- United States

- /

- Auto Components

- /

- NYSE:QS

QuantumScape (QS): Valuation Spotlight After New Strategic Alliances and Rising Industry Interest

Reviewed by Kshitija Bhandaru

QuantumScape, a U.S.-based developer of solid-state batteries, recently announced new strategic alliances with Corning and Murata to speed up the path toward commercial production of its lithium-metal battery technology. These moves come amid increased investor attention, driven by shifting global mineral supply dynamics and anticipation for the company’s next quarterly update.

See our latest analysis for QuantumScape.

QuantumScape’s share price has powered to a fresh 52-week high, surging over 200% year-to-date, as investors respond to headline-making deals and wider industry shifts such as tightening mineral export rules in China and ongoing partnerships with auto giants. Momentum is clearly building, with optimism fueled by real-world demos and expanded manufacturing plans. However, some caution remains around the path to profitability for this pre-revenue innovator.

If the recent battery breakthroughs have you curious what else could be gaining steam, now’s the perfect time to explore See the full list for free.

With shares at multiyear highs after a flurry of strategic partnerships and positive demos, the real question for investors is whether QuantumScape remains undervalued, or if today's stock price already reflects years of future potential.

Most Popular Narrative: 32% Undervalued

QuantumScape’s top narrative suggests the stock’s fair value sits well above its last close, painting the current rally as just the beginning. The narrative focuses on industry-defining milestones and signals that market momentum may only accelerate from here.

"A partnership with Honda, a company legendary for its engineering prowess and manufacturing excellence, would be the final, undeniable stamp of approval. It would signal to the entire market that QuantumScape's technology is not only viable but is the chosen platform for one of the world's premier automakers. This moves QS from Volkswagen's promising partner to the foundational battery technology provider for a significant portion of the global auto industry."

Want to see what fuels such a bold call? Discover the foundational drivers behind this valuation, including assumptions about product launches, partnership inflection points, and a financial trajectory that could rewrite expectations for the entire battery sector. Only the full narrative lays bare which tangible milestones and execution bets support this sky-high target.

Result: Fair Value of $25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, manufacturing scale-up delays or unexpected technical setbacks could quickly challenge the bullish outlook and test investor confidence in QuantumScape’s trajectory.

Find out about the key risks to this QuantumScape narrative.

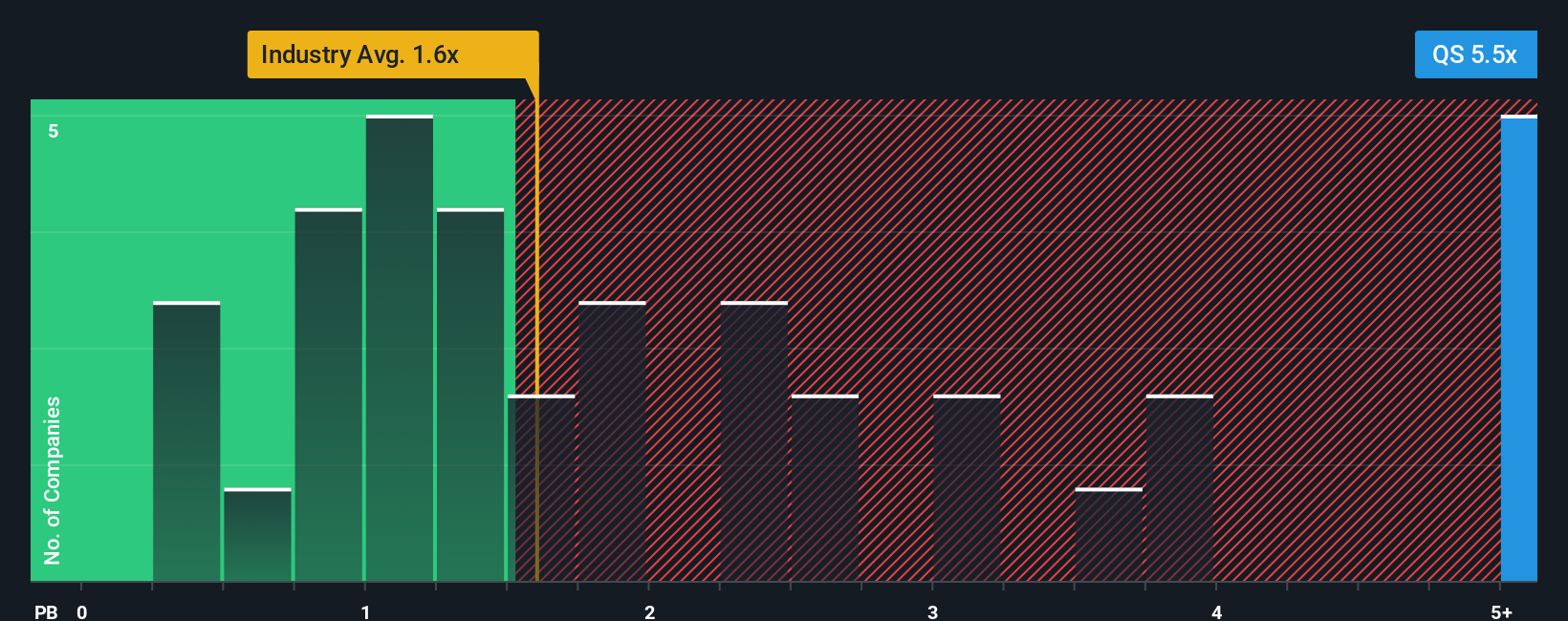

Another View: Multiple-Based Valuation Sends a Caution Flag

While enthusiasm runs high around growth prospects, some valuation signals offer a different story. QuantumScape trades at a lofty price-to-book ratio of 9.4x, far above both peer (3.5x) and industry averages (1.5x). This suggests the stock price is rich relative to underlying assets, raising the risk if future results fall short. How much premium is too much for potential?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own QuantumScape Narrative

If you see the story unfolding differently, or prefer a hands-on approach, explore the data and develop your perspective in just a few minutes. Do it your way

A great starting point for your QuantumScape research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep their radar up for the next opportunity. Skip the waiting game and get an edge by finding fresh potential before the crowd does.

- Tap into future tech by checking out these 25 AI penny stocks, where innovative businesses are harnessing artificial intelligence to drive industry transformation.

- Capitalize on cash flow strength and market mispricing with these 891 undervalued stocks based on cash flows, featuring companies trading below their intrinsic value today.

- Chase resilient returns with these 18 dividend stocks with yields > 3%, connecting you to businesses offering stable yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QuantumScape might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QS

QuantumScape

Focuses on the development and commercialization of solid-state lithium-metal batteries for electric vehicles and other applications in the United States.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives