- United States

- /

- Auto Components

- /

- NasdaqCM:XPEL

XPEL (XPEL): Assessing Valuation Following Q3 Results, New Product Launch, and Expansion Plans

Reviewed by Simply Wall St

XPEL (XPEL) just released third quarter earnings, reporting higher revenue but a slight decrease in net income compared to last year. The company also unveiled its new COLOR Paint Protection Film at the SEMA Show and shared plans for expansion.

See our latest analysis for XPEL.

Despite some recent volatility, XPEL’s share price has surged nearly 20% over the past month and rallied over 12% in just the past week. The market has responded to strong revenue growth, ambitious expansion plans, and the debut of new products. Still, the one-year total shareholder return remains in the red, suggesting that momentum is only beginning to rebuild after last year’s setbacks.

If automotive innovation like XPEL’s COLOR Paint Protection has you thinking bigger, now is a smart time to broaden your sights and discover See the full list for free.

But the real question for investors is whether XPEL’s recent surge means there is still room for upside, or if the market has already priced in its ambitious plans and improving fundamentals. Could this be a true buying opportunity, or has the future growth story been fully valued?

Most Popular Narrative: 21.7% Undervalued

Compared to XPEL’s last close at $40.74, the most-followed narrative suggests considerable upside, with fair value pegged at $52. The gap between price and potential raises eyebrows about what’s fueling such optimism, especially as XPEL’s outlook evolves.

Expansion into emerging and international markets (e.g., Thailand, Japan, China, Brazil, Europe, India, Middle East) is well underway. Further direct distribution efforts and M&A are planned, which broadens XPEL's addressable market and diversifies revenue streams. This supports accelerated revenue growth and reduces regional concentration risk over time.

Curious what forecasts power this 21% valuation gap? Hint: The blueprint behind this price hinges on bold international moves, rising margins, and aggressive profit growth. Want to know which assumptions shape these numbers? The full narrative exposes the financial logic for XPEL’s new price target. Don’t miss what drives it.

Result: Fair Value of $52 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, increased global competition or a decline in vehicle sales could quickly dampen XPEL’s growth trajectory and call bullish forecasts into question.

Find out about the key risks to this XPEL narrative.

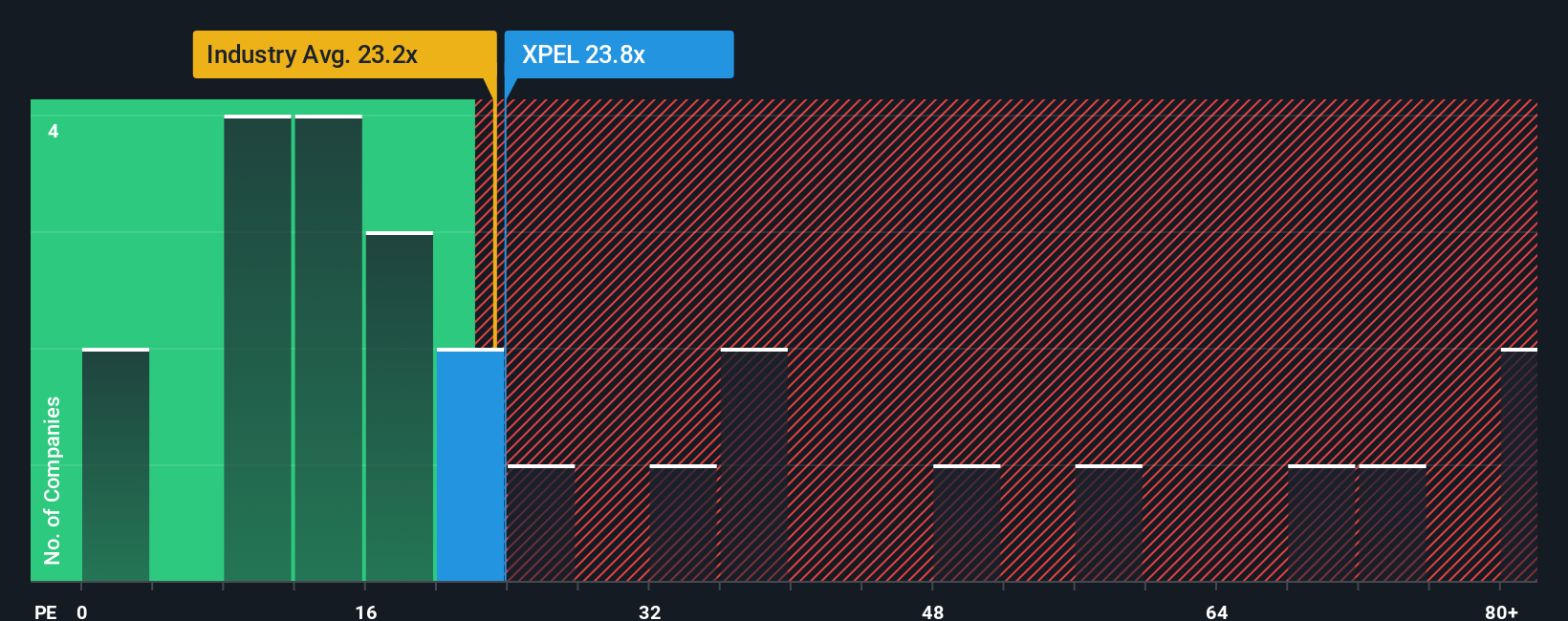

Another View: What About the Market Multiple?

Looking from a market perspective, XPEL trades at a price-to-earnings ratio of 24.1 times. This makes it pricier than both its peers (20.7x) and the broader auto components industry (23.5x). It also stands above its fair ratio of 19.6x, suggesting the market is already eager for growth. Is that optimism warranted, or could it set up for disappointment?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own XPEL Narrative

If you see XPEL’s story unfolding differently or prefer to dig into the details on your own, crafting a fresh perspective takes just minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding XPEL.

Looking for More Investment Ideas?

Don’t let standout opportunities pass you by. Simply Wall Street’s screeners can help you pinpoint high-potential stocks other investors might be missing right now.

- Uncover high-yield picks and boost your income with these 15 dividend stocks with yields > 3% that have reliably delivered strong returns above 3%.

- Jump in early on the fast-moving fintech shift by checking out these 82 cryptocurrency and blockchain stocks making waves in decentralized finance and blockchain advancements.

- Spot exciting innovation by seeking out these 27 AI penny stocks harnessing artificial intelligence to drive growth and transform industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:XPEL

XPEL

Manufactures, installs, sells, and distributes protective films, coatings and related services.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives