- United States

- /

- Auto

- /

- NYSE:RACE

Ferrari (NYSE:RACE): Evaluating Valuation After Recent Share Price Volatility

Reviewed by Kshitija Bhandaru

See our latest analysis for Ferrari.

Ferrari’s share price has taken investors on a wild ride recently, dipping 15.1% over the past month as momentum softened following a strong multi-year run. Despite the turbulence, longtime holders still enjoy an impressive 116% total shareholder return over three years.

If you’re curious about how other auto manufacturers are performing in this shifting landscape, it’s a great time to discover See the full list for free.

With shares pulling back after years of gains, investors are now asking whether Ferrari is undervalued amid recent volatility or if today’s price already reflects expectations for the brand’s future growth potential.

Most Popular Narrative: 16.5% Undervalued

Ferrari’s narrative fair value of $477.93 stands notably above its latest close at $399.08, suggesting significant upside as viewed by closely watched forecasts. The contrast between these figures puts the spotlight on the ambitious outlook that supports this consensus.

Ferrari's expansion of infrastructure and product offerings, including the new e-building and paint shop for enhanced personalization, is expected to increase production flexibility, supporting revenue growth and improved net margins through operational efficiencies. The launch of six new models in 2025, including the anticipation of the Ferrari full electric, is likely to drive revenue growth, capturing both existing and new customers while expanding Ferrari's electrification journey.

What is powering this strong valuation view? The underlying blueprint hints at a future shaped by next-generation model launches, bold margin expansion, and aggressive financial targets. Curious which major forecasts drive this estimate, and where expectations might surprise? The full narrative unpacks the pivotal projections behind Ferrari’s price potential.

Result: Fair Value of $477.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain. Brand exclusivity could be diluted by rapid model launches, and supply chain pressures may squeeze profitability, challenging the current narrative.

Find out about the key risks to this Ferrari narrative.

Another View: Market Ratios Tell a Different Story

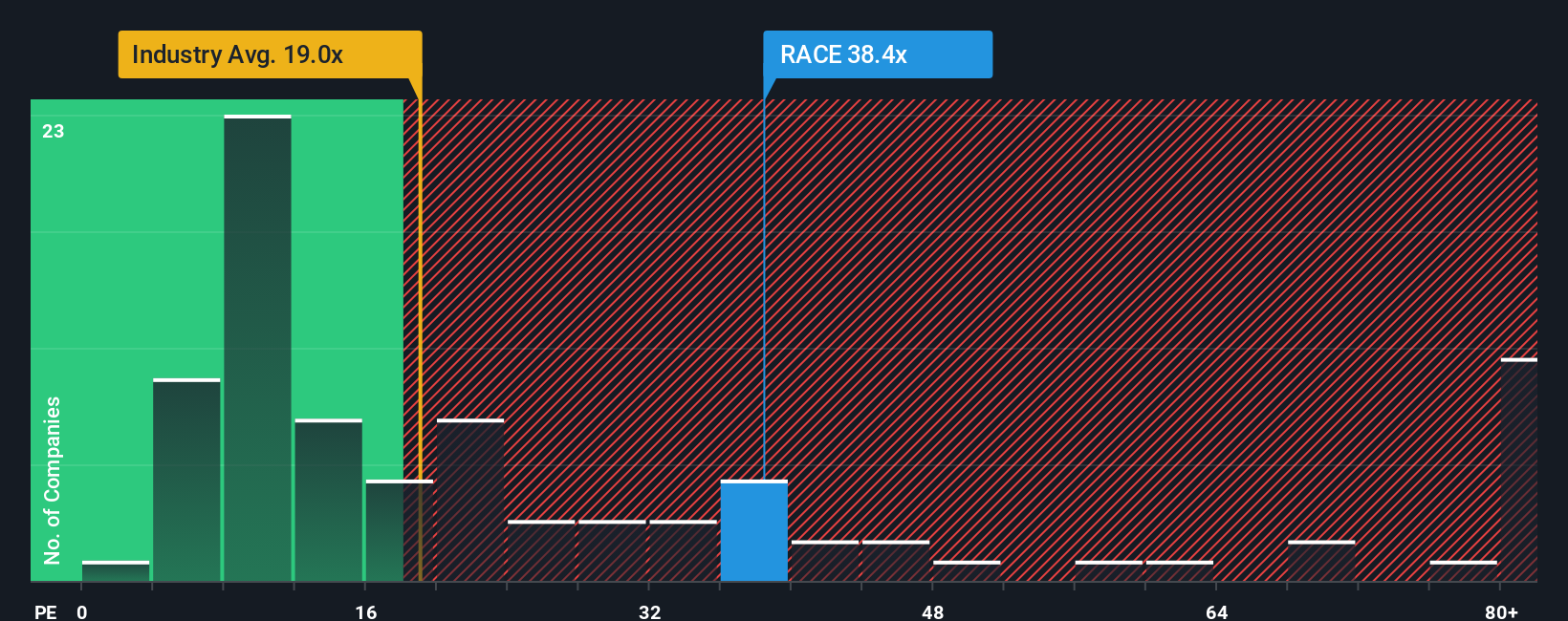

While consensus targets and narratives highlight upside, Ferrari’s current price-to-earnings ratio is 38x, which is more than twice the global auto industry average of 18.4x and far above its own fair ratio of 14.2x. This sizable gap signals that investors are already pricing in a premium for quality, brand, and future growth. However, such elevated expectations can bring increased volatility if results do not keep pace. Does this premium create excess valuation risk, or is Ferrari’s uniqueness worth the cost?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ferrari Narrative

If you see Ferrari’s story unfolding differently, dive into the details and shape your own perspective. Building your personal thesis can take just minutes. Do it your way

A great starting point for your Ferrari research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t miss out on smart opportunities that go beyond Ferrari. Let Simply Wall Street guide your next move with ready-made lists tailored to today’s hottest market themes.

- Capitalize on growing demand for secure payments and digital innovation with these 79 cryptocurrency and blockchain stocks.

- Unlock hidden potential by checking out these 878 undervalued stocks based on cash flows, which could be trading below their true worth right now.

- Maximize passive income and stability by scanning these 18 dividend stocks with yields > 3%, offering attractive yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RACE

Ferrari

Through its subsidiaries, engages in design, engineering, production, and sale of luxury performance sports cars worldwide.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives