- United States

- /

- Auto Components

- /

- NYSE:PHIN

Why Investors Shouldn't Be Surprised By PHINIA Inc.'s (NYSE:PHIN) 26% Share Price Surge

PHINIA Inc. (NYSE:PHIN) shares have had a really impressive month, gaining 26% after a shaky period beforehand. The last month tops off a massive increase of 110% in the last year.

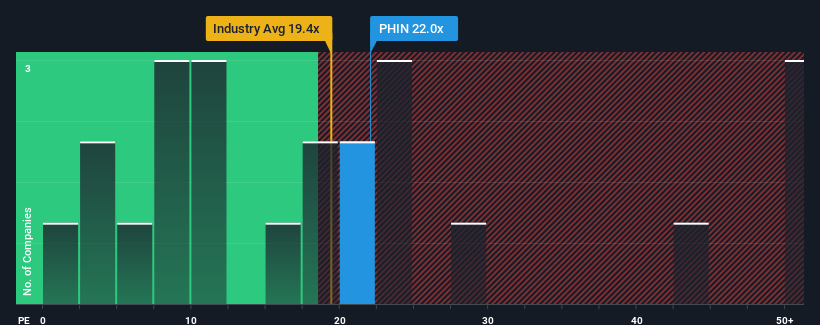

Following the firm bounce in price, given around half the companies in the United States have price-to-earnings ratios (or "P/E's") below 19x, you may consider PHINIA as a stock to potentially avoid with its 22x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

While the market has experienced earnings growth lately, PHINIA's earnings have gone into reverse gear, which is not great. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for PHINIA

How Is PHINIA's Growth Trending?

PHINIA's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 23%. This means it has also seen a slide in earnings over the longer-term as EPS is down 21% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 71% over the next year. That's shaping up to be materially higher than the 15% growth forecast for the broader market.

In light of this, it's understandable that PHINIA's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

PHINIA shares have received a push in the right direction, but its P/E is elevated too. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of PHINIA's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for PHINIA with six simple checks.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:PHIN

PHINIA

Engages in the development, design, and manufacture of integrated components and systems.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.