- United States

- /

- Auto Components

- /

- NasdaqGS:QS

QuantumScape (NYSE:QS) Integrates Advanced Cobra Separator Process

QuantumScape (NYSE:QS) achieved a significant milestone by successfully integrating its advanced Cobra separator process into baseline cell production, potentially impacting its share price 102% increase over the last quarter. This development, expected to improve production speed and scalability, likely added weight to the company’s recent stock performance. While the broader market, including the Dow and Nasdaq, experienced moderate gains amid AI-driven growth and trade policy speculations, QuantumScape's innovations in battery technology distinguished its trajectory from index trends, contrasting with market sectors influenced by trade and inflation concerns.

We've identified 3 weaknesses for QuantumScape (1 is significant) that you should be aware of.

Find companies with promising cash flow potential yet trading below their fair value.

Over the past year, QuantumScape's shares have produced a total return of 54.34% for investors, registering a significant appreciation. Against the broader market's return of 12.6% and the US Auto Components industry's decline of 2.6% over the same period, QuantumScape's performance distinctly stands out. This robust performance underscores the market's optimism concerning the company's technological advancements and strategic partnerships.

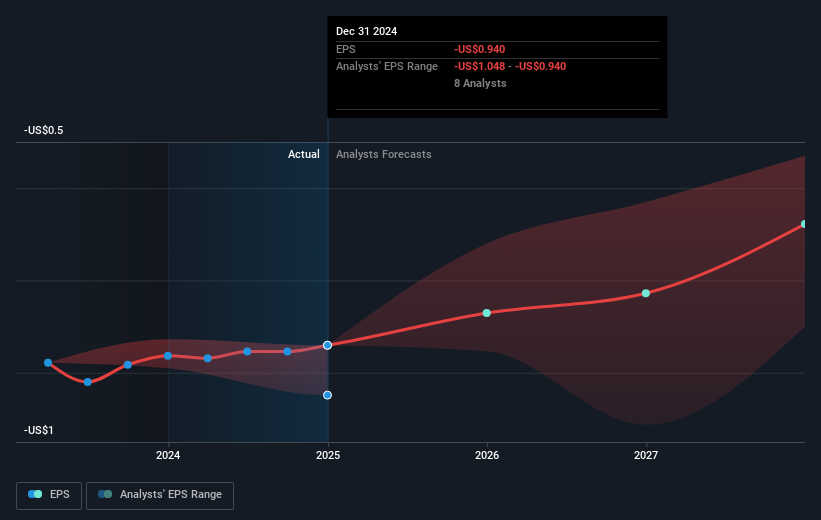

The integration of the advanced Cobra separator process, as mentioned in the introduction, may positively impact QuantumScape's future revenue and earnings, even though the company currently reports zero revenue and remains unprofitable with earnings of negative US$471.63 million. Analysts forecast revenue growth rates that surpass market averages, and the company's share price, despite recent volatility, remains below the consensus fair value estimate of US$20.08. This discount suggests potential misalignment between current market sentiments and analyst expectations, indicating room for possible price movement towards the target. Additionally, with the share price still trading well below its estimated fair value, there seems to be room for potential upside if QuantumScape's innovations achieve anticipated commercial successes.

Assess QuantumScape's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QuantumScape might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:QS

QuantumScape

Focuses on the development and commercialization of solid-state lithium-metal batteries for electric vehicles and other applications in the United States.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Beyond the "Value Trap"—Defending the $50 Intrinsic Floor

The Concentration Trap: Why the S&P 500 Is No Longer a 'Safe' Diversifier

Transformational Merger

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.