- United States

- /

- Auto

- /

- NYSE:LVWR

Why LiveWire Group (LVWR) Is Up 6.5% After Joining the S&P Total Market Index

Reviewed by Sasha Jovanovic

- LiveWire Group, Inc. (NYSE:LVWR) was recently added to the S&P Total Market Index (TMI), expanding the company's presence within major equity benchmarks.

- This inclusion often prompts purchases by index funds and institutional investors seeking to replicate the index's composition.

- We'll explore how increased index inclusion could influence LiveWire Group's investment appeal and longer-term profile.

Outshine the giants: these 23 early-stage AI stocks could fund your retirement.

What Is LiveWire Group's Investment Narrative?

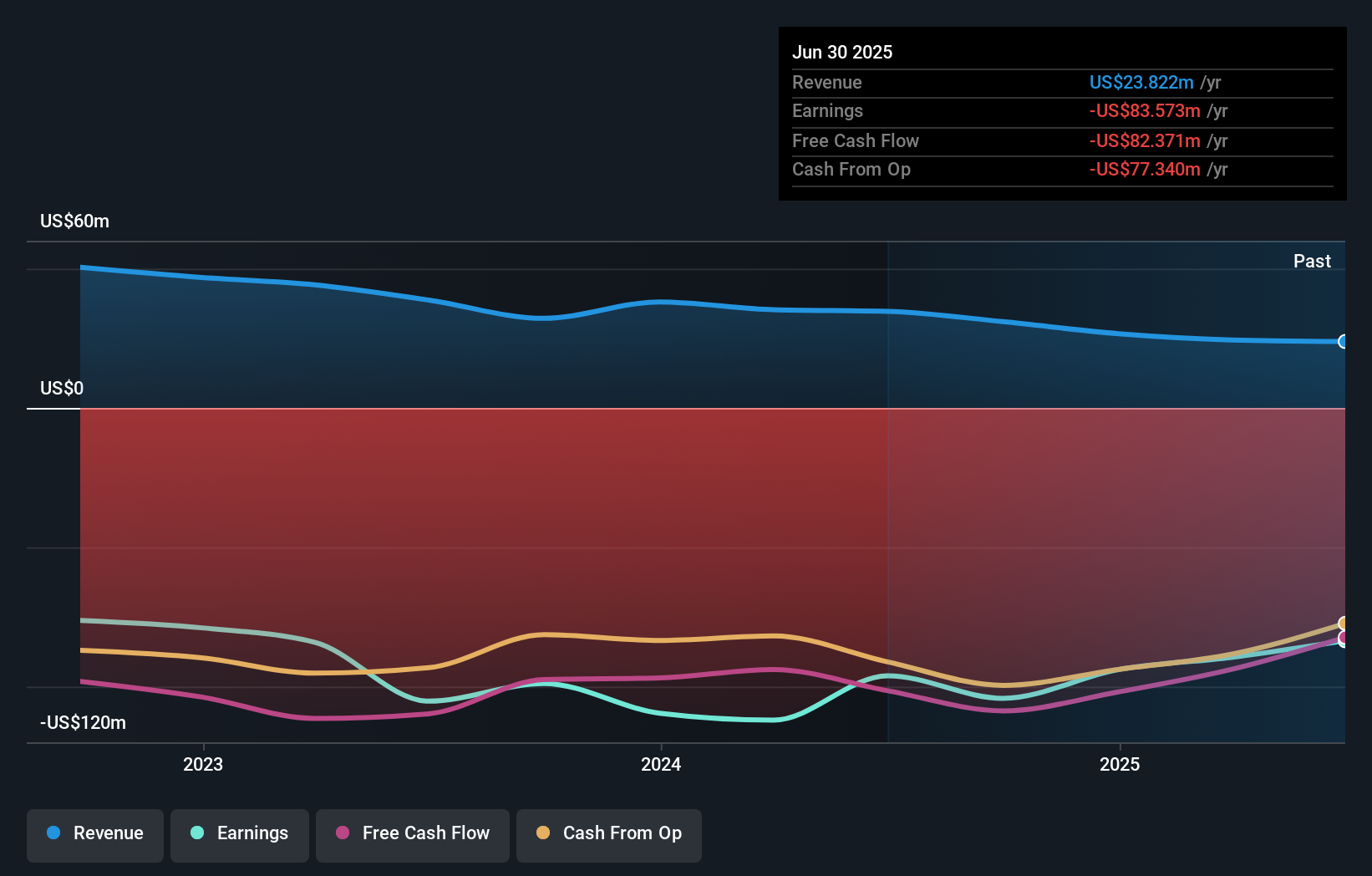

Being a shareholder in LiveWire Group means believing in the potential of electric motorcycles to carve out a meaningful space in the broader mobility market, despite early-stage financial challenges and questions around sustained demand. The company's recent addition to the S&P Total Market Index could increase near-term visibility and attract index-driven investment, but with losses persisting and recent top management turnover, the most significant shapers of the investment case remain product traction and leadership stability. The technical boost from index inclusion may temporarily support liquidity and price, but doesn't fundamentally resolve slower sales growth, board inexperience, or the hefty valuation premium compared to peers. While promotions and new features create talking points, it's the bigger test of consumer adoption and the company's path to profitability that will ultimately define LiveWire's trajectory, especially as execution risk remains elevated after executive shake-ups.

Yet, there's one business risk few investors are talking about, leadership changes can directly affect direction and stability.

Exploring Other Perspectives

Explore 2 other fair value estimates on LiveWire Group - why the stock might be worth less than half the current price!

Build Your Own LiveWire Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LiveWire Group research is our analysis highlighting 2 important warning signs that could impact your investment decision.

- Our free LiveWire Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LiveWire Group's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LVWR

LiveWire Group

Manufactures and sells electric motorcycles in the United States, Austria, and internationally.

Flawless balance sheet with very low risk.

Market Insights

Community Narratives