- United States

- /

- Auto

- /

- NasdaqGS:RIVN

Rivian (RIVN) Forecasts 38.6% Annual Revenue Growth, But Profitability Remains Elusive

Reviewed by Simply Wall St

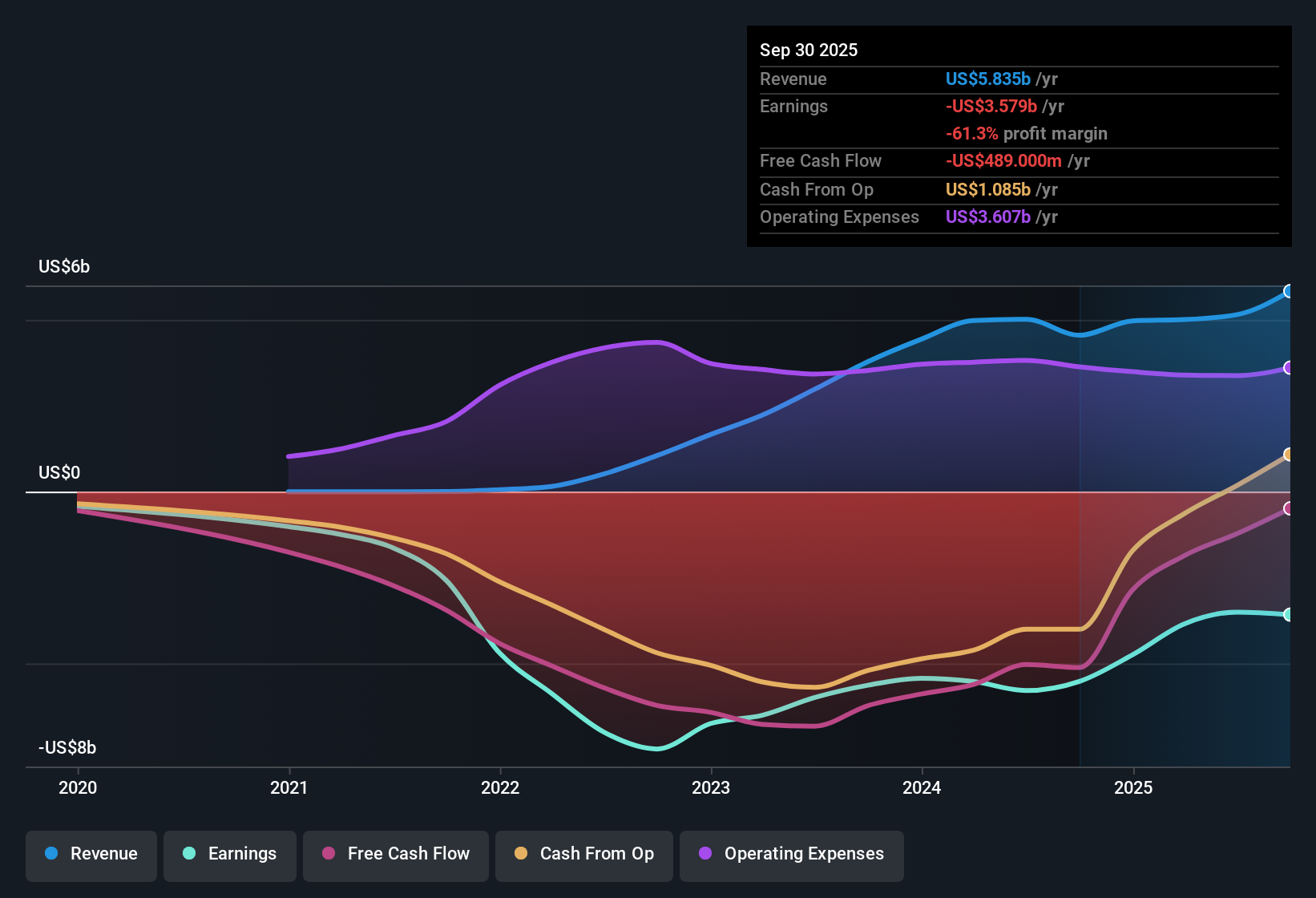

Rivian Automotive (RIVN) is forecast to grow revenue at 38.6% per year, handily beating industry and market averages, but ongoing losses remain a sticking point for investors. Despite the rapid top-line expansion, the company has not yet achieved profitability, with losses increasing at an average rate of 11.4% per year over the past five years and net profit margins showing no meaningful improvement. Meanwhile, the stock trades at a 3.7x price-to-sales ratio, a premium to both peers and the broader US auto industry, and its $15.42 share price sits notably above one estimate of fair value at $13.04. This suggests anticipation of robust future growth is already baked in.

See our full analysis for Rivian Automotive.Next, we will see how these headline results measure up against the dominant market narratives, highlighting where consensus is validated and where it may be up for debate.

See what the community is saying about Rivian Automotive

Share Dilution Ramps Up Capital Pressure

- Rivian’s outstanding share count is projected by analysts to grow by 7.0% per year over the next three years, signaling a higher rate of dilution than many automakers.

- Consensus narrative notes shareholders will need to weigh this dilution alongside persistent negative profits, since losses have averaged 11.4% annual growth over five years and are expected to continue, potentially impacting future earnings per share.

- If Rivian remains unprofitable while issuing more shares, existing holders may see slower EPS recovery even if revenue keeps rising.

- Maintaining liquidity may require ongoing capital raises, which can strain valuation unless operational performance surprises to the upside.

- To see how the latest share dilution and growth forecasts shape market expectations, check out the full Consensus Narrative for Rivian Automotive. 📊 Read the full Rivian Automotive Consensus Narrative.

Profit Margins Stuck Deep in Red

- Net profit margins have not improved, and analysts expect Rivian to remain unprofitable for at least the next three years. This highlights a stubborn gap between growing revenue and lasting profitability.

- Consensus narrative emphasizes that even with the expected launch of the R2 platform and improved manufacturing efficiency, gross and net margin gains will require Rivian to drastically reduce its cost structure. This is backed by evidence that its current profit margin stands at a steep -68.1%.

- Policy and supply chain risks could further delay a turnaround, with ongoing negative EBITDA and heavy R&D spend cited as contributing headwinds.

- Despite targeted operating improvements, a long path to positive margins challenges the view that scale alone will ensure profitability in the near term.

Premium Stock Valuation Tests Market Faith

- Rivian trades at a 3.7x price-to-sales ratio, more than double the peer average (1.5x) and more than triple the US auto industry average (1.1x). This reinforces that investors are pricing in future growth rather than current earnings.

- Analysts' consensus view raises a critical tension. While models set DCF fair value at $13.04, the share price of $15.42 sits nearly 18% above this mark and is close to the analyst target of $14.26, suggesting the stock is priced for near-flawless execution and rapid scaling of both revenue and margins.

- Share price premium signals that only significant progress toward profitability or positive surprises in vehicle delivery will justify current market faith.

- Investors relying on sector momentum should be mindful that, at these levels, the multiple leaves a narrow margin for error if growth or margin improvements stall.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Rivian Automotive on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do you interpret the data with a fresh angle? In just a few minutes, you can craft and share your perspective. Do it your way

A great starting point for your Rivian Automotive research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Rivian’s steep ongoing losses, widening profit margins, and lofty stock valuation all present tough hurdles for investors seeking profitable, fairly priced growth.

If you want to target opportunities with better value and less froth, look to these 843 undervalued stocks based on cash flows and discover stocks trading below their intrinsic worth with greater potential for upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RIVN

Rivian Automotive

Designs, develops, manufactures, and sells electric vehicles and accessories.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives