- United States

- /

- Auto

- /

- NasdaqGS:VFS

Did Rising Revenue, Wider Losses, and a New Director Just Shift VinFast Auto's (VFS) Investment Narrative?

Reviewed by Sasha Jovanovic

- VinFast Auto recently reported its third-quarter and nine-month 2025 results, with revenue rising to ₫18,100,218 million and ₫51,015,903 million respectively, while net losses also increased to ₫23,952,814 million for the quarter and ₫61,940,691 million for the nine-month period.

- The company also added senior executive Pham Nhat Quan Anh to its Board of Directors, reinforcing board-level expertise in global operations and quality oversight.

- Next, we’ll examine how higher revenue but larger losses in VinFast’s latest results affect its investment narrative and growth assumptions.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

VinFast Auto Investment Narrative Recap

To own VinFast, you need to believe it can convert rapid top line expansion into a path toward breakeven while managing heavy cash burn and competition in global EV markets. The latest results show revenue growth alongside widening losses, which keeps liquidity and dilution risk front and center. The appointment of senior executive Pham Nhat Quan Anh strengthens board oversight, but does not materially change the near term catalyst of improving unit economics or the key risk of ongoing large losses.

The most relevant recent announcement here is VinFast’s third quarter and nine month 2025 earnings release, which highlighted revenue of ₫18,100,218 million for the quarter and ₫51,015,903 million for the period, alongside net losses of ₫23,952,814 million and ₫61,940,691 million. For investors, this combination of scale up spending and deeper losses connects directly to the main catalyst of achieving cost efficiency on newer platforms and the central risk around liquidity and potential shareholder dilution.

But while top line growth may catch the eye, investors also need to be aware of the liquidity risk tied to persistent cash burn and reliance on...

Read the full narrative on VinFast Auto (it's free!)

VinFast Auto's narrative projects ₫177527.7 billion revenue and ₫8991.9 billion earnings by 2028. This requires 48.9% yearly revenue growth and a ₫89207.8 billion earnings increase from ₫-80215.9 billion today.

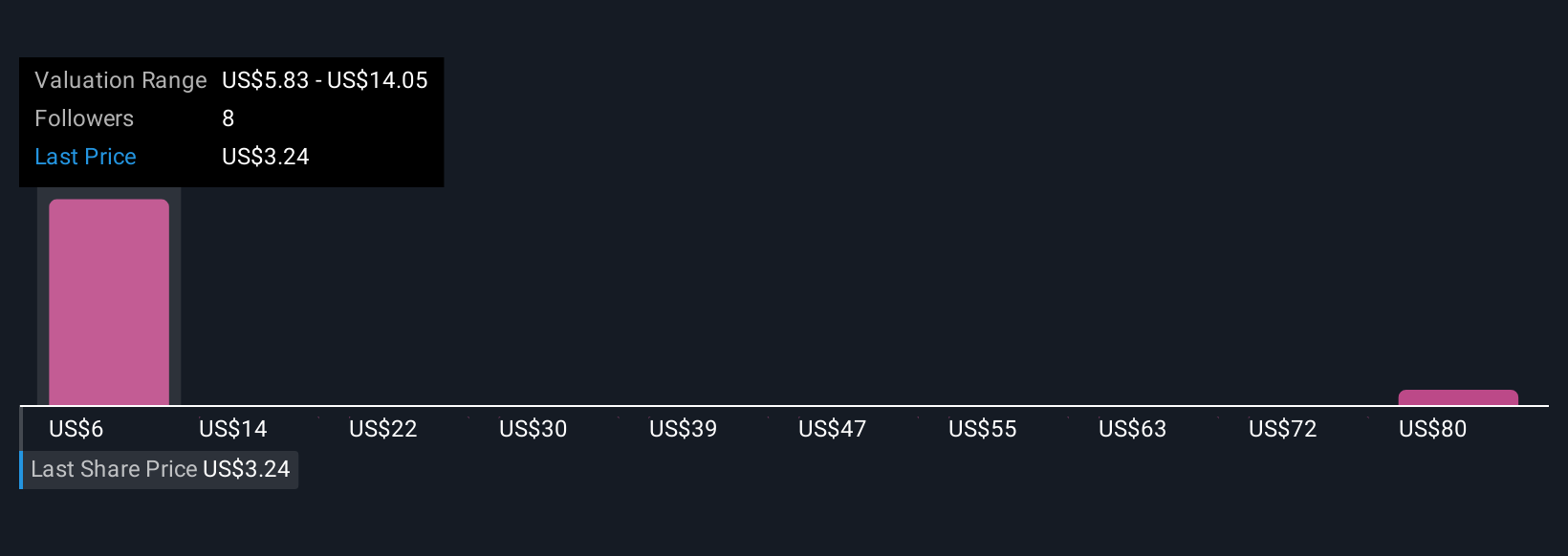

Uncover how VinFast Auto's forecasts yield a $5.83 fair value, a 74% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community range from US$5.83 to US$88, showing wide disagreement on VinFast’s potential. Against this backdrop of sharply different views, the company’s continued heavy losses and short cash runway make it especially important to weigh how long it can fund its growth plan.

Explore 3 other fair value estimates on VinFast Auto - why the stock might be worth just $5.83!

Build Your Own VinFast Auto Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your VinFast Auto research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free VinFast Auto research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate VinFast Auto's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VFS

VinFast Auto

Engages in the design and manufacture of electric vehicles (EV), e-scooters, and e-buses in Vietnam, Canada, and the United States.

Low risk with limited growth.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Staggered by dilution; positions for growth

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026