- United States

- /

- Auto Components

- /

- NYSE:BWA

BorgWarner (BWA): Assessing Valuation After Analyst Upgrades and Renewed Growth Optimism

Reviewed by Kshitija Bhandaru

Investor interest in BorgWarner (BWA) has picked up following a wave of analyst optimism. Several firms, including Goldman Sachs, have reaffirmed positive outlooks and updated earnings estimates. This has fueled new conversations about the company’s direction.

See our latest analysis for BorgWarner.

BorgWarner's shares have steadily gained attention, with recent analyst optimism adding fuel to a slow but notable build in investor momentum. While the stock's 1-year total shareholder return sits just under 0.3%, its reputation as a key player in both electric and combustion vehicle markets keeps long-term prospects lively and valuations in focus.

If industry shifts in auto technology have you interested, now is a perfect moment to discover See the full list for free.

The question for investors now is whether BorgWarner’s latest upgrades reveal untapped value or if the market has already priced in the company’s electric and combustion vehicle growth. Could this be a genuine buying opportunity, or is optimism fully reflected?

Most Popular Narrative: Fairly Valued

The most closely watched narrative puts BorgWarner’s fair value almost exactly at the last closing price, suggesting the market has already priced in both its strengths and uncertainties. What’s fueling this sharp consensus? It’s all about electrification momentum, new OEM partnerships, and deeper bets on sustainable tech. But here is what stands out most from the narrative’s logic.

Expanding platform wins, particularly with major Chinese OEMs for inverters, electric motors, and differential technologies, reflect deeper integration into next-generation EV architectures and can drive higher content per vehicle. This strengthens long-term earnings visibility through recurring, higher-margin supply contracts.

Want a peek behind the curtain? There is a bold call here that hinges on aggressive future earnings growth, a profit margin rebound, and a discounted price-to-earnings target rarely seen in this industry. Think you know what is driving this razor-sharp valuation? Dive into the full narrative and see if your assumptions match the numbers powering this fair value call.

Result: Fair Value of $43.93 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing reliance on combustion technologies and uncertainty in battery segment recovery could challenge BorgWarner’s long-term momentum if electrification trends slow.

Find out about the key risks to this BorgWarner narrative.

Another View: Market Ratios Raise New Questions

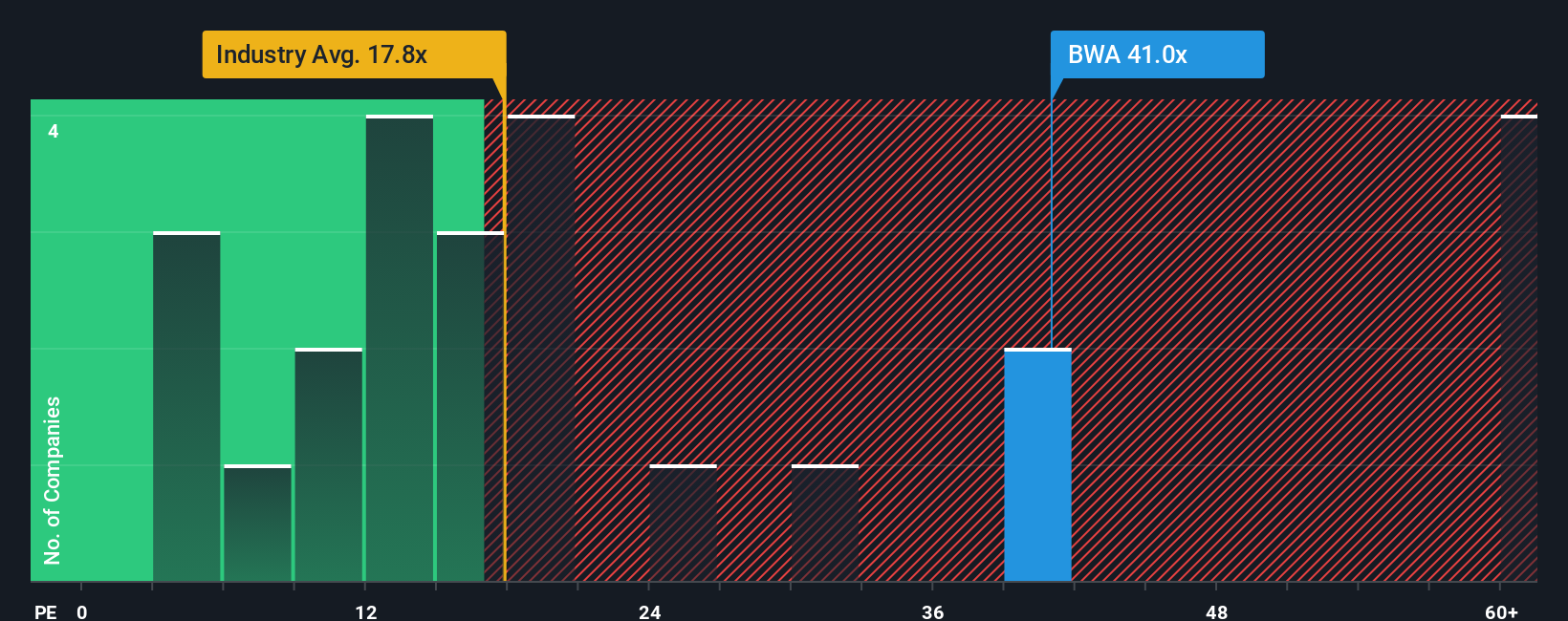

Looking beyond analyst forecasts, BorgWarner currently trades at a price-to-earnings ratio of 43.7x, which is far above both the industry average of 18.7x and the peer average of 20.5x. The fair ratio for the company stands at 16.4x, suggesting that the current market premium might carry risk if investor sentiment shifts sharply. Is this a sign of continued optimism, or a warning of potential pullback if expectations are not met?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out BorgWarner for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own BorgWarner Narrative

If you see things differently or want to dig into the data your way, you can shape your own narrative in just a few minutes. Do it your way

A great starting point for your BorgWarner research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t miss your chance to uncover stocks with real potential across today’s most exciting market themes. Find your next opportunity before others catch on.

- Capture the upside of high-potential sectors by reviewing these 24 AI penny stocks now gaining attention for innovation in artificial intelligence and automation.

- Supercharge your passive income strategy, and check out these 19 dividend stocks with yields > 3% that are rewarding investors with compelling yields above 3%.

- Tap into undervalued opportunities ahead of the crowd through these 907 undervalued stocks based on cash flows, which is ideal for finding stocks set up for a comeback based on strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BorgWarner might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BWA

BorgWarner

Provides solutions for combustion, hybrid, and electric vehicles worldwide.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives