- United States

- /

- Auto

- /

- NasdaqGS:RIVN

Does Rivian’s Gen 2 Cost Cuts and AI Push Shift the Bull Case for RIVN?

Reviewed by Sasha Jovanovic

- At the recent Barclays Global Automotive and Mobility Tech Conference, Rivian announced plans to cut material costs by 45% with its Gen 2 platform, target profitability by 2027, and launch a new plant in Georgia by 2028.

- The company also revealed a new partnership with Google Maps to power its in-vehicle navigation and highlighted forthcoming product and technology updates at its upcoming Autonomy & AI Day.

- We'll examine how Rivian's ambitious material cost reductions and technology enhancements could reshape its investment outlook and path to profitability.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Rivian Automotive Investment Narrative Recap

To be a Rivian shareholder today, you need to believe that the company can turn rapid revenue growth, ongoing platform improvements, and deeper tech integrations into meaningful cost reductions and, ultimately, profitability. The recent news about aggressive material cost cuts and profitability targets highlights management's focus on closing the gap to breakeven, which remains the key short-term catalyst. However, these announcements do not remove the biggest challenge, Rivian's high ongoing cash burn and negative earnings, which continue to pose liquidity risks and the need for future capital raises.

The planned 45% cut to material costs through Rivian’s Gen 2 platform, set to roll out by 2026, is the most relevant update. This step aims to substantially improve gross margins as the company works toward scaling up R2 platform deliveries, addressing a central hurdle on the path to profitability and financial self-sufficiency.

Yet, despite these cost-saving ambitions, investors should be aware that persistent cash outflows mean...

Read the full narrative on Rivian Automotive (it's free!)

Rivian Automotive's outlook projects $15.7 billion in revenue and $788.9 million in earnings by 2028. Achieving this would require 44.9% annual revenue growth and a $4.3 billion increase in earnings from the current -$3.5 billion.

Uncover how Rivian Automotive's forecasts yield a $14.79 fair value, a 5% downside to its current price.

Exploring Other Perspectives

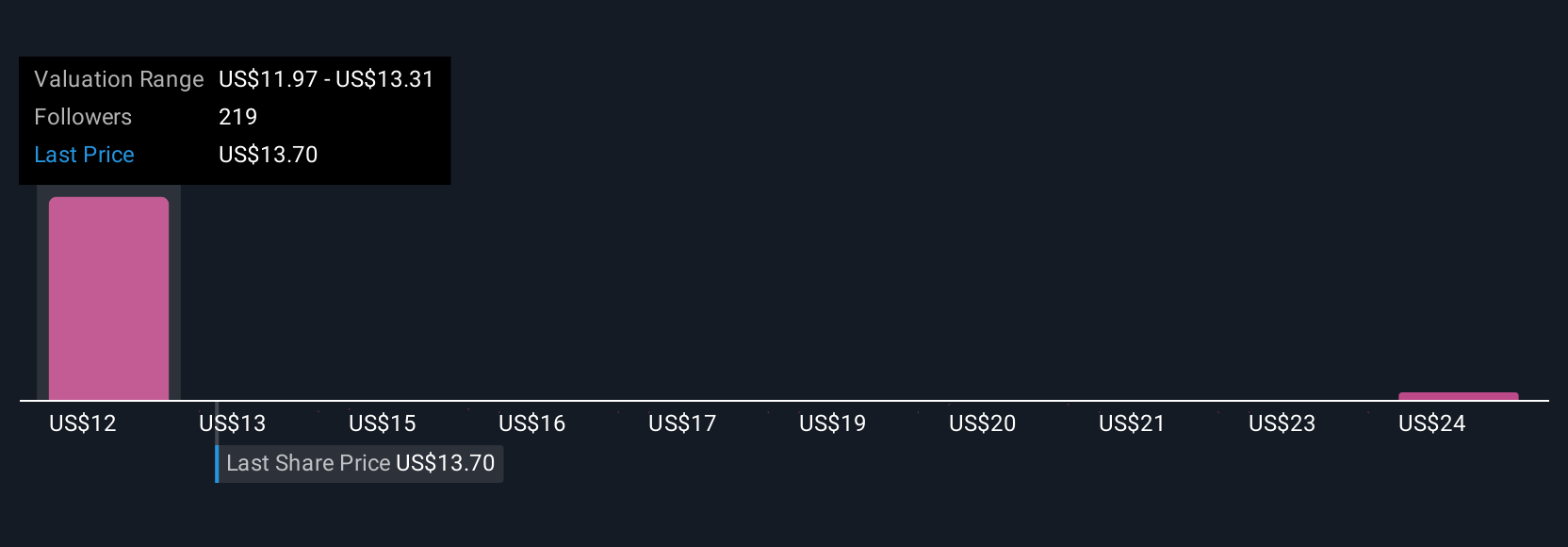

Private investors in the Simply Wall St Community estimate Rivian’s fair value between US$2.50 and US$25.41 across 21 analyses. While many expect material cost reductions to be transformative for margins, ongoing cash burn and the risk of dilution remain crucial for the company’s future market performance.

Explore 21 other fair value estimates on Rivian Automotive - why the stock might be worth as much as 63% more than the current price!

Build Your Own Rivian Automotive Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rivian Automotive research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Rivian Automotive research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rivian Automotive's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RIVN

Rivian Automotive

Designs, develops, manufactures, and sells electric vehicles and accessories.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success