- United States

- /

- Auto

- /

- NasdaqGS:TSLA

Does the Market Expect Too Much From Tesla After Latest Autonomous Driving Headlines?

Reviewed by Bailey Pemberton

- Wondering if Tesla shares are actually a good buy right now, or if the hype has run ahead of value? You are not alone, because investors are constantly debating whether current prices make sense for the company’s future.

- Tesla’s stock has seen its share of ups and downs, with returns of -4.4% over the past week, -9.8% in the last month, but still up 15.5% over the past year and an impressive 113.8% over three years.

- Recent headlines have included ongoing debate about Tesla’s advancements in autonomous driving technology and developments in its global expansion strategy. These updates help explain sudden swings in investor optimism or nervousness, depending on how the news is interpreted.

- According to our valuation checks, Tesla scores 0 out of 6 on undervaluation, a figure we will unpack in detail using several different approaches. In addition, there is an even deeper way to see a company’s true worth by the end of this article.

Tesla scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

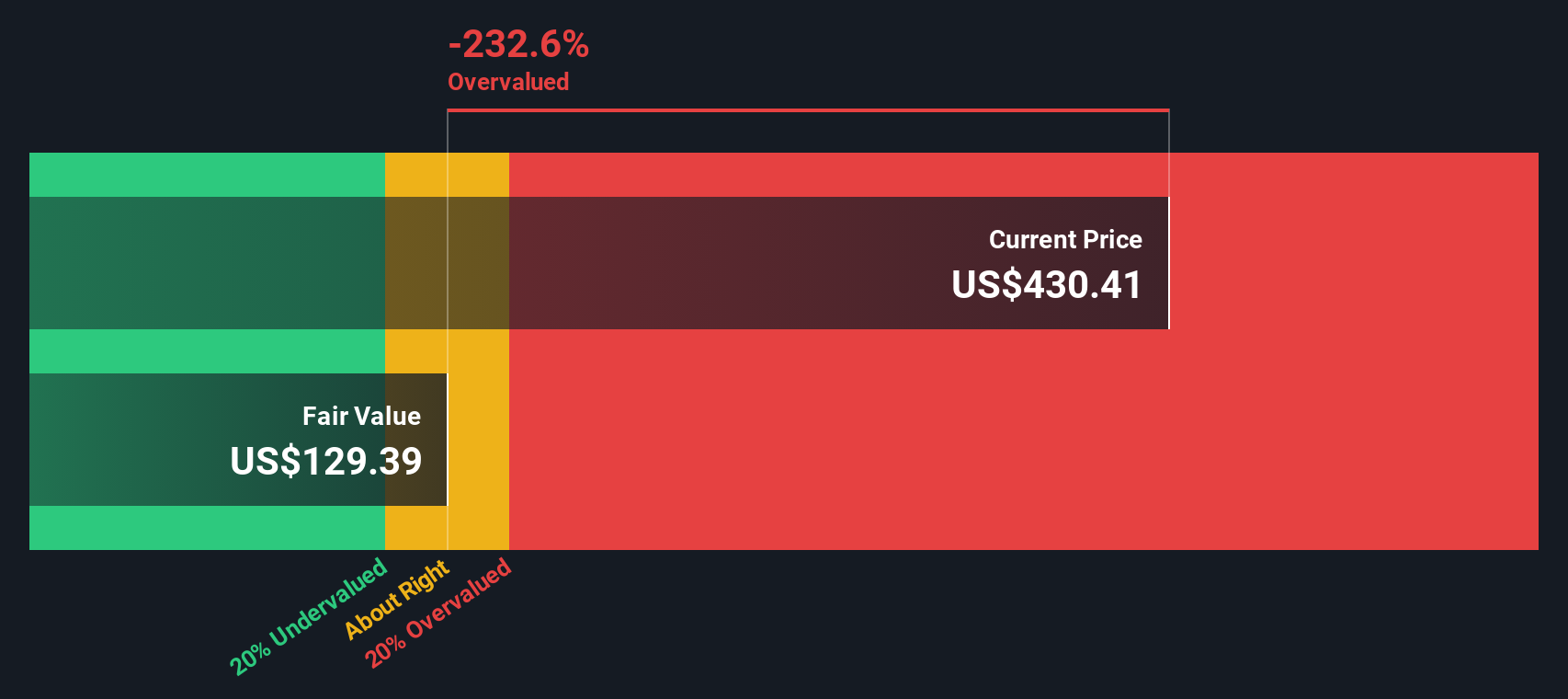

Approach 1: Tesla Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is worth by forecasting its future cash flows and discounting them back to today's value. For Tesla, this means analysts try to predict how much cash the company will generate each year and apply a discount to account for the risks and time value of money.

Currently, Tesla's Free Cash Flow (FCF) stands at $6.40 Billion. Looking forward, analysts project that the company's FCF could reach $22.23 Billion by the end of 2029. Beyond the next five years, cash flows are extrapolated based on expectations for the industry and the company's unique growth drivers. These longer-term forecasts introduce more uncertainty, but they help build a clearer picture of possible future value.

Using these projections, the DCF analysis calculates an intrinsic fair value for Tesla's shares at $154.56. Compared to the current share price, the model implies that the stock is around 153% overvalued at today’s levels.

For investors, this suggests that the market’s expectations for Tesla are much higher than what its future cash flows can justify using this model. While the company's growth is impressive, it appears the current share price already more than incorporates many years of optimistic assumptions.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Tesla may be overvalued by 153.0%. Discover 927 undervalued stocks or create your own screener to find better value opportunities.

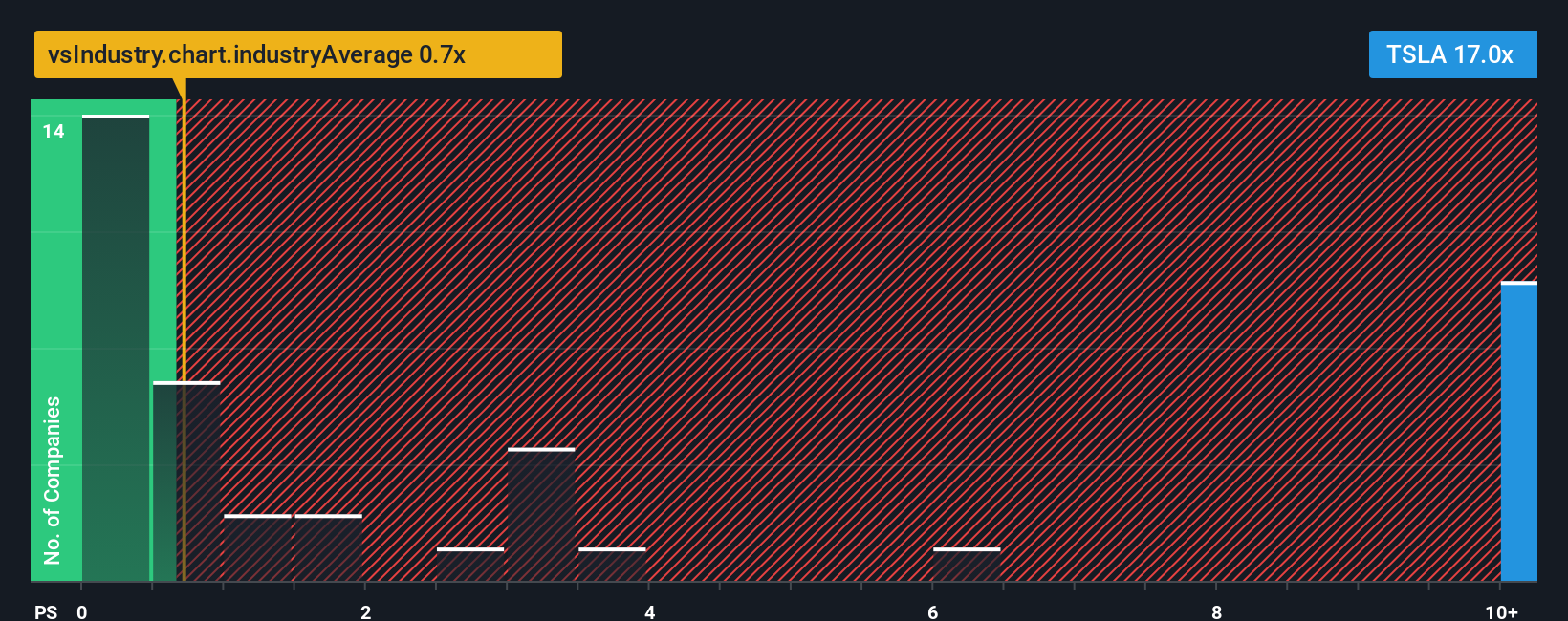

Approach 2: Tesla Price vs Sales (P/S)

The Price-to-Sales (P/S) ratio is often used for evaluating companies that are rapidly growing but may not yet have the steady profits needed for metrics like Price-to-Earnings. For a company like Tesla, which continues to reinvest cash in expansion and innovation, P/S is considered a suitable valuation metric because it measures the market’s expectations directly against the company’s actual sales, regardless of temporary profit fluctuations.

Growth expectations and perceived risk both impact what a fair P/S ratio should be. In general, a faster-growing, lower-risk business will command a higher multiple. If growth slows or execution risks rise, investors will be less willing to pay a premium for every dollar of sales.

Tesla currently trades at a P/S ratio of 13.6x, which is significantly higher than both its industry average of 0.82x and the average for its peers at 1.00x. To dig deeper, we use Simply Wall St’s proprietary Fair Ratio, calculated at 3.39x for Tesla. This metric adjusts for Tesla's unique profile, including its growth rate, profit margins, industry dynamics, market cap, and business risks. By tailoring the multiple specifically to Tesla, the Fair Ratio gives a more complete picture than basic industry or peer comparisons.

With Tesla trading at 13.6x sales, well above its Fair Ratio of 3.39x, the stock appears overvalued on this measure.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1434 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Tesla Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple yet powerful approach that connects your own story about a company, your perspective on where Tesla is heading and why, to the underlying numbers, such as your estimates for revenue, profit, and ultimately your calculation of fair value.

With Narratives on Simply Wall St’s Community page, you can create or explore these story-driven forecasts in minutes. Narratives help you see not just what the numbers are, but why they matter and how new developments (like earnings releases or breaking news) instantly update the story. This makes it easy to decide if Tesla’s fair value, according to your narrative or others, makes it a buy, hold, or sell compared to today’s price.

For example, some Tesla investors use Narratives with a fair value below $70, viewing the company as facing persistent delivery struggles and limited robotaxi progress. Others see Tesla’s fair value soaring above $2,700 if it dominates AI, robotics, and energy. By comparing Narratives, you can quickly decide which vision best matches your own outlook and upgrade your investment decisions with confidence.

For Tesla, however, we'll make it really easy for you with previews of two leading Tesla Narratives:

Fair Value: $2,707.91

Current Price is approximately 85.6% below this fair value

Revenue Growth Rate: 77%

- This narrative splits Tesla into five segments (robots, energy storage, software/FSD, automotive, and solar), projects revenue of $1.94 trillion and net profit of $534 billion in 2030, based on a 27.5% net margin.

- Discounted cash flow and forward P/E analysis suggest a present fair value for Tesla in the range of $2,120 to $4,240 per share. The current price is drastically below this range, implying strong undervaluation if Tesla executes on AI, FSD, and energy.

- Risks include ambitious growth assumptions, competitive and regulatory pressures, but the upside is described as “massive” if Tesla achieves its multi-industry vision.

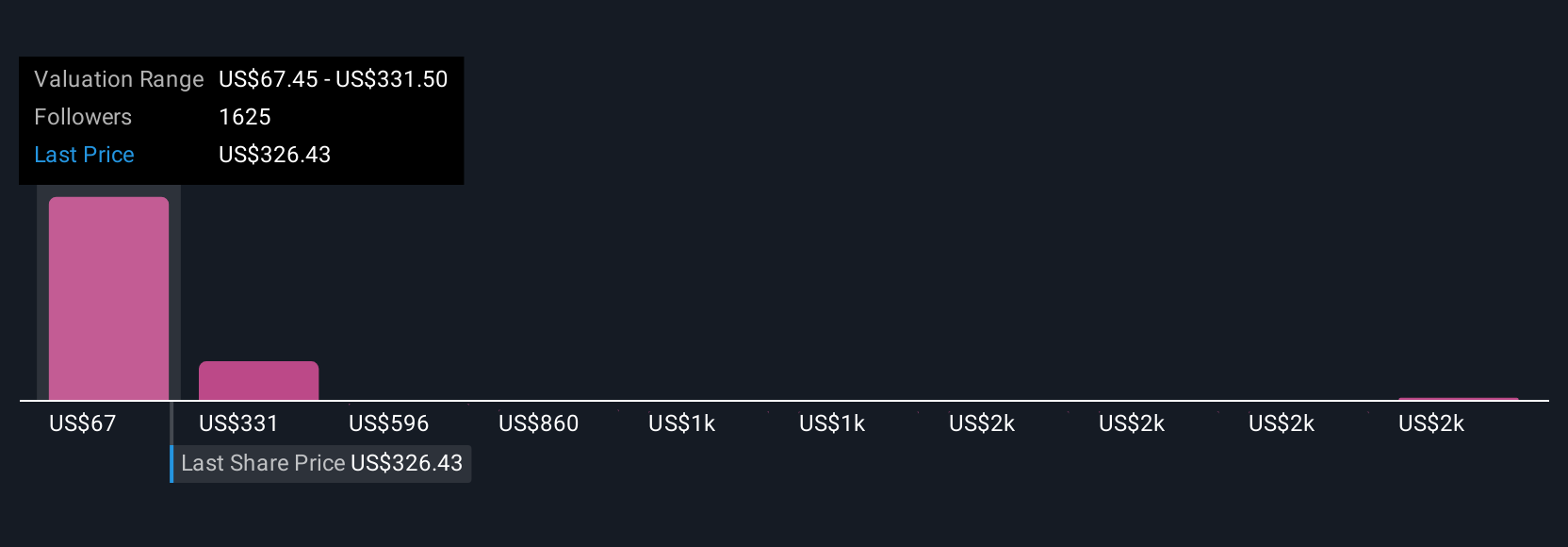

Fair Value: $332.71

Current Price is approximately 17.6% above this fair value

Revenue Growth Rate: 30%

- This narrative weighs Tesla’s exciting pipeline (Cybertruck, Roadster 2.0, Model 2, Semi, Optimus, FSD) as potential growth drivers, but notes they each carry execution and regulatory uncertainties.

- Estimates 2029 revenue at $150 billion and profits at $15 billion, highlighting increasing competition (especially China), price cuts, and supply chain and regulatory risks that could hinder delivery of growth ambitions.

- Valuation outlook is more cautious, assuming moderation in revenue and profit margin growth, with Tesla trading above its projected fair value given industry and company-specific risks ahead.

Do you think there's more to the story for Tesla? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tesla might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSLA

Tesla

Designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives