- United States

- /

- Auto

- /

- NYSE:NIO

Is NIO’s Valuation Justified After a 20% Monthly Slide and International Expansion News?

Reviewed by Bailey Pemberton

- Curious whether NIO's share price actually reflects its true value? You are not alone, and that is exactly what we are unpacking here.

- The stock has had a wild ride lately, jumping 20.9% year-to-date but sliding 20.3% over the past month and losing 8.0% just this week.

- Recent headlines have spotlighted NIO's ambitious push into international markets alongside evolving partnerships in battery technology and charging infrastructure. These strategic moves have sparked renewed debate among investors about the company's potential trajectory in the electric vehicle space.

- On our valuation screen, NIO scores just 2 out of 6 for being undervalued, which might surprise some. Next, let us dive into the different ways analysts, algorithms, and investors try to pin down NIO’s value, but stick around because there is a smarter way to look at valuation that we will reveal at the end.

NIO scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: NIO Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's true value by projecting its future cash flows and then discounting them back to today's value. This process reflects the time value of money. For NIO, the DCF analysis uses a two-stage Free Cash Flow to Equity model, expressed in Chinese Yuan (CN¥).

NIO's latest twelve months Free Cash Flow stands at negative CN¥20.2 billion, highlighting the company's significant investments and current cash outflows. Analyst estimates suggest NIO's free cash flows will turn positive in the coming years, reaching CN¥8.3 billion by 2029. Projections from Simply Wall St indicate continued increases well into the 2030s. The variety in analyst-sourced and extrapolated estimates illustrates the uncertainty, but also the potential acceleration in cash generation as the company scales.

Based on these inputs, the DCF model calculates an intrinsic fair value of $6.82 per share for NIO stock. This is about 19.4% higher than its recent trading price. According to projected future cash flows discounted to the present, NIO appears to be undervalued by nearly one-fifth.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests NIO is undervalued by 19.4%. Track this in your watchlist or portfolio, or discover 929 more undervalued stocks based on cash flows.

Approach 2: NIO Price vs Sales

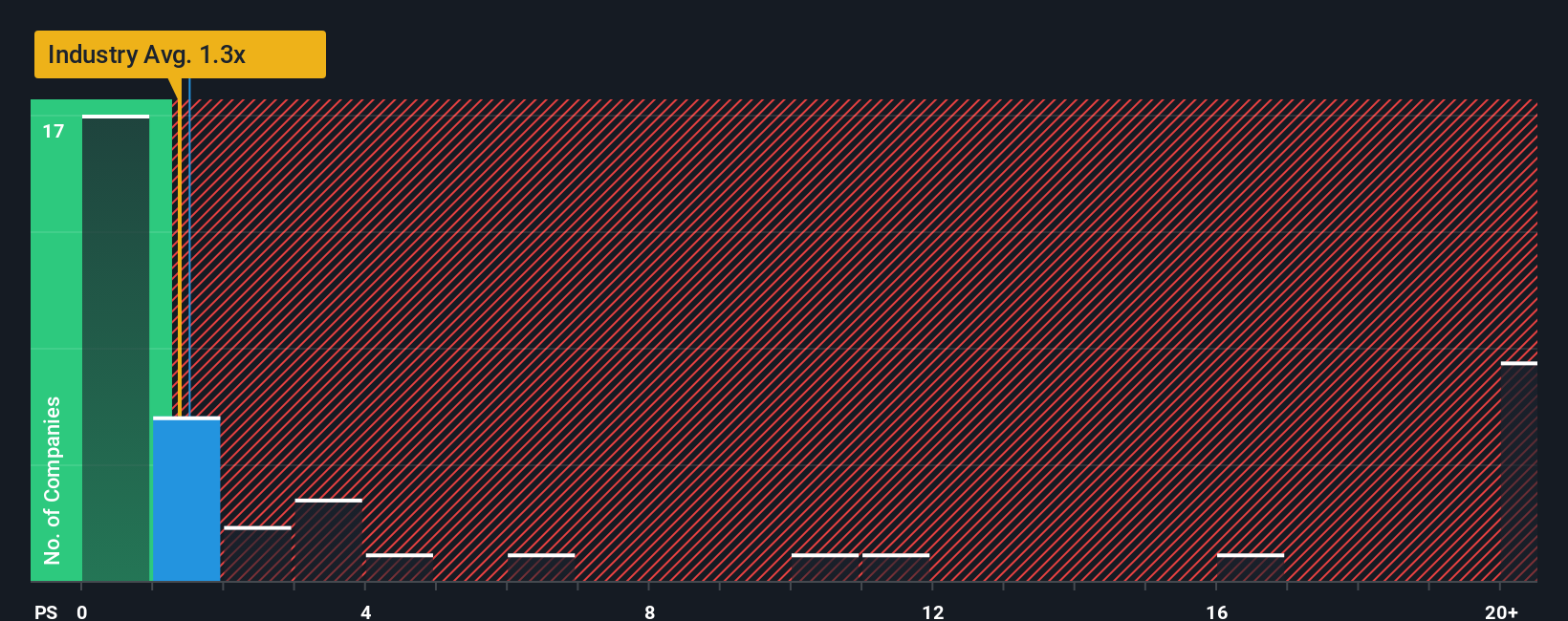

The Price-to-Sales (P/S) ratio is often preferred for valuing early-stage or unprofitable companies like NIO, where traditional earnings-based metrics such as P/E are less meaningful due to negative or highly volatile profits. The P/S ratio gives investors a sense of how much the market is willing to pay for each dollar of the company’s current sales. This makes it a relevant gauge for growth-focused firms operating in fast-moving industries.

Growth expectations and risk play a big role in what qualifies as a “normal” or “fair” P/S ratio. High-growth companies or those with unique competitive advantages can typically support a higher multiple. Firms facing greater risks or industry headwinds might trade at a discount.

NIO currently trades at a P/S ratio of 1.39x. To put this into perspective, the average P/S ratio for the auto industry is 0.86x, while NIO’s direct peers average 1.67x. This suggests NIO is valued above the industry norm but slightly below its closest competitors.

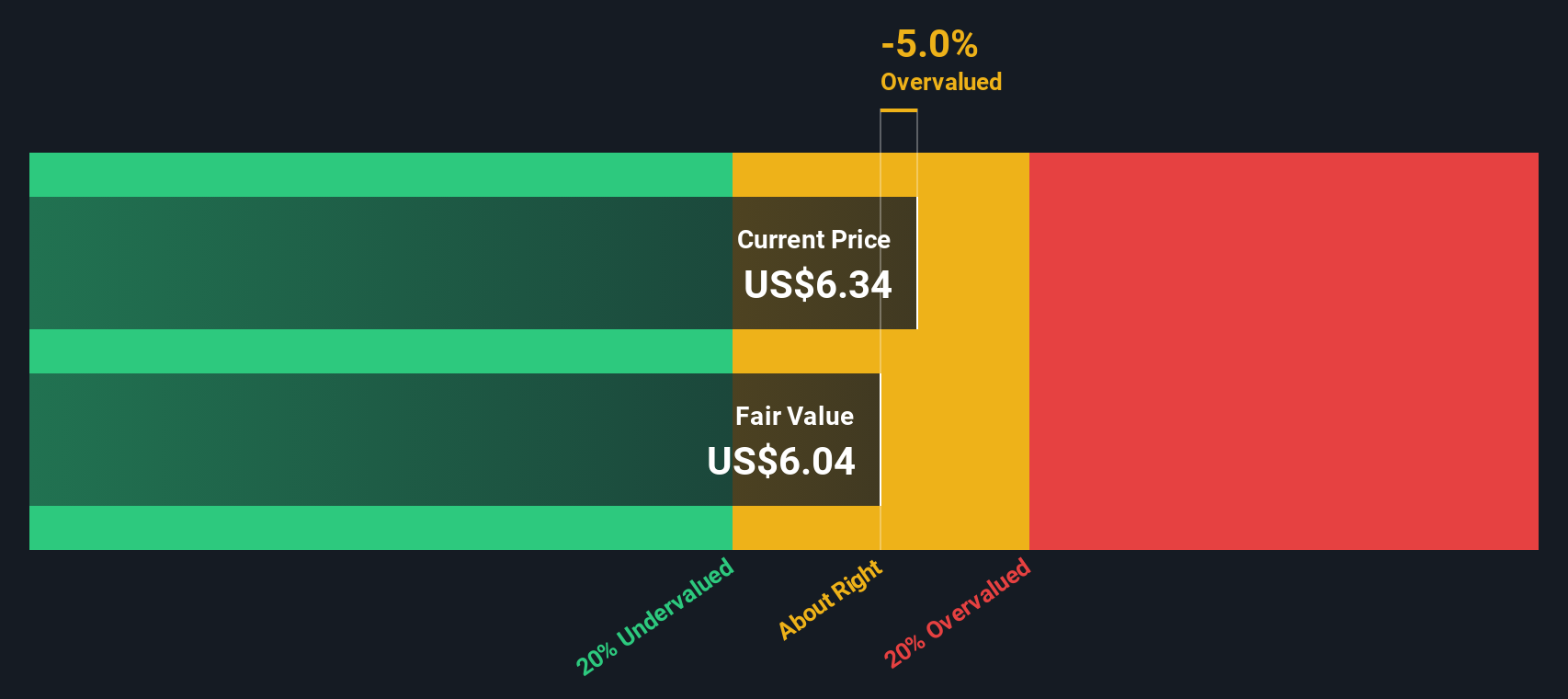

Simply Wall St goes a step further by calculating a company-specific “Fair Ratio” for the P/S multiple, currently estimated at 1.16x for NIO. Unlike simple peer or industry comparisons, the Fair Ratio incorporates NIO’s unique growth outlook, market cap, risk profile, and margins. This tailored approach better reflects what a reasonable multiple should be for a company like NIO and helps investors avoid being misled by broad averages.

Comparing NIO’s current P/S of 1.39x to its Fair Ratio of 1.16x, the difference is 0.23. This suggests the stock is trading above what’s considered reasonable for its circumstances.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1439 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your NIO Narrative

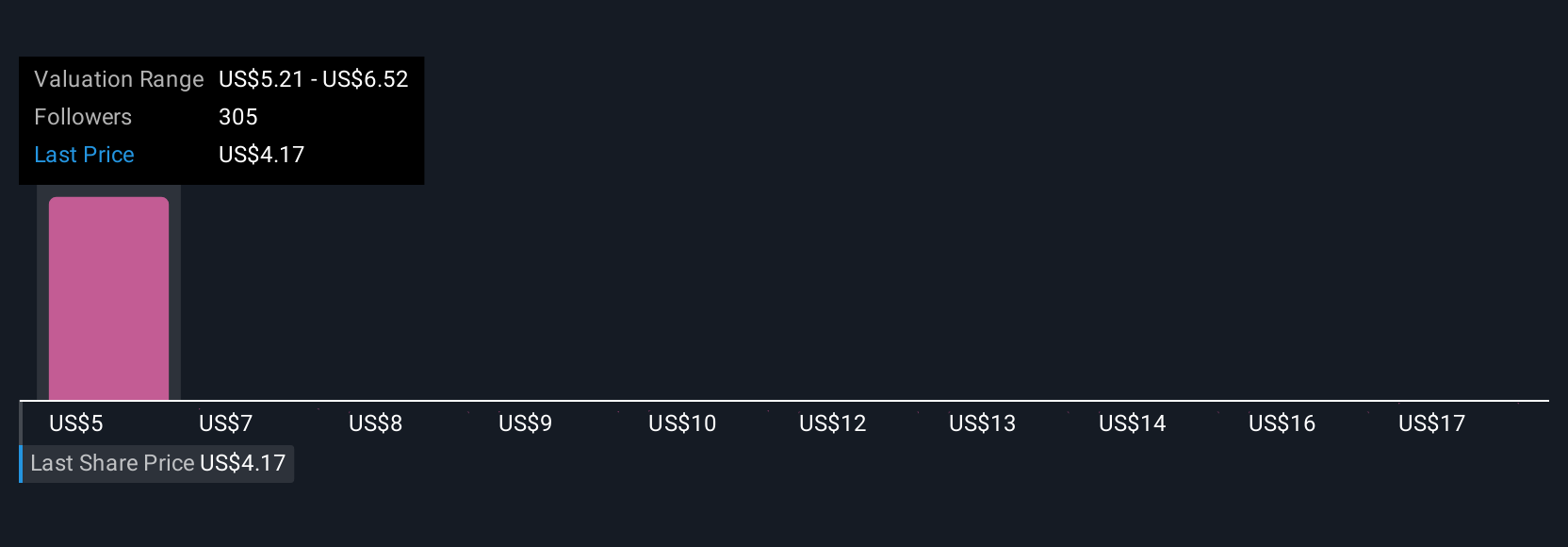

Earlier, we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is a way to combine your perspective or “story” about NIO, including how you imagine its future growth, margins, and risks, with the numbers, so you can see the fair value that truly fits your view.

Instead of relying solely on analyst models or broad comparisons, Narratives allow you to map out the key events and changes you believe will shape NIO’s future. You can then connect those ideas directly to a personalized forecast and valuation. This approach is not only for financial professionals but is available to everyone on Simply Wall St’s Community page, where millions of investors share and update their own Narratives every day.

By choosing or building a Narrative that reflects how you see NIO’s prospects, you can immediately see the fair value that aligns with your assumptions and easily compare it to today’s share price to decide whether now is the right time to buy or sell.

One of the most valuable aspects of Narratives is that they update in real time as new information appears, such as earnings or major news. This ensures your investment thesis keeps pace with reality.

For example, some investors see NIO heading toward the highest analyst target of $9.00 per share, driven by product expansion and strong delivery growth. Others adopt a cautious Narrative closer to $3.00, citing tough competition and profitability risks.

Do you think there's more to the story for NIO? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NIO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NIO

NIO

Designs, develops, manufactures, and sells smart electric vehicles in China, Europe, and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success