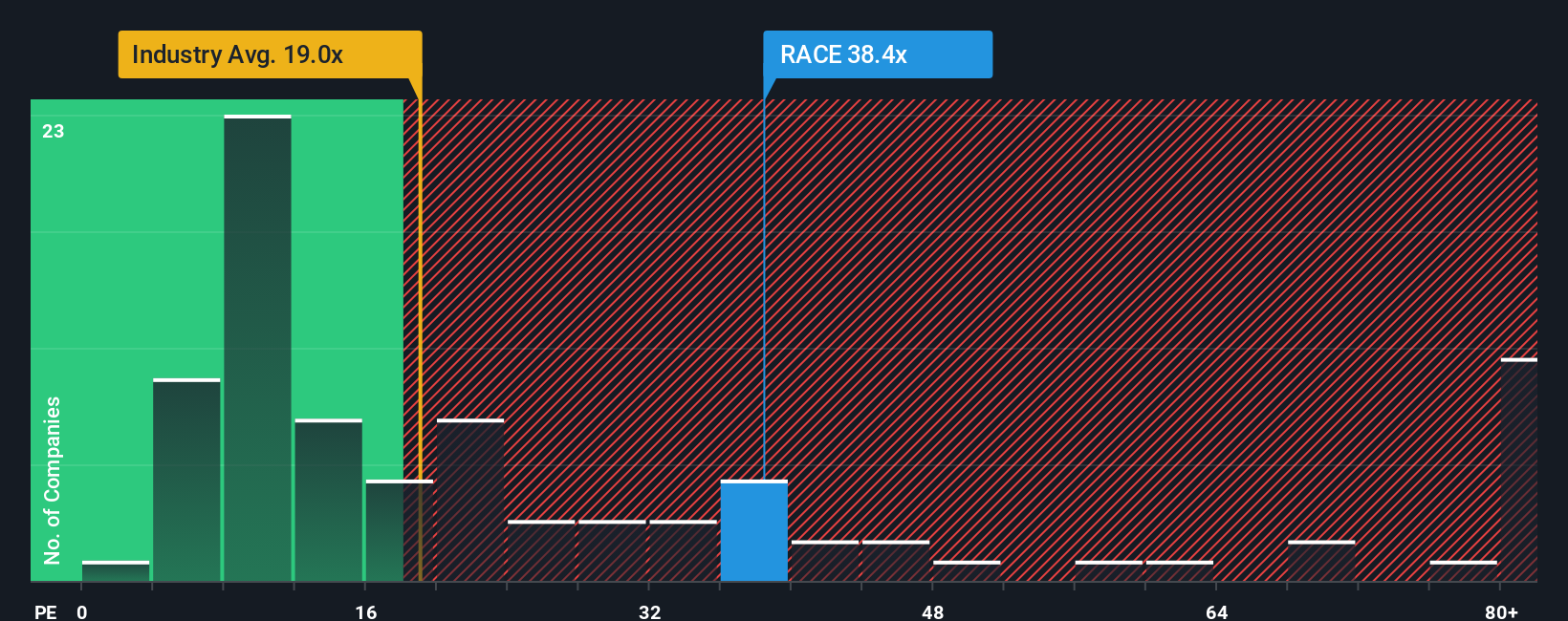

For established, profitable companies like Ferrari, the price-to-earnings (PE) ratio is a popular tool for quickly gauging how much investors are willing to pay for each dollar of current earnings. It is especially useful because it reflects both market optimism about future growth and potential risk. Higher expected growth or lower risk usually justify a higher PE, while the opposite pulls it lower.

Currently, Ferrari’s PE ratio is 38.39x. This stands in sharp contrast to the auto industry’s average of 18.41x and the peer group’s average of 17.63x. On the surface, Ferrari looks expensive compared to those benchmarks, but these simple averages miss a lot of nuance.

Enter Simply Wall St's “Fair Ratio.” This proprietary metric aims to set a more tailored benchmark by considering Ferrari’s forecasted earnings growth, profitability, risk profile, industry trends, and scale. For Ferrari, the Fair Ratio is 14.14x. This custom calculation helps sidestep the pitfalls of apples-to-oranges comparisons, presenting a more accurate picture than generic industry or peer multiples.

Comparing Ferrari’s actual PE of 38.39x to its Fair Ratio of 14.14x, the stock trades at a substantial premium and appears significantly overvalued by this method.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

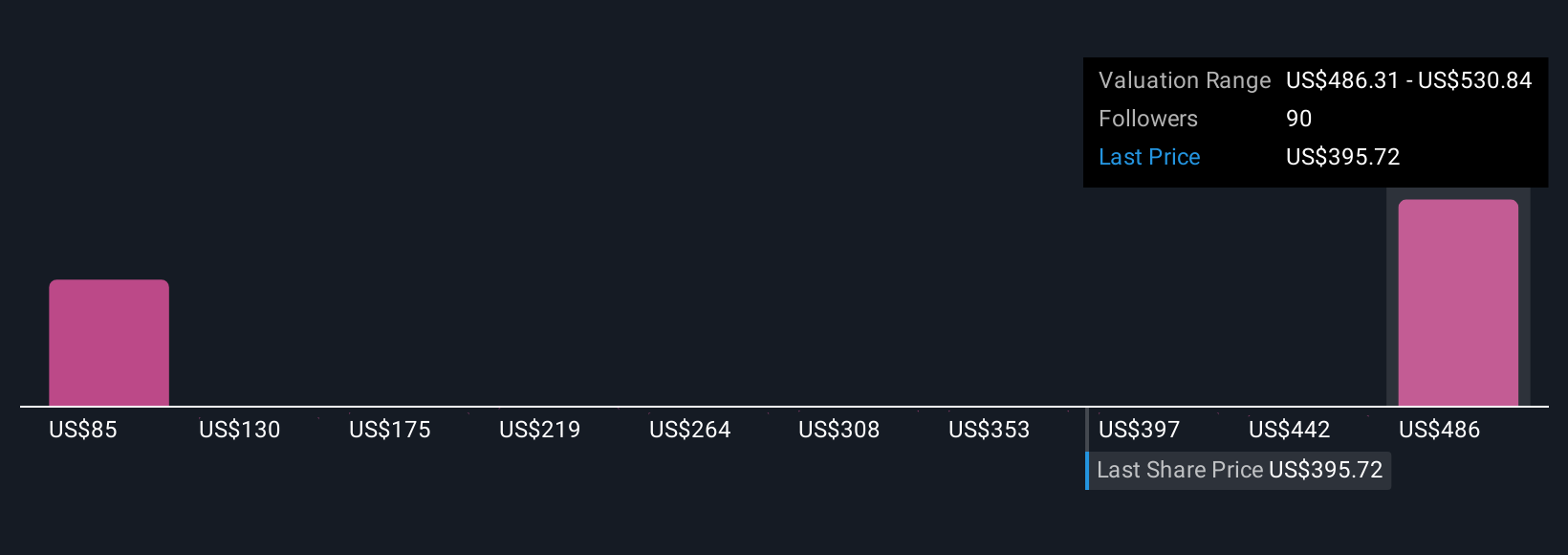

Upgrade Your Decision Making: Choose your Ferrari Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, personalized story you build around a company, connecting your assumptions and perspective, such as how fast you think Ferrari will grow, how profitable it might become, and what risks could arise, into a financial forecast and ultimately a fair value. Narratives turn numbers into insights by letting you express why you believe Ferrari should be worth a certain amount, and see how those beliefs compare to others. On Simply Wall St’s platform, available to millions through the Community page, Narratives make it easy for anyone to join the discussion: you can compare your own Fair Value with the current Market Price to decide whether it is time to buy or sell, and Narratives update dynamically as news, analyst updates, and earnings releases flow in. For instance, some investors currently estimate Ferrari’s fair value as high as $597.04, reflecting optimism about electrification and new models, while others are more cautious, placing fair value as low as $397.31, highlighting how different stories and expectations lead to different investment choices.

Do you think there's more to the story for Ferrari? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RACE

Ferrari

Through its subsidiaries, engages in design, engineering, production, and sale of luxury performance sports cars worldwide.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives