- United States

- /

- Auto

- /

- NYSE:NIO

Assessing NIO Stock After 5% Weekly Jump and New Vehicle Launch News

Reviewed by Bailey Pemberton

- Ever wondered if NIO shares are a bargain or if you might be buying in at a premium? Let’s break down what’s going on beneath the surface so you can decide for yourself.

- NIO’s stock price has seen its share of drama lately, jumping 5.1% just this week, but still down 5.8% for the past month and up a notable 59.3% so far in 2024.

- Some of this volatility can be traced back to recent headlines, including reports of new vehicle model launches and ongoing conversations about strategic partnerships in the EV sector. As competitors ramp up their global ambitions, NIO’s moves in technology and market expansion are attracting plenty of attention from investors.

- When it comes to valuation, NIO currently scores just 1 out of 6 on our core valuation checks. Next up, we’ll dive into those traditional valuation approaches. Stay tuned, because there’s an even more insightful way to assess whether NIO is really worth your investment.

NIO scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: NIO Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by forecasting its future cash flows and then discounting them back to present value. This helps investors understand what NIO could be worth today based on its projected financial performance rather than relying solely on market sentiment.

According to the latest financials, NIO’s current free cash flow sits at approximately negative CN¥20.2 billion, signaling that more money is currently leaving the business than coming in. Analysts forecast a turning point; by 2029, NIO’s free cash flow is expected to reach CN¥8.26 billion, with further growth extrapolated out to 2035. The initial five-year projections draw from analysts, while longer-term estimates are based on the platform's own calculations.

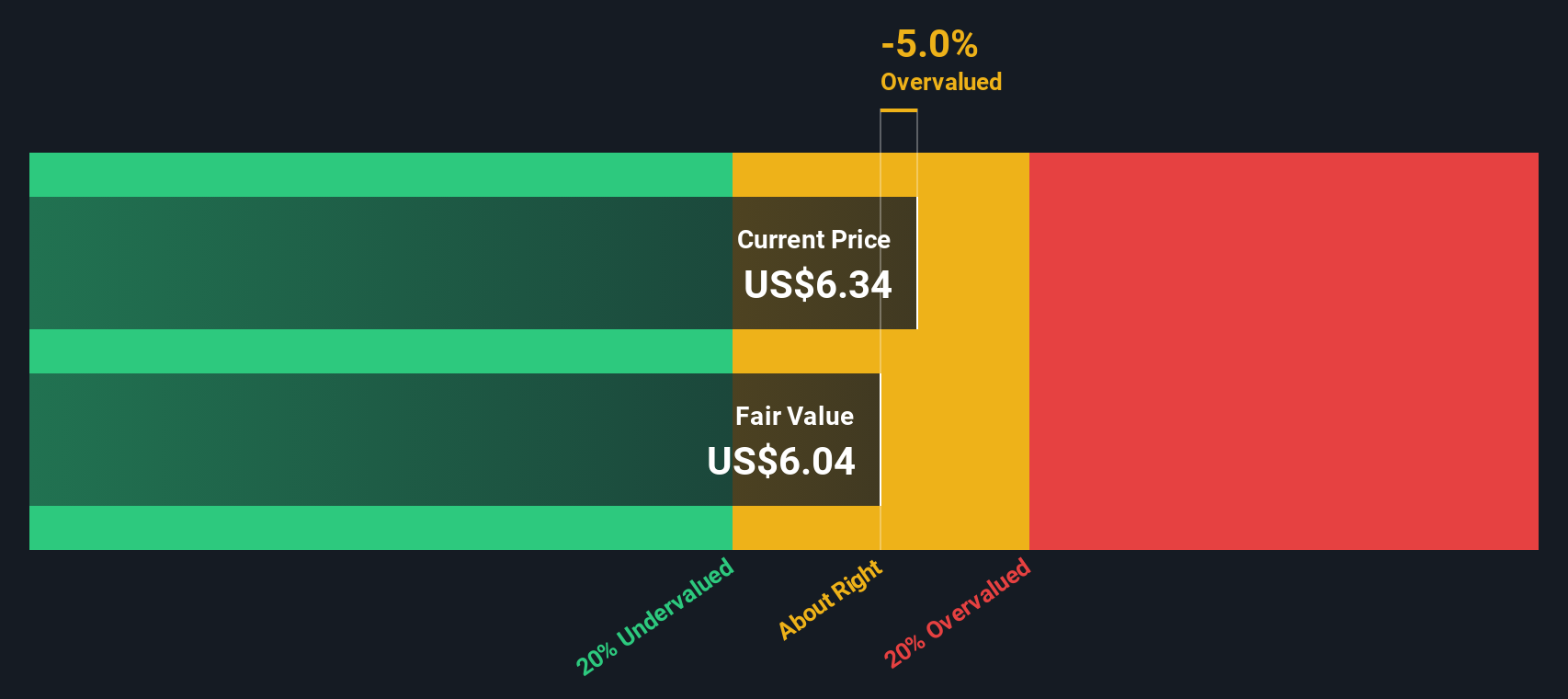

Based on the DCF approach, the intrinsic value of NIO’s shares is estimated at $6.18. This suggests the stock is about 17.2% above its fair value, meaning it is considered overvalued according to this model.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests NIO may be overvalued by 17.2%. Discover 839 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: NIO Price vs Sales

For many growing companies, the Price-to-Sales (P/S) ratio is a helpful tool for valuation, especially when profits are still elusive but sales are showing momentum. It is often preferred for high-growth businesses because it focuses on revenue, a metric less prone to accounting adjustments than earnings. This gives investors a clearer view of how the market prices current and potential sales growth.

Growth expectations and risk levels play a significant role in determining what is considered a “normal” or “fair” P/S ratio. Companies with faster revenue growth and lower risk typically command higher P/S ratios, while slower-growth or riskier companies often trade closer to or below industry averages.

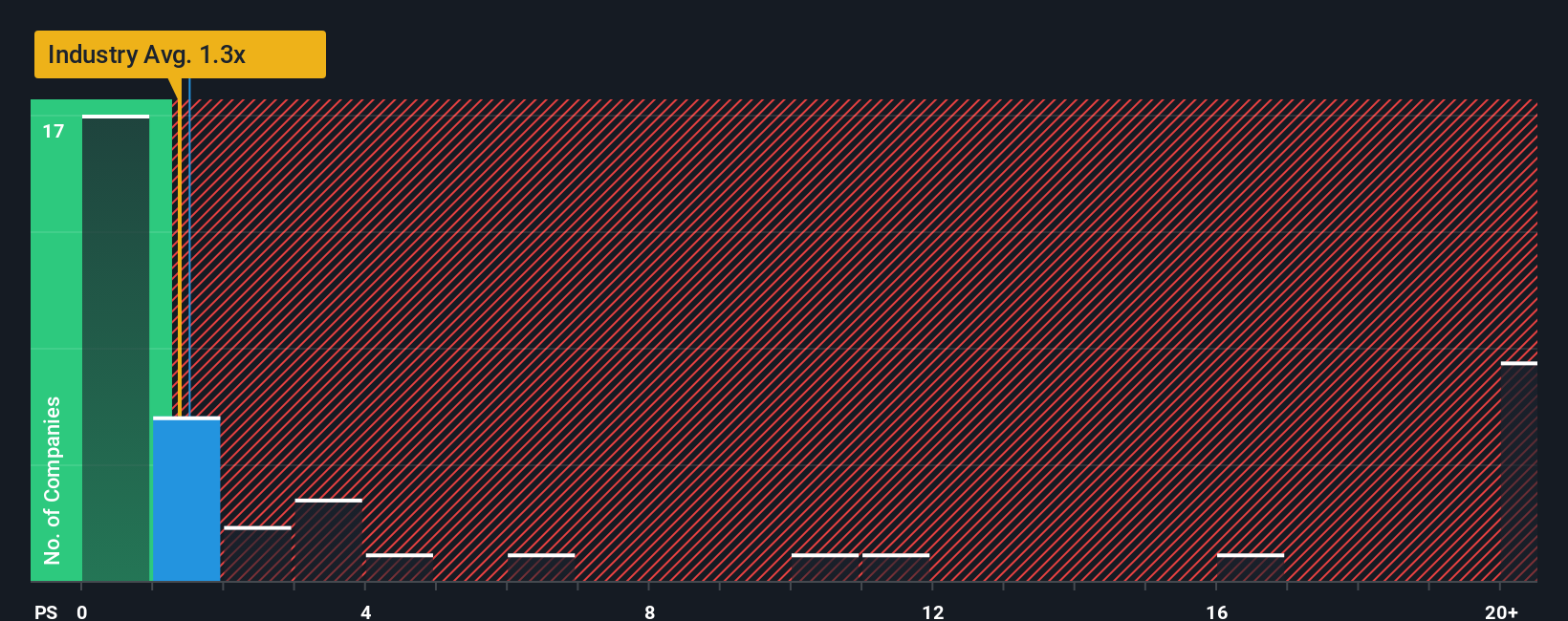

Currently, NIO trades at a 1.84x P/S ratio. For context, the average in the auto industry stands at 1.25x, while NIO’s peer group averages around 1.89x. These comparisons provide some insight, but raw multiples often overlook important nuances such as growth prospects and company-specific risks.

This is where Simply Wall St’s “Fair Ratio” comes in. For NIO, the proprietary Fair Ratio is calculated at 1.46x. Unlike basic peer or industry benchmarks, the Fair Ratio adjusts for a variety of factors such as revenue growth, profit margins, risk profile, and market capitalization. This offers a more tailored and relevant valuation target for the business.

Comparing the Fair Ratio to NIO’s actual multiple, the difference is just 0.38x. While NIO is currently trading a little above its tailored fair value, the gap is not dramatic, but it does suggest the stock is slightly overvalued on this metric.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your NIO Narrative

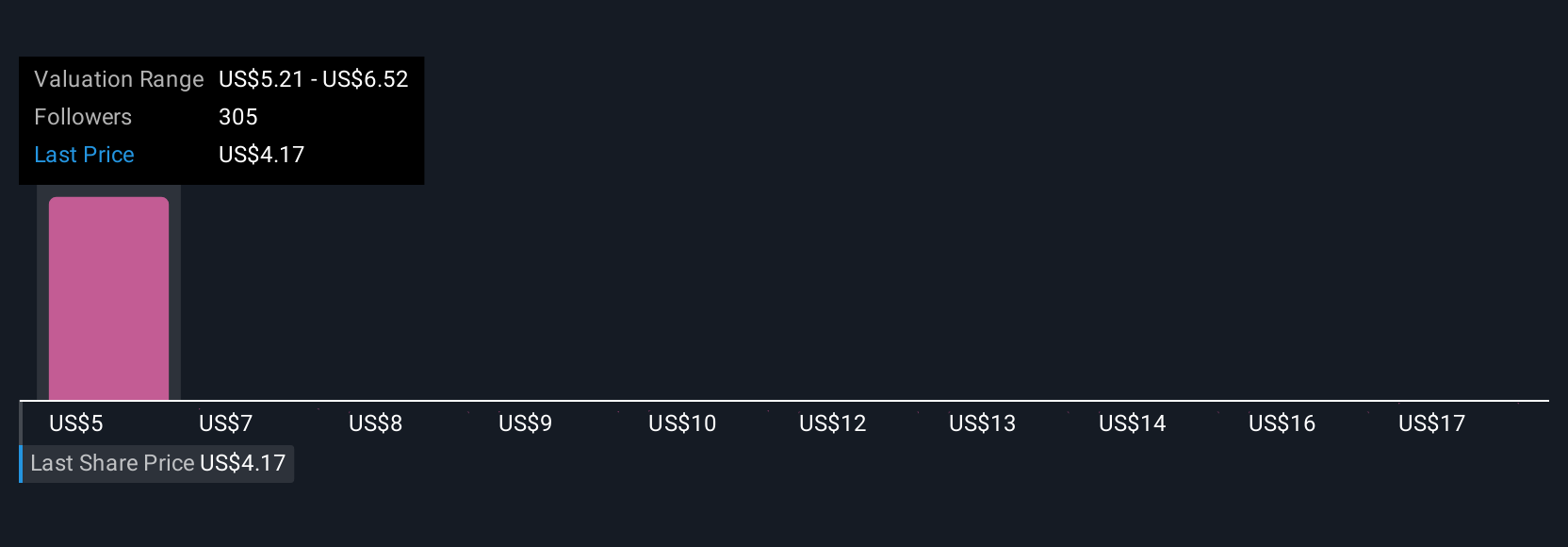

Earlier we mentioned there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story about a company, the perspective that shapes how you see NIO’s future, weaving together your own forecasts on revenue, profit, and margins to arrive at what you believe is a fair value.

Narratives connect the dots between a business’s real-world progress and the numbers behind its share price. They help you transform dry data into actionable insight by framing every financial forecast within the bigger NIO story, whether that's new battery technologies, global expansion, or changing policy trends.

On Simply Wall St’s Community page, anyone can build and share a Narrative using intuitive tools, so it’s easy for beginners and seasoned investors alike. Narratives are dynamic and automatically update as fresh news, earnings, or events happen, giving you an agile way to review and rethink your assumptions.

By comparing the Fair Value from your Narrative with today’s market price, you will see a clear signal on whether you think NIO is a buy or a sell, and you can track how your conviction changes as the facts evolve.

For example, some investors see NIO’s fair value as low as $3.00 if risks dominate, while others forecast as high as $9.00 with ambitious growth, showing how Narratives capture a full range of perspectives in one place.

Do you think there's more to the story for NIO? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NIO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NIO

NIO

Designs, develops, manufactures, and sells smart electric vehicles in China, Europe, and internationally.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives