- United States

- /

- Auto Components

- /

- NYSE:QS

QuantumScape (QS): Evaluating Valuation After Breakthrough Solid-State Battery Demo and Volkswagen Partnership Expansion

Reviewed by Simply Wall St

QuantumScape’s recent unveiling of its solid-state lithium-metal batteries at IAA Mobility in Munich has everyone talking. For the first time, the company powered a Ducati electric motorcycle in front of a global audience, making the leap from lab development to real-world showcase. This moment not only underlined the viability of their anode-free battery technology, but also spotlighted the expanded collaboration with Volkswagen's PowerCo and a production approach designed to scale.

After the event, QuantumScape (QS) shares surged over 20% in a single day, reflecting renewed investor optimism. This sudden spike stands in contrast to a mixed longer-term performance, with gains building over the past three months but set against a more volatile multi-year backdrop. The excitement has been fueled by the demo’s promise of faster charging times, greater energy density, and real progress toward commercialization, as well as the recent strategic partnership updates and manufacturing breakthroughs.

With the stock’s sharp jump and such bold technical progress, the big question now is whether QuantumScape is just getting started or if all this potential has already been baked into the current price.

Most Popular Narrative: Fairly Valued

According to the most widely followed narrative, QuantumScape is trading close to its fair value, reflecting a balanced assessment of potential upside versus execution risks.

“QuantumScape (QS), a company that for years was often dismissed as a mere ‘science project’ by skeptics, has definitively transformed into a formidable business on the verge of real-world impact. Having chosen the ‘Hard Path’ to tackle fundamental battery challenges, QuantumScape's journey, spanning over a decade and fueled by approximately $1.5 billion in funding (with roughly $300 million strategically deployed to date), is now poised for commercial success.”

This valuation narrative hints at a bold future driven by rapid innovation and aggressive manufacturing scale-up. Are ground-breaking cost cuts and battery lifespan improvements about to redefine the industry’s economics? The suspense lies in the game-changing targets set for commercialization and market entry. Want to uncover the core assumptions that set this fair value? Dive into the full narrative for the numbers behind the headline.

Result: Fair Value of $0 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, rapid changes in battery technology and delays in mass production could still challenge QuantumScape’s ambitious timeline and its commercial path forward.

Find out about the key risks to this QuantumScape narrative.Another View: Market-Based Valuation Raises Questions

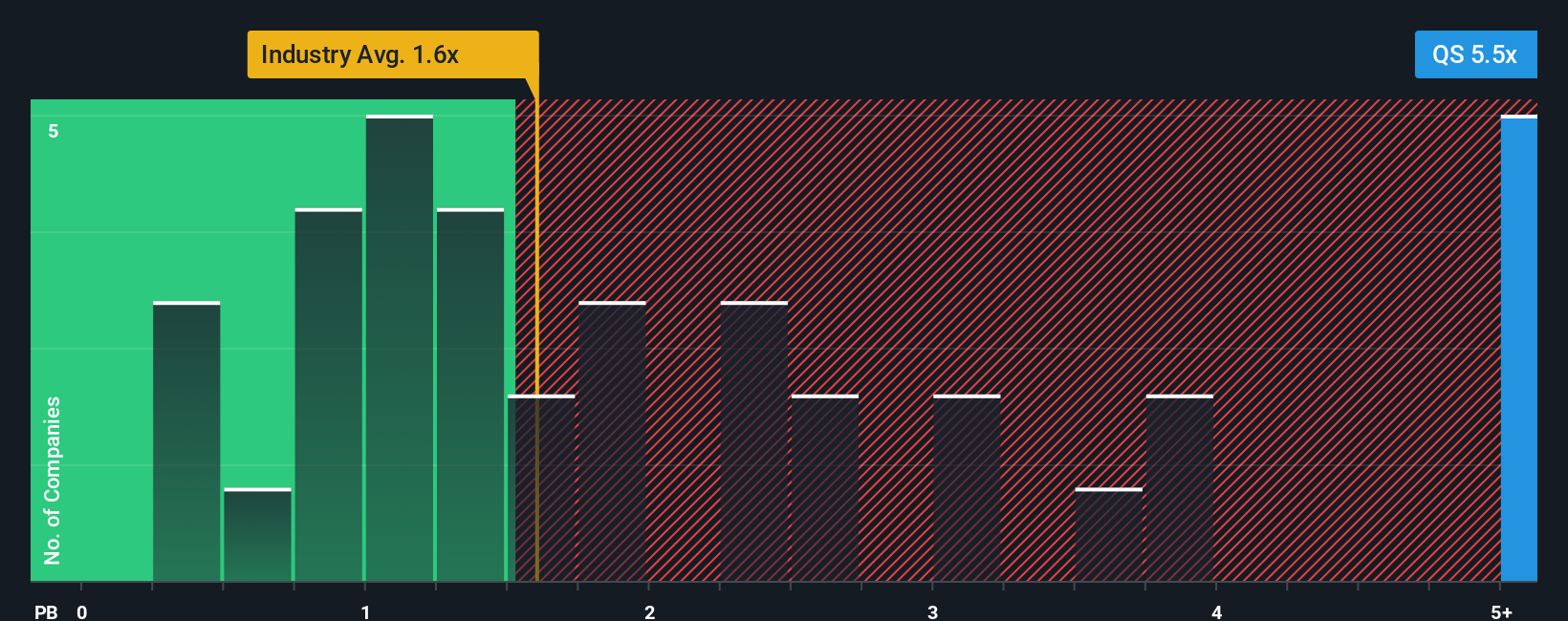

Switching gears, a market comparison tells a different story. On this metric, QuantumScape is trading at a premium compared to similar companies in its industry. Could this reflect optimism, or is the stock getting ahead of itself?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding QuantumScape to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own QuantumScape Narrative

If you see things differently or want to dive into the details yourself, there is nothing stopping you from shaping your own view in minutes. Do it your way.

A great starting point for your QuantumScape research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Seize the opportunity to spot tomorrow’s winners. There is a whole universe of forward-thinking companies waiting for your attention with the Simply Wall Street Screener.

- Supercharge your portfolio by targeting penny stocks with strong financials using our penny stocks with strong financials for standout growth opportunities often overlooked by the market.

- Boost your returns with access to dividend stocks with yields > 3%, helping you uncover companies consistently delivering attractive yields over 3% for steady income potential.

- Tap into the future of innovation by tracking quantum computing stocks, a collection of quantum computing pioneers poised to transform entire industries with groundbreaking technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QuantumScape might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QS

QuantumScape

Focuses on the development and commercialization of solid-state lithium-metal batteries for electric vehicles and other applications in the United States.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives