- United States

- /

- Auto Components

- /

- NYSE:HLLY

Holley's (NYSE:HLLY) Returns On Capital Not Reflecting Well On The Business

Did you know there are some financial metrics that can provide clues of a potential multi-bagger? Firstly, we'd want to identify a growing return on capital employed (ROCE) and then alongside that, an ever-increasing base of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. However, after briefly looking over the numbers, we don't think Holley (NYSE:HLLY) has the makings of a multi-bagger going forward, but let's have a look at why that may be.

What Is Return On Capital Employed (ROCE)?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. To calculate this metric for Holley, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.062 = US$70m ÷ (US$1.2b - US$89m) (Based on the trailing twelve months to October 2023).

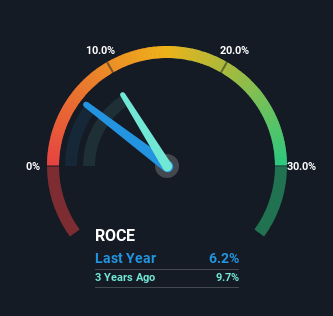

Thus, Holley has an ROCE of 6.2%. In absolute terms, that's a low return and it also under-performs the Auto Components industry average of 13%.

See our latest analysis for Holley

In the above chart we have measured Holley's prior ROCE against its prior performance, but the future is arguably more important. If you'd like, you can check out the forecasts from the analysts covering Holley here for free.

How Are Returns Trending?

In terms of Holley's historical ROCE movements, the trend isn't fantastic. Around three years ago the returns on capital were 9.7%, but since then they've fallen to 6.2%. However it looks like Holley might be reinvesting for long term growth because while capital employed has increased, the company's sales haven't changed much in the last 12 months. It's worth keeping an eye on the company's earnings from here on to see if these investments do end up contributing to the bottom line.

The Bottom Line

To conclude, we've found that Holley is reinvesting in the business, but returns have been falling. And investors appear hesitant that the trends will pick up because the stock has fallen 52% in the last three years. All in all, the inherent trends aren't typical of multi-baggers, so if that's what you're after, we think you might have more luck elsewhere.

On a final note, we found 3 warning signs for Holley (1 is a bit unpleasant) you should be aware of.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

Valuation is complex, but we're here to simplify it.

Discover if Holley might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:HLLY

Holley

Designs, manufactures, and distributes automotive aftermarket products to car and truck enthusiasts primarily in the United States, Canada, and Europe.

Fair value with moderate growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026