- United States

- /

- Auto Components

- /

- NasdaqGS:SLDP

Solid Power, Inc. (NASDAQ:SLDP) Just Released Its First-Quarter Earnings: Here's What Analysts Think

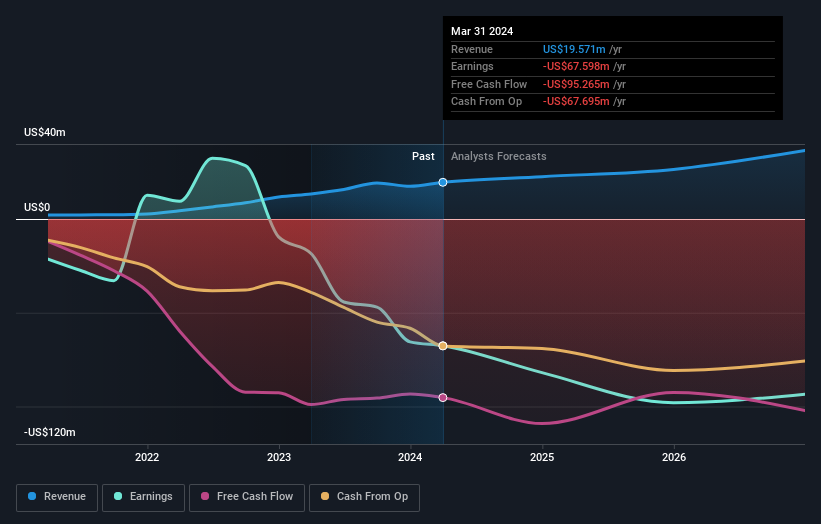

Shareholders might have noticed that Solid Power, Inc. (NASDAQ:SLDP) filed its first-quarter result this time last week. The early response was not positive, with shares down 5.5% to US$1.72 in the past week. Revenues came in 23% better than analyst models expected, at US$6.0m, although statutory losses ballooned 29% to US$0.12, which is much worse than what was forecast. This is an important time for investors, as they can track a company's performance in its report, look at what experts are forecasting for next year, and see if there has been any change to expectations for the business. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

Check out our latest analysis for Solid Power

Taking into account the latest results, the consensus forecast from Solid Power's five analysts is for revenues of US$22.6m in 2024. This reflects a solid 15% improvement in revenue compared to the last 12 months. Losses are expected to increase substantially, hitting US$0.45 per share. Yet prior to the latest earnings, the analysts had been forecasting revenues of US$21.3m and losses of US$0.43 per share in 2024. Overall it looks as though the analysts were a bit mixed on the latest consensus updates. Although there was a nice uplift to revenue, the consensus also made a moderate increase in its losses per share forecasts.

The consensus price target stayed unchanged at US$3.63, seeming to suggest that higher forecast losses are not expected to have a long term impact on the valuation. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. There are some variant perceptions on Solid Power, with the most bullish analyst valuing it at US$5.00 and the most bearish at US$3.00 per share. As you can see, analysts are not all in agreement on the stock's future, but the range of estimates is still reasonably narrow, which could suggest that the outcome is not totally unpredictable.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. It's pretty clear that there is an expectation that Solid Power's revenue growth will slow down substantially, with revenues to the end of 2024 expected to display 21% growth on an annualised basis. This is compared to a historical growth rate of 71% over the past three years. Juxtapose this against the other companies in the industry with analyst coverage, which are forecast to grow their revenues (in aggregate) 10% per year. Even after the forecast slowdown in growth, it seems obvious that Solid Power is also expected to grow faster than the wider industry.

The Bottom Line

The most important thing to take away is that the analysts increased their loss per share estimates for next year. Happily, they also upgraded their revenue estimates, and are forecasting them to grow faster than the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

With that in mind, we wouldn't be too quick to come to a conclusion on Solid Power. Long-term earnings power is much more important than next year's profits. At Simply Wall St, we have a full range of analyst estimates for Solid Power going out to 2026, and you can see them free on our platform here..

It is also worth noting that we have found 2 warning signs for Solid Power (1 is potentially serious!) that you need to take into consideration.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SLDP

Solid Power

Develops solid-state battery technologies for the electric vehicles (EV) and other markets in the United States.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

EU#1 - From German Startup to EU’s Biggest Company

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Amazon - A Fundamental and Historical Valuation

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

The "Sleeping Giant" Stumbles, Then Wakes Up

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Trending Discussion

As a gamer, I would not touch this company now. They are hated by the community and have been releasing major flops on their AAA games during the last 5 years (for good reasons). It is true that the valuation is ridiculously low compared to what the licenses are worth, but if the trend continues the value of those will also decline. Management needs to almost make a 180° turnaround to get things right. I agree that a take-private deal before it is too late might be the best option for an investor entering today. We might also see a split sales of the different studios. It is a very risky play, but potentially with high reward.