- United States

- /

- Auto Components

- /

- NasdaqGS:SLDP

Can Solid Power’s (SLDP) OEM Partnerships and Cash Reserves Offset Early Risks in Battery Commercialization?

Reviewed by Sasha Jovanovic

- Solid Power is leveraging its solid-state battery technology and partnerships with major automakers like BMW and Ford to target long-term growth in the electric vehicle market, supported by its strong patent portfolio and stable financial position.

- An interesting aspect is that, despite early-stage financial losses, Solid Power’s robust cash reserves and low shareholder dilution are providing the company with a cushion as it navigates commercialization risks.

- We’ll explore how rising interest in Solid Power’s solid-state batteries and OEM partnerships may influence the broader investment outlook.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Solid Power Investment Narrative Recap

To be a Solid Power shareholder today, you need to believe in the company’s ability to commercialize its solid-state battery technology and turn partnerships with automakers like BMW and Ford into real, recurring revenues. The recent news largely reinforces the long-term potential, but it does not materially change the immediate importance of securing large-scale licensing agreements or addressing the risks tied to ongoing operating losses and the timing of commercial adoption.

The most relevant recent announcement is Solid Power’s September 2025 equity offering, which raised US$150,000,000. This move helps maintain cash reserves, providing financial flexibility as the company faces the expensive process of scaling up production, a key catalyst for its future adoption and revenue growth.

But on the flip side, it’s important for investors to understand how raising new capital through share offerings could affect future shareholder value if...

Read the full narrative on Solid Power (it's free!)

Solid Power's narrative projects $33.2 million revenue and $1.6 million earnings by 2028. This requires 13.5% yearly revenue growth and a $95.1 million earnings increase from the current -$93.5 million earnings.

Uncover how Solid Power's forecasts yield a $4.00 fair value, a 37% downside to its current price.

Exploring Other Perspectives

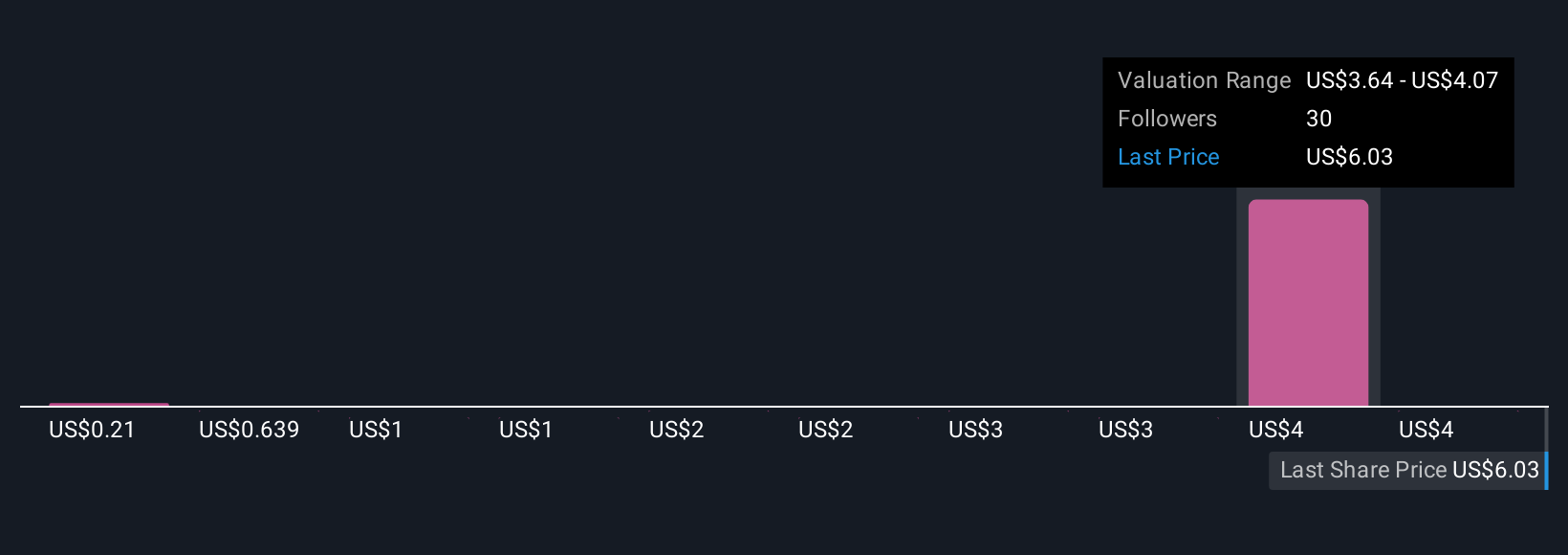

Seven members of the Simply Wall St Community estimate fair values from US$0.21 to US$4.50 per share, a strikingly broad span. Against these wide-ranging views, the company’s ability to maintain a strong balance sheet while growing sales but staying unprofitable highlights how opinions, and outcomes, can widely differ.

Explore 7 other fair value estimates on Solid Power - why the stock might be worth less than half the current price!

Build Your Own Solid Power Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Solid Power research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Solid Power research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Solid Power's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SLDP

Solid Power

Develops solid-state battery technologies for the electric vehicles (EV) and other markets in the United States.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives