- United States

- /

- Auto

- /

- NYSE:NIO

Does NIO's Capital Raise and Delivery Surge Signal a New Growth Phase for NIO (NIO)?

Reviewed by Simply Wall St

- Earlier this month, NIO completed a follow-on equity offering that raised approximately US$1.81 billion, while also reporting record monthly deliveries of 31,305 vehicles in August 2025 and setting ambitious fourth-quarter production goals for its ONVO L90 and ES8 models.

- Cheche Group announced a deepening partnership with NIO to enhance insurance services across NIO's expanding multi-brand portfolio, aligning with the company's strong delivery pace and new milestones in cumulative deliveries.

- We'll explore how NIO’s capital raise amid record deliveries could influence its ability to pursue growth and innovation in the evolving EV landscape.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

NIO Investment Narrative Recap

To be a NIO shareholder today, you need confidence that rapid delivery growth and innovation will outweigh persistent net losses and fierce EV market competition. The recent US$1.81 billion equity raise provides substantial capital for ongoing expansion and model launches but also highlights continued reliance on external funding, leaving the profitability question unresolved. As a result, while the capital boost may support short-term growth milestones, it does not appear to materially shift the central risk of achieving sustainable earnings amid heightened competition.

One of the more interesting recent announcements is NIO's August delivery record of 31,305 vehicles, alongside aggressive fourth-quarter production targets for the ONVO L90 and ES8 models. These ambitious goals tie closely to the company’s main growth catalysts, broadening its market reach with new models and scaling volumes, yet operational execution and margin discipline remain front and center as the main challenges.

In contrast, investors should also be aware of the ongoing pressure on margins from intense competition as NIO pushes for rapid expansion and...

Read the full narrative on NIO (it's free!)

NIO's narrative projects CN¥148.4 billion revenue and CN¥7.5 billion earnings by 2028. This requires 28.8% yearly revenue growth and a CN¥31.8 billion earnings increase from CN¥-24.3 billion today.

Uncover how NIO's forecasts yield a $6.26 fair value, in line with its current price.

Exploring Other Perspectives

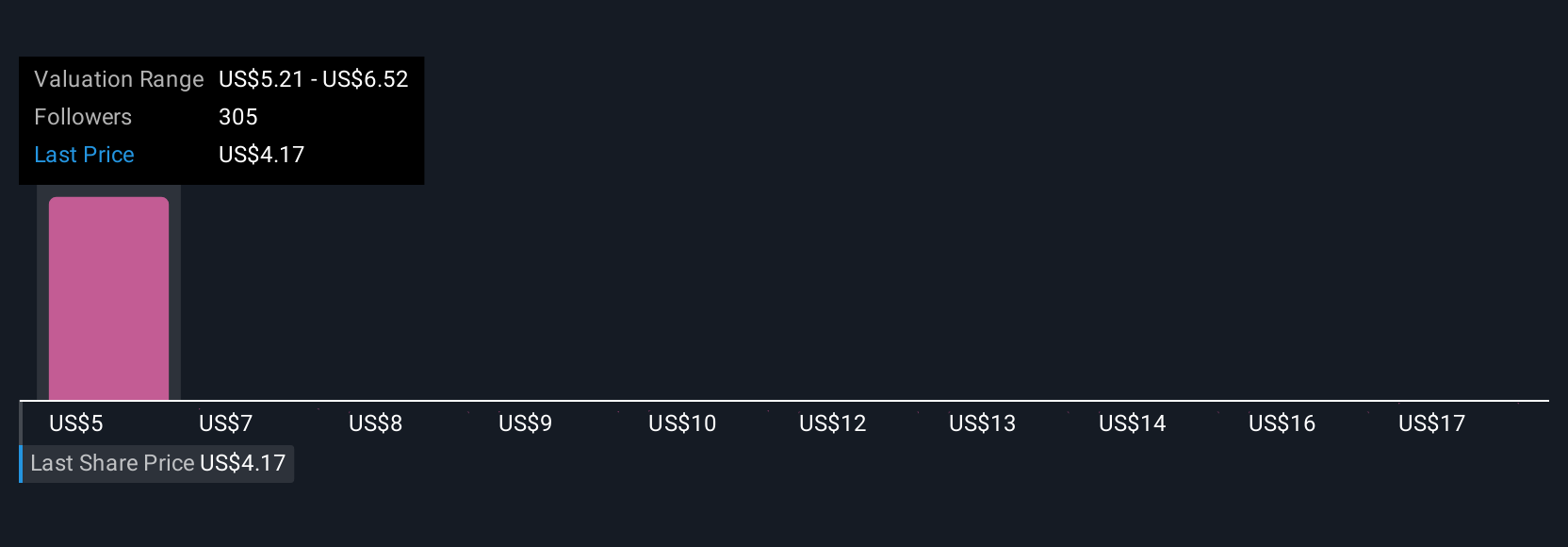

The Simply Wall St Community’s 18 fair value estimates for NIO range from US$4.41 to US$18.27 per share. While many see growth potential as new models ramp up, several also recognize that persistent losses and margin pressure are top-of-mind for future performance, explore these varied perspectives for a more complete view.

Explore 18 other fair value estimates on NIO - why the stock might be worth 29% less than the current price!

Build Your Own NIO Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NIO research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free NIO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NIO's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NIO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NIO

NIO

Designs, develops, manufactures, and sells smart electric vehicles in China, Europe, and internationally.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives