- United States

- /

- Auto

- /

- NasdaqCM:WKHS

This Insider Has Just Sold Shares In Workhorse Group Inc. (NASDAQ:WKHS)

Anyone interested in Workhorse Group Inc. (NASDAQ:WKHS) should probably be aware that the Corporate Controller, Gregory Ackerson, recently divested US$129k worth of shares in the company, at an average price of US$40.00 each. However, the silver lining is that the sale only reduced their total holding by 3.2%, so we're hesitant to read anything much into it, on its own.

See our latest analysis for Workhorse Group

Workhorse Group Insider Transactions Over The Last Year

The Independent Director, H. Samuels, made the biggest insider sale in the last 12 months. That single transaction was for US$2.5m worth of shares at a price of US$25.03 each. That means that an insider was selling shares at slightly below the current price (US$34.32). We generally consider it a negative if insiders have been selling, especially if they did so below the current price, because it implies that they considered a lower price to be reasonable. Please do note, however, that sellers may have a variety of reasons for selling, so we don't know for sure what they think of the stock price. We note that the biggest single sale was only 6.0% of H. Samuels's holding.

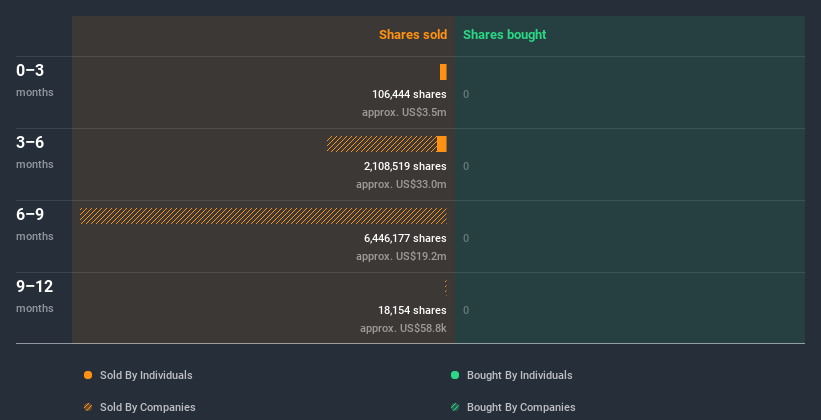

Insiders in Workhorse Group didn't buy any shares in the last year. The chart below shows insider transactions (by companies and individuals) over the last year. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

If you like to buy stocks that insiders are buying, rather than selling, then you might just love this free list of companies. (Hint: insiders have been buying them).

Insider Ownership of Workhorse Group

Many investors like to check how much of a company is owned by insiders. I reckon it's a good sign if insiders own a significant number of shares in the company. Workhorse Group insiders own 6.7% of the company, currently worth about US$277m based on the recent share price. This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

So What Does This Data Suggest About Workhorse Group Insiders?

Insiders sold Workhorse Group shares recently, but they didn't buy any. And there weren't any purchases to give us comfort, over the last year. The company boasts high insider ownership, but we're a little hesitant, given the history of share sales. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Workhorse Group. For instance, we've identified 5 warning signs for Workhorse Group (3 are a bit concerning) you should be aware of.

Of course Workhorse Group may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you’re looking to trade Workhorse Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Workhorse Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:WKHS

Workhorse Group

A technology company, engages in design, manufacture, and sale of zero-emission commercial vehicles in the United States.

Moderate risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.