- United States

- /

- Auto

- /

- NYSE:LVWR

LiveWire Group, Inc. (NYSE:LVWR) Not Lagging Industry On Growth Or Pricing

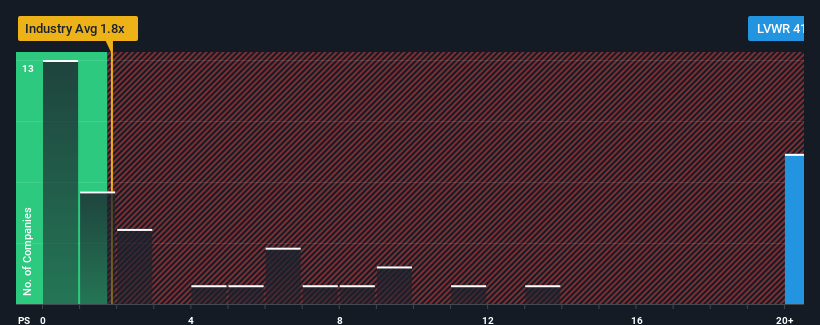

LiveWire Group, Inc.'s (NYSE:LVWR) price-to-sales (or "P/S") ratio of 41.6x may look like a poor investment opportunity when you consider close to half the companies in the Auto industry in the United States have P/S ratios below 1.8x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for LiveWire Group

How Has LiveWire Group Performed Recently?

LiveWire Group hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on LiveWire Group.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as LiveWire Group's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 20%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 14% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 62% over the next year. That's shaping up to be materially higher than the 13% growth forecast for the broader industry.

With this in mind, it's not hard to understand why LiveWire Group's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From LiveWire Group's P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of LiveWire Group's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 2 warning signs for LiveWire Group (1 shouldn't be ignored!) that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LVWR

LiveWire Group

Manufactures and sells electric motorcycles in the United States, Austria, and internationally.

Adequate balance sheet slight.

Market Insights

Community Narratives