- United States

- /

- Insurance

- /

- NasdaqCM:TIPT

US Undiscovered Gems 3 Small Caps With Strong Potential

Reviewed by Simply Wall St

The United States market has seen a positive trajectory, climbing by 2.0% over the past week and achieving a 12% increase over the past year, with earnings forecasted to grow by 14% annually. In such an environment, identifying small-cap stocks with strong potential can offer unique opportunities for investors seeking to capitalize on emerging growth stories.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| West Bancorporation | 169.96% | -1.41% | -8.52% | ★★★★★★ |

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| Gulf Island Fabrication | 19.65% | -2.17% | 42.26% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

| Vantage | 6.72% | -16.62% | -15.47% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Tiptree (NasdaqCM:TIPT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Tiptree Inc. operates through its subsidiaries to offer specialty insurance products and related services across the United States and Europe, with a market capitalization of approximately $831.68 million.

Operations: The primary revenue stream for Tiptree comes from its insurance segment, generating approximately $1.98 billion. The mortgage segment contributes an additional $65.20 million in revenue.

Tiptree, a smaller player in the financial sector, has shown strong earnings growth of 107.4% over the past year, outpacing the broader insurance industry. The company's interest payments are well-covered by EBIT at 5.3 times, indicating solid financial health. Over five years, Tiptree's debt to equity ratio improved significantly from 125.8% to 81%, and its net debt to equity stands at a satisfactory 30.3%. Despite recent insider selling and a slight dip in quarterly revenue and net income compared to last year, Tiptree remains profitable with positive free cash flow and offers dividends of $0.06 per share.

- Unlock comprehensive insights into our analysis of Tiptree stock in this health report.

Gain insights into Tiptree's past trends and performance with our Past report.

XPEL (NasdaqCM:XPEL)

Simply Wall St Value Rating: ★★★★★★

Overview: XPEL, Inc. is involved in the manufacturing, installation, sale, and distribution of protective films and coatings with a market capitalization of approximately $995.10 million.

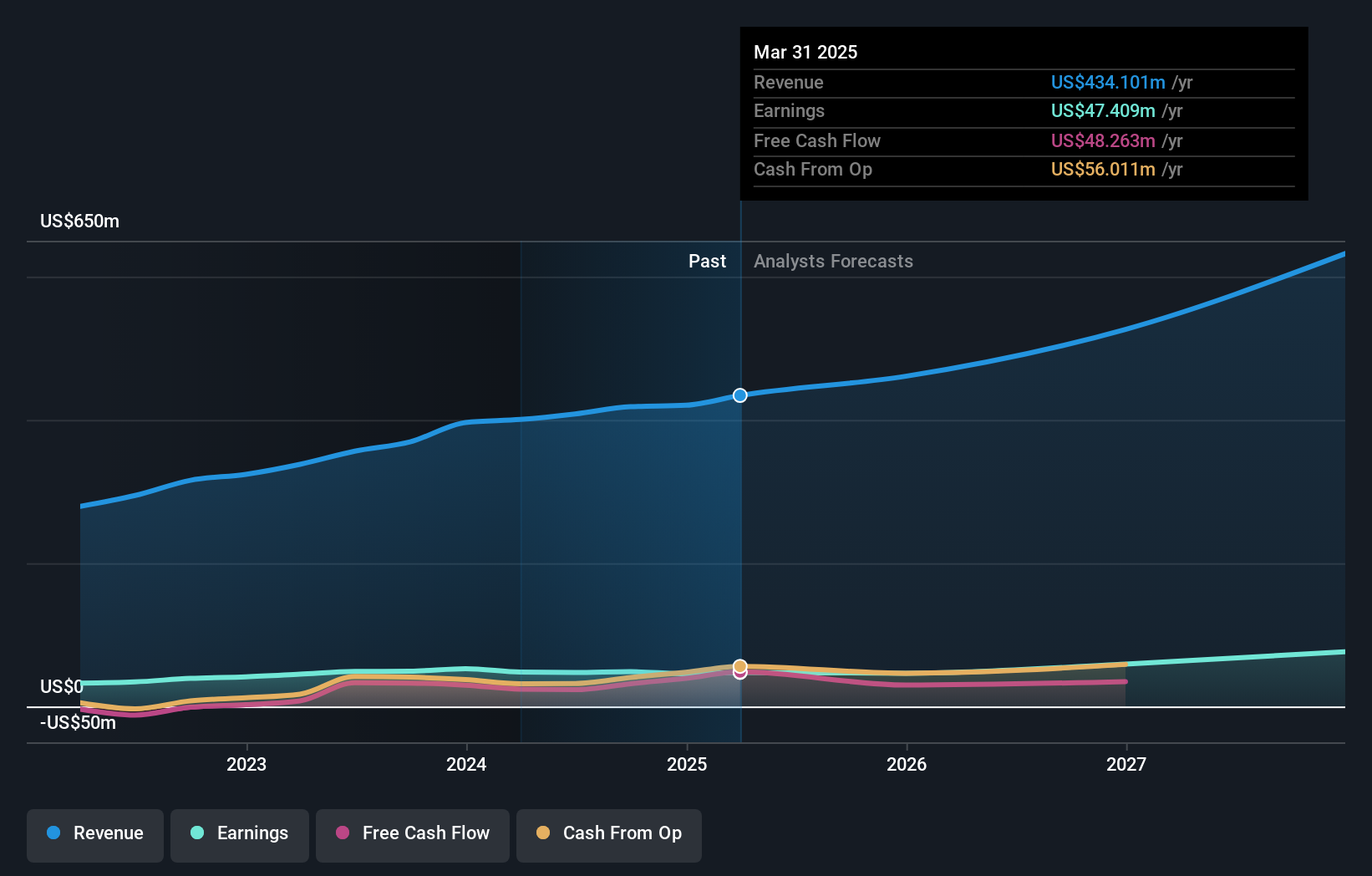

Operations: The company generates revenue primarily from its Auto Parts & Accessories segment, amounting to $434.10 million.

XPEL, a nimble player in the auto components sector, has been making strides with its strategic moves. The company reported first-quarter revenue of US$103.81 million, up from US$90.1 million last year, and net income increased to US$8.59 million from US$6.67 million previously. With debt levels well-managed—cash surpassing total debt—and interest payments covered 102 times by EBIT, financial health appears robust. Despite recent insider selling and challenges like rising SG&A expenses due to acquisitions, XPEL's expansion into China and new product launches promise growth potential with projected earnings growth of 17% annually over the coming years.

CRA International (NasdaqGS:CRAI)

Simply Wall St Value Rating: ★★★★★☆

Overview: CRA International, Inc. offers economic, financial, and management consulting services globally and has a market cap of approximately $1.29 billion.

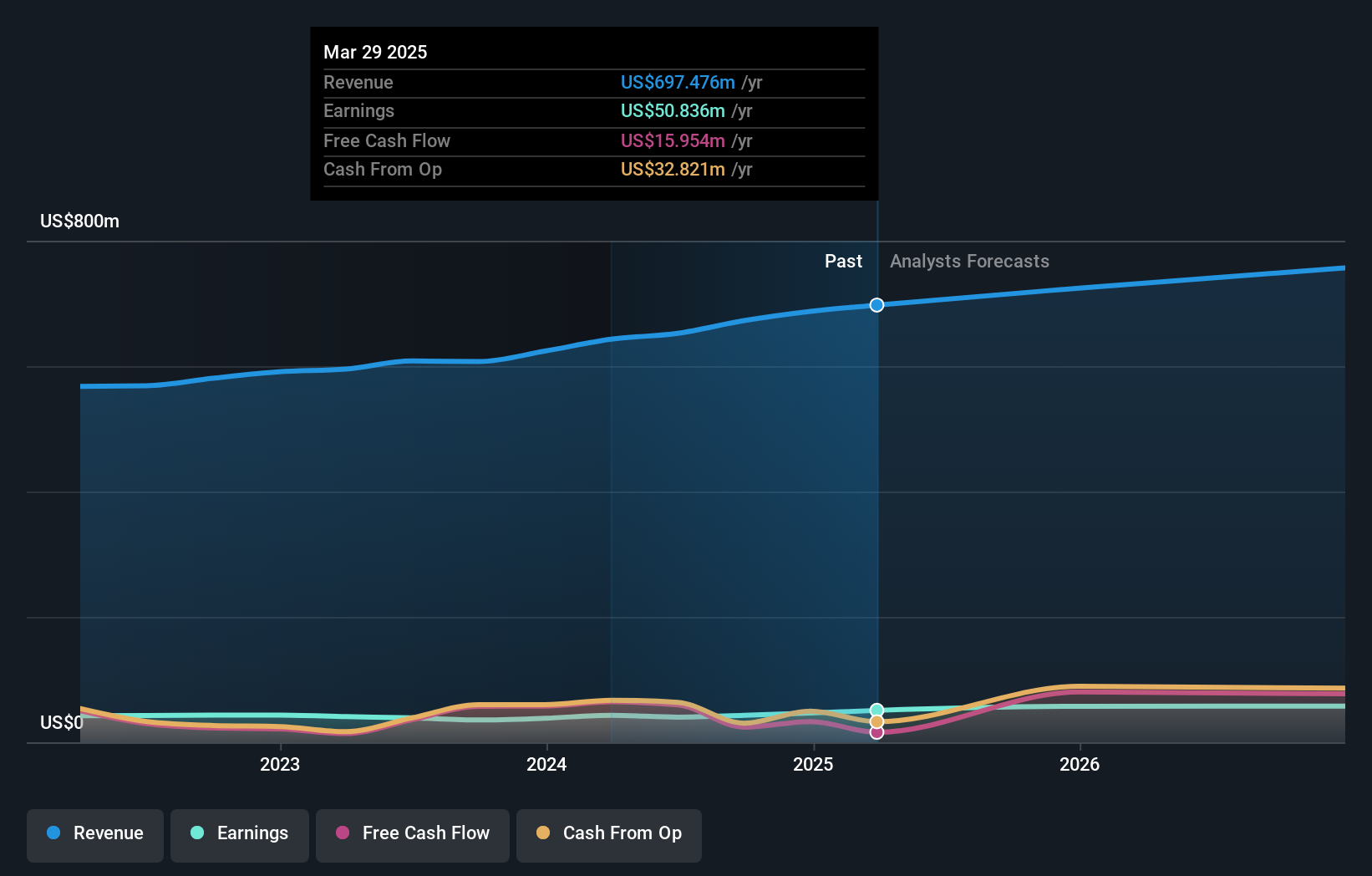

Operations: CRA International generates revenue primarily from its consulting services, amounting to $697.48 million. The company has a market cap of approximately $1.29 billion.

With a strong foothold in the professional services sector, CRA International seems to be an intriguing prospect, especially given its 18.1% earnings growth last year surpassing the industry's 15.3%. The company is trading at a good value, currently 24% below its estimated fair value. Despite a slight increase in debt-to-equity from 35.6% to 37.4% over five years, CRAI's net debt to equity remains satisfactory at 26.1%, with interest payments well covered by EBIT at 17.5x coverage. Recent earnings results showed sales of US$181 million and net income of US$18 million for Q1, reflecting solid financial health and potential for future growth in high-demand sectors like Antitrust & Competition Economics and Intellectual Property services.

Next Steps

- Access the full spectrum of 286 US Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tiptree might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:TIPT

Tiptree

Through its subsidiaries, provides specialty insurance products and related services in the United States and Europe.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives