- United States

- /

- Auto Components

- /

- NYSE:MOD

Subdued Growth No Barrier To Modine Manufacturing Company (NYSE:MOD) With Shares Advancing 25%

Modine Manufacturing Company (NYSE:MOD) shares have continued their recent momentum with a 25% gain in the last month alone. The last month tops off a massive increase of 226% in the last year.

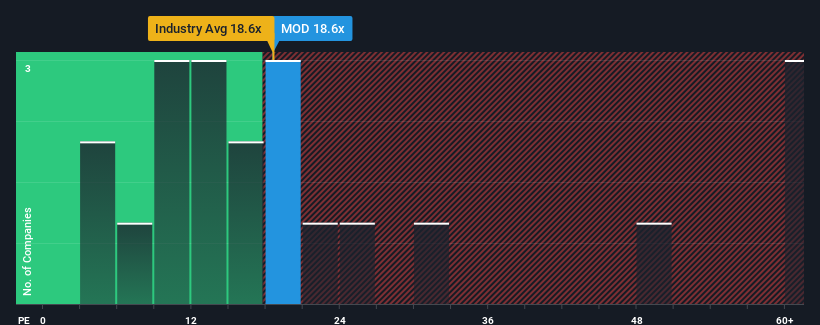

Since its price has surged higher, Modine Manufacturing may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 18.6x, since almost half of all companies in the United States have P/E ratios under 16x and even P/E's lower than 9x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Modine Manufacturing certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Modine Manufacturing

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as Modine Manufacturing's is when the company's growth is on track to outshine the market.

If we review the last year of earnings growth, the company posted a terrific increase of 214%. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the four analysts covering the company suggest earnings growth is heading into negative territory, declining 20% over the next year. Meanwhile, the broader market is forecast to expand by 13%, which paints a poor picture.

In light of this, it's alarming that Modine Manufacturing's P/E sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh heavily on the share price eventually.

The Final Word

The large bounce in Modine Manufacturing's shares has lifted the company's P/E to a fairly high level. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Modine Manufacturing currently trades on a much higher than expected P/E for a company whose earnings are forecast to decline. When we see a poor outlook with earnings heading backwards, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You should always think about risks. Case in point, we've spotted 1 warning sign for Modine Manufacturing you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:MOD

Modine Manufacturing

Provides thermal management products and solutions in the United States, Italy, Hungary, China, the United Kingdom, and internationally.

Flawless balance sheet with reasonable growth potential.