- United States

- /

- Auto

- /

- NYSE:GM

Is GM Ready for a Revaluation After White House Tariff Easing?

Reviewed by Bailey Pemberton

If you are eyeing General Motors stock and wondering whether now is the right moment to jump in or hold tight, you are not alone. The stock has been on quite the ride lately, with headlines buzzing about potential changes that could shift the whole industry landscape. In just the past week, GM’s share price climbed 2.5%, even after dipping a bit over the last 30 days. Zooming out, the picture gets even more interesting: up 11.6% since the start of the year, 17.4% over the past twelve months, and a massive 77% in the last three years. Clearly, something is in motion.

So, what is driving this? Two developments stand out. First, the White House is preparing to ease tariffs for automakers, which could mean lower costs and higher margins for GM in the future. Second, GM’s bet on producing rare-earth magnets in the U.S. is paying off, putting the company in a strong position with supply chain advantages that few rivals can match. Although not every plan went smoothly, with GM recently scrapping a last-minute strategy around electric vehicle tax credits, the overall sentiment around risk appears to be changing to the company’s benefit.

When we turn to valuation, GM scores an impressive 5 out of 6 on our value checklist, signaling that the stock may still be flying under the radar for many investors. But numbers alone only tell part of the story. Next, we will look at how each valuation approach weighs in, and why there might be an even better way to assess the company’s true worth than you might expect.

Why General Motors is lagging behind its peers

Approach 1: General Motors Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is designed to estimate a company’s intrinsic value by projecting its future cash flows and discounting them back to present-day dollars. For General Motors, analysts start by looking at its current Free Cash Flow, which over the last twelve months stands at $13.05 billion. This figure sets the benchmark for future growth scenarios.

Forecasts suggest that by 2029, General Motors’ annual Free Cash Flow will be about $8.6 billion. Analyst estimates for the next five years show some variance, with cash flow projections between $7 billion and $8.6 billion per year. Beyond this period, Simply Wall St continues the projection through to 2035, resulting in estimates of over $10 billion in annual Free Cash Flow within the next decade.

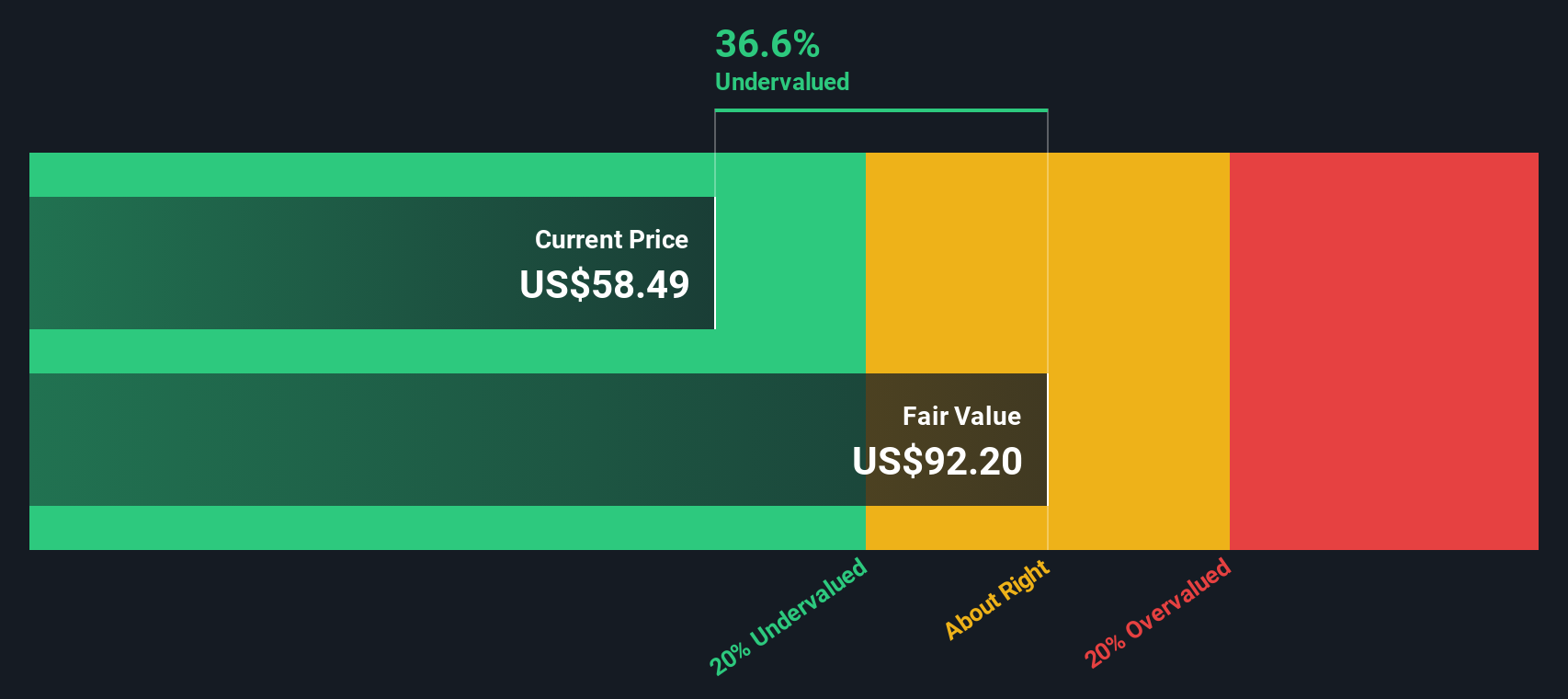

When all these cash flows are discounted and summed, the DCF model arrives at a fair value of $89.84 per share for GM. This figure is 36.2% higher than the company’s current share price. This points to meaningful potential upside and suggests the stock is undervalued at present.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests General Motors is undervalued by 36.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: General Motors Price vs Earnings

For profitable companies like General Motors, the price-to-earnings (PE) ratio is a widely recognized measure for valuation because it shows how much investors are willing to pay for each dollar of earnings generated. As a company’s future growth opportunities expand or its perceived risks decline, its “normal” or “fair” PE ratio tends to rise. This reflects improved expectations for returns and stability. On the other hand, higher risks or slower growth typically lead to lower PE ratios being considered fair.

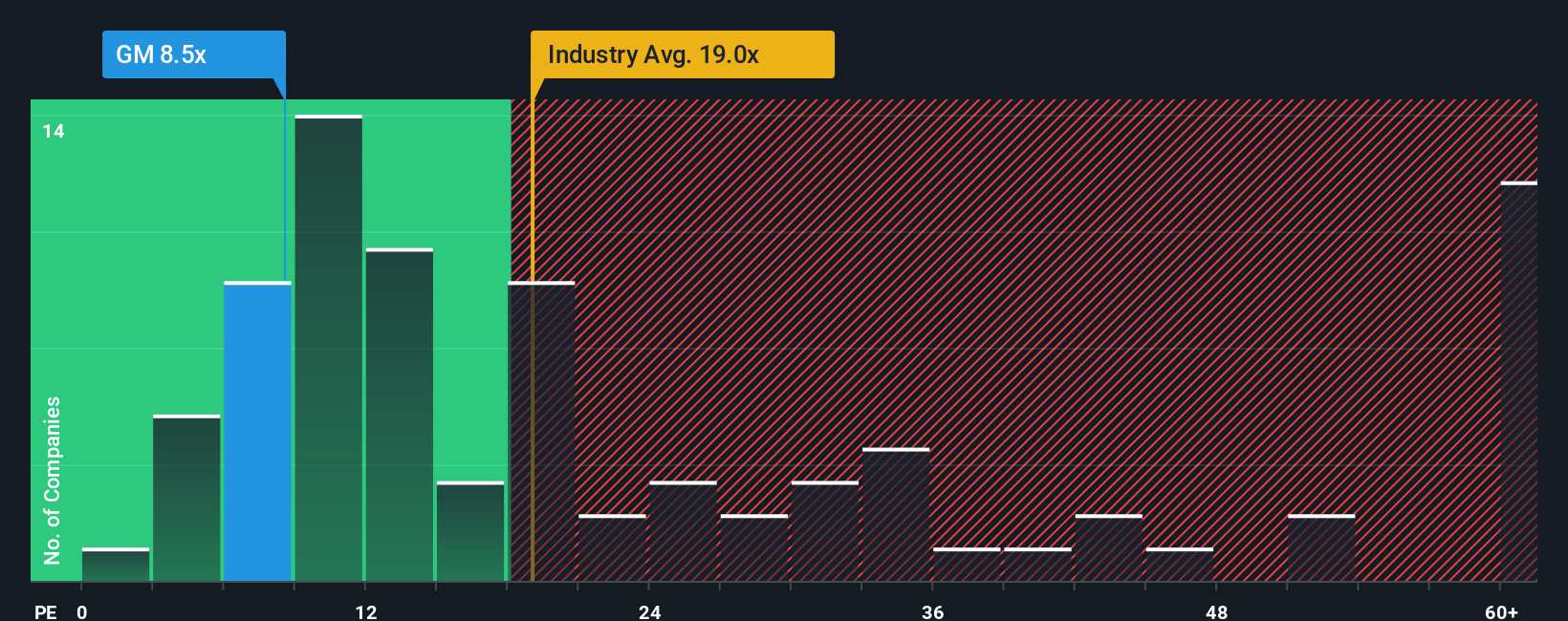

Currently, GM trades at 8.4x earnings. This is notably below both the average PE ratio for its industry, which is 19.2x, and the average of its direct peers at 18.5x. At first glance, this sizable discount could suggest undervaluation. However, headline comparisons do not always tell the full story.

This is where Simply Wall St’s “Fair Ratio” comes into play. The Fair Ratio for GM is calculated at 15.1x, which takes into account the company’s specific factors, such as growth outlook, profit margins, market cap, and unique risks, alongside its role in the auto industry. Unlike a simple peer or industry comparison, the Fair Ratio aims to tailor the benchmark to what is really relevant for GM, providing a more precise yardstick for value.

Comparing GM’s current multiple of 8.4x to its Fair Ratio of 15.1x, the company still trades at a significant discount. This means that, based on these forward-looking and company-specific factors, GM appears undervalued on a PE basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your General Motors Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply the story you believe about a company, your perspective on where it’s headed and why, backed up by your own estimates for future revenue, profitability, and fair value. Narratives connect the dots between what’s happening on the ground, your financial forecasts, and what you think GM should be worth, forming a clear and actionable investment thesis.

On Simply Wall St’s Community page, millions of investors use Narratives to share their views and track how their expectations compare to the current share price. Narratives help you decide when to buy or sell by highlighting the gap between fair value and market price, so you always know whether the opportunity matches your story. Even better, Narratives update in real time as news or earnings come out, so your thesis stays relevant.

For example, one investor’s Narrative for General Motors might predict robust electric vehicle growth and resilient margins, giving a bullish fair value of $80 per share. Another focused on risks from tariffs and EV adoption could justify a lower target of $38. Narratives let you define, refine, and act on your own investment rationale with confidence.

Do you think there's more to the story for General Motors? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GM

General Motors

Designs, builds, and sells trucks, crossovers, cars, and automobile parts worldwide.

Good value with slight risk.

Similar Companies

Market Insights

Community Narratives