- United States

- /

- Auto Components

- /

- NasdaqCM:XPEL

Does XPEL (NASDAQ:XPEL) Deserve A Spot On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in XPEL (NASDAQ:XPEL). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out the opportunities and risks within the US Auto Components industry.

XPEL's Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That makes EPS growth an attractive quality for any company. Recognition must be given to the that XPEL has grown EPS by 52% per year, over the last three years. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

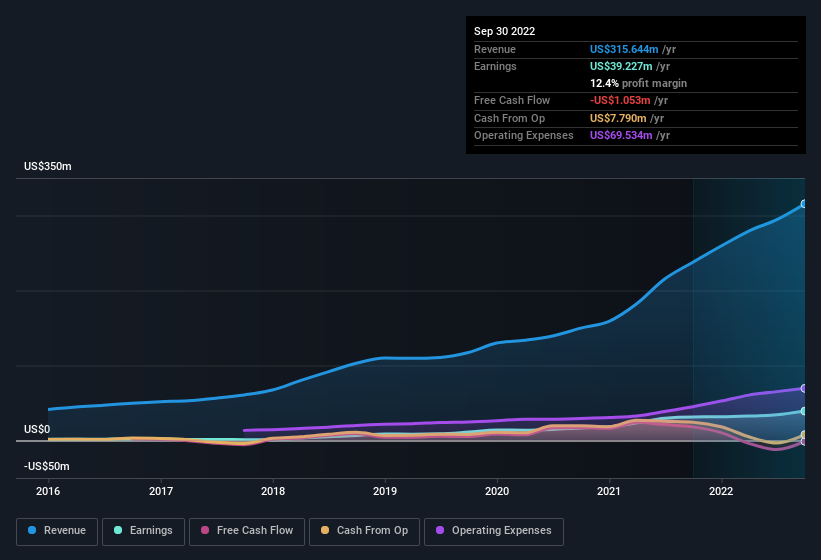

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. XPEL maintained stable EBIT margins over the last year, all while growing revenue 33% to US$316m. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for XPEL's future EPS 100% free.

Are XPEL Insiders Aligned With All Shareholders?

It's a necessity that company leaders act in the best interest of shareholders and so insider investment always comes as a reassurance to the market. So it is good to see that XPEL insiders have a significant amount of capital invested in the stock. Notably, they have an enviable stake in the company, worth US$568m. Coming in at 31% of the business, that holding gives insiders a lot of influence, and plenty of reason to generate value for shareholders. Looking very optimistic for investors.

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. Well, based on the CEO pay, you'd argue that they are indeed. Our analysis has discovered that the median total compensation for the CEOs of companies like XPEL with market caps between US$1.0b and US$3.2b is about US$5.6m.

The CEO of XPEL only received US$1.3m in total compensation for the year ending December 2021. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Does XPEL Deserve A Spot On Your Watchlist?

XPEL's earnings per share growth have been climbing higher at an appreciable rate. The sweetener is that insiders have a mountain of stock, and the CEO remuneration is quite reasonable. The sharp increase in earnings could signal good business momentum. XPEL is certainly doing some things right and is well worth investigating. Before you take the next step you should know about the 2 warning signs for XPEL (1 makes us a bit uncomfortable!) that we have uncovered.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:XPEL

XPEL

Manufactures, installs, sells, and distributes protective films, coatings and related services.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success