- United States

- /

- Auto

- /

- NasdaqGS:VFS

VinFast Auto Ltd.'s (NASDAQ:VFS) 28% Cheaper Price Remains In Tune With Revenues

VinFast Auto Ltd. (NASDAQ:VFS) shares have retraced a considerable 28% in the last month, reversing a fair amount of their solid recent performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 43% in that time.

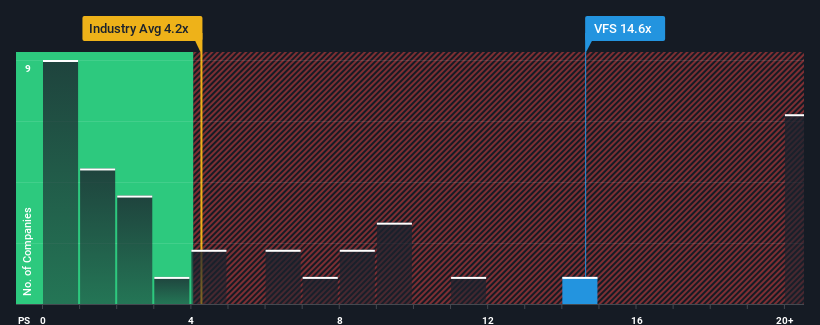

In spite of the heavy fall in price, VinFast Auto may still be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 14.6x, since almost half of all companies in the Auto industry in the United States have P/S ratios under 4.2x and even P/S lower than 1.2x are not unusual. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for VinFast Auto

How Has VinFast Auto Performed Recently?

With revenue growth that's inferior to most other companies of late, VinFast Auto has been relatively sluggish. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on VinFast Auto will help you uncover what's on the horizon.How Is VinFast Auto's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as VinFast Auto's is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue growth, the company posted a terrific increase of 48%. The latest three year period has also seen an excellent 65% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 92% each year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 31% per annum, which is noticeably less attractive.

With this in mind, it's not hard to understand why VinFast Auto's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

VinFast Auto's shares may have suffered, but its P/S remains high. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into VinFast Auto shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with VinFast Auto (at least 2 which are potentially serious), and understanding these should be part of your investment process.

If you're unsure about the strength of VinFast Auto's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:VFS

VinFast Auto

Engages in the design and manufacture of electric vehicles (EV), e-scooters, and e-buses in Vietnam, Canada, and the United States.

Low with limited growth.

Market Insights

Community Narratives