- United States

- /

- Auto

- /

- NYSE:HOG

If You Had Bought Harley-Davidson (NYSE:HOG) Stock Five Years Ago, You'd Be Sitting On A 48% Loss, Today

The main aim of stock picking is to find the market-beating stocks. But every investor is virtually certain to have both over-performing and under-performing stocks. So we wouldn't blame long term Harley-Davidson, Inc. (NYSE:HOG) shareholders for doubting their decision to hold, with the stock down 48% over a half decade. There was little comfort for shareholders in the last week as the price declined a further 4.1%.

View our latest analysis for Harley-Davidson

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

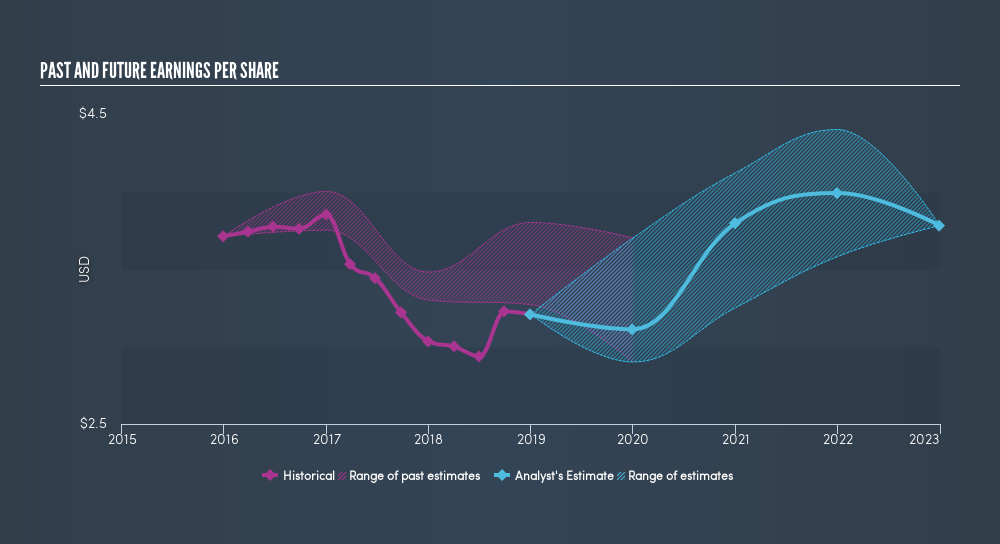

During the five years over which the share price declined, Harley-Davidson's earnings per share (EPS) dropped by 0.6% each year. Readers should note that the share price has fallen faster than the EPS, at a rate of 12% per year, over the period. This implies that the market is more cautious about the business these days. The less favorable sentiment is reflected in its current P/E ratio of 10.90.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

This free interactive report on Harley-Davidson's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Harley-Davidson, it has a TSR of -40% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Investors in Harley-Davidson had a tough year, with a total loss of 16% (including dividends), against a market gain of about 5.6%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 9.7% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

Of course Harley-Davidson may not be the best stock to buy. So you may wish to see this freecollection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:HOG

Harley-Davidson

Manufactures and sells motorcycles in the United States and internationally.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives