- United States

- /

- Auto Components

- /

- NasdaqGS:QS

Is QuantumScape (QS) Pricing Reflect Solid State Battery Progress After Mixed Recent Returns?

- If you are asking whether QuantumScape is reasonably priced or just riding a story, you are in the right place. We are going to focus squarely on what you are getting for the current share price.

- The stock has had a mixed run, with a 1 year return of 89.5% but declines of 8.8% over 7 days, 5.1% over 30 days and 10.9% year to date. This can change how investors think about both upside and risk.

- Recent attention on QuantumScape has largely centered on its solid state battery technology progress and its position in the electric vehicle supply chain, which has kept it on many watchlists. These themes help explain why the share price has seen strong 1 year performance alongside shorter term pullbacks.

- Right now, QuantumScape has a valuation score of 2/6, meaning it screens as undervalued on 2 of 6 checks. Next we will look at how different valuation methods treat the stock and then finish with an even clearer way to think about what that valuation really implies.

QuantumScape scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: QuantumScape Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model takes estimates of the cash a business may generate in the future and discounts those amounts back to today to arrive at an implied value per share.

For QuantumScape, the model used is a 2 Stage Free Cash Flow to Equity approach based on projected free cash flow in $. The latest twelve month free cash flow is a loss of $280.027 million. Analyst inputs run through 2030, where free cash flow is projected at $533 million, with further years extrapolated by Simply Wall St rather than based on direct analyst forecasts.

Rolling these projections together, the DCF output suggests an intrinsic value of about $50.90 per share. Compared with the current share price, the model indicates the stock screens as about 80.6% undervalued on this cash flow view.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests QuantumScape is undervalued by 80.6%. Track this in your watchlist or portfolio, or discover 869 more undervalued stocks based on cash flows.

Approach 2: QuantumScape Price vs Book

For companies that are still building out their operations and are not yet focused on earnings, price based on book value can be a useful cross check. The P/B ratio compares what the market is paying for each dollar of net assets on the balance sheet, which is often a reference point for asset heavy or early stage businesses.

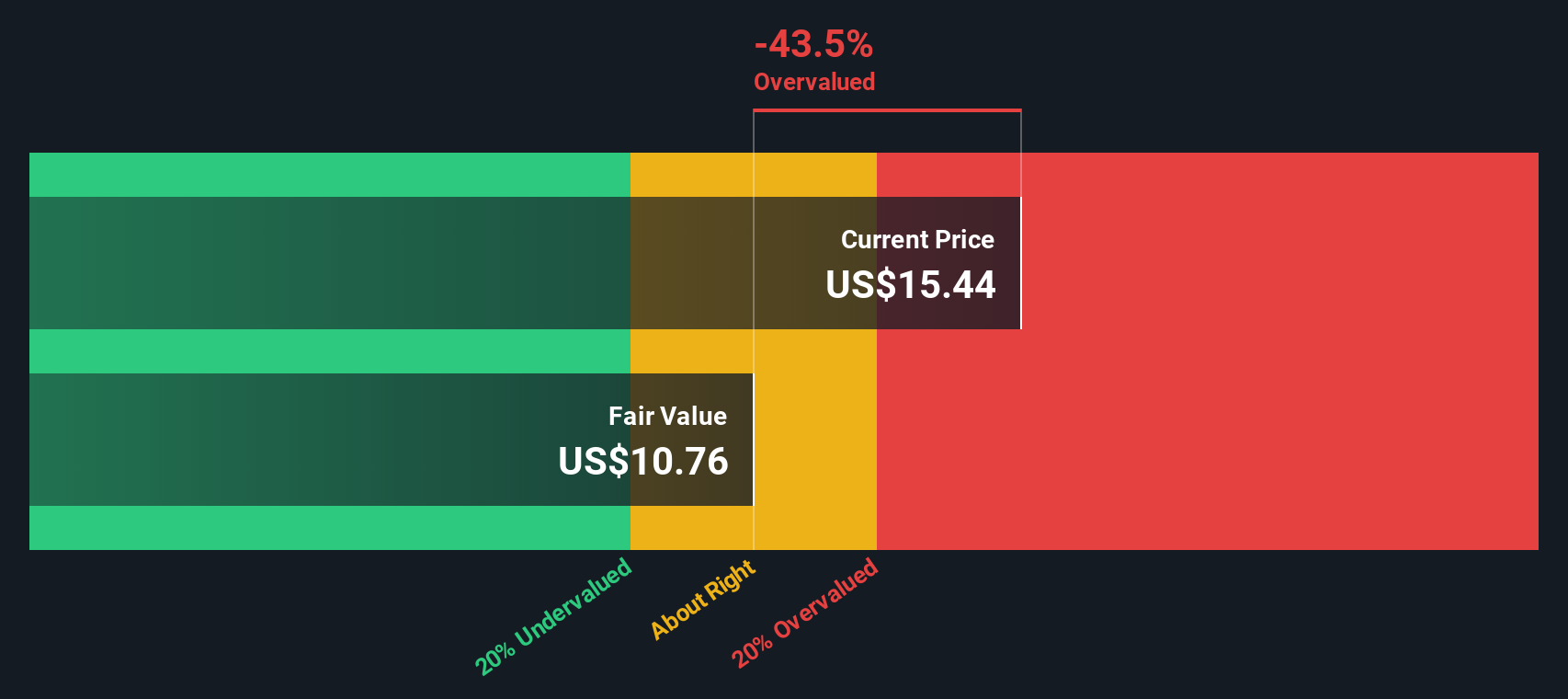

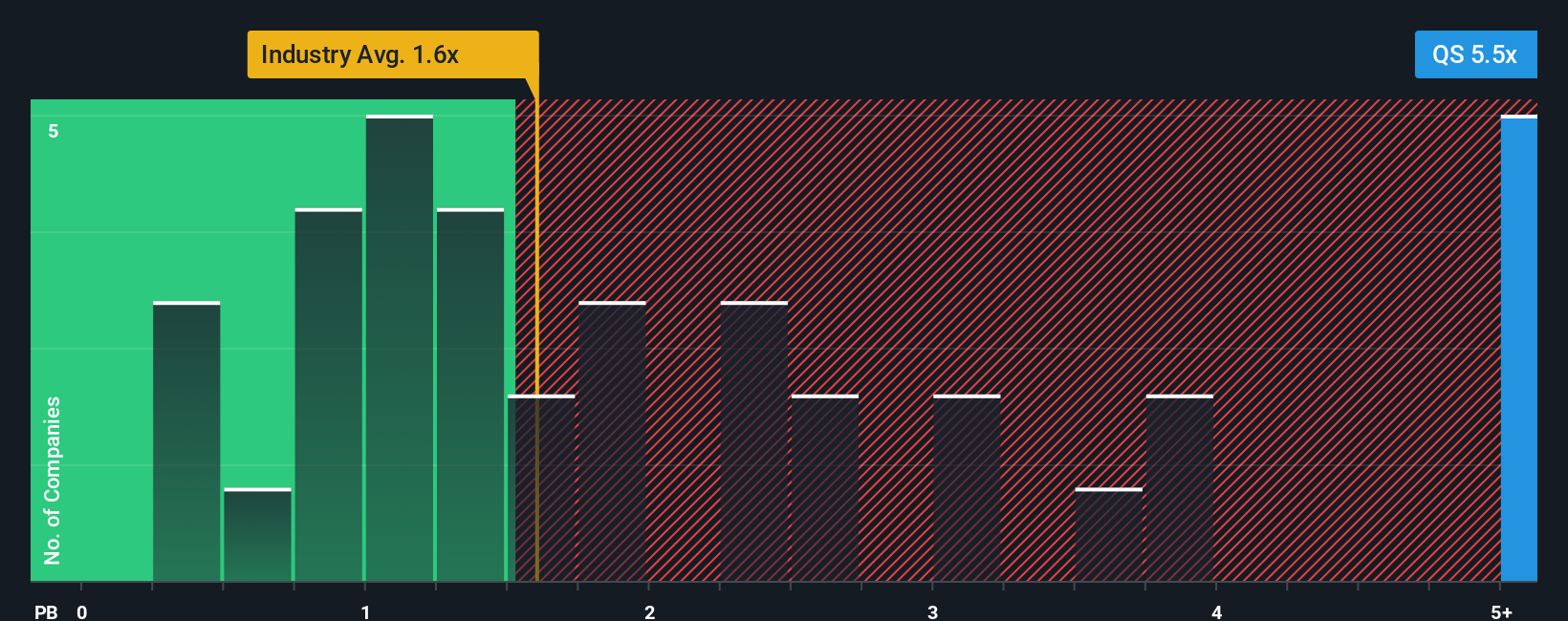

In general, higher growth expectations and lower perceived risk can support a higher “normal” P/B multiple, while slower growth or higher risk tends to anchor that multiple closer to or even below 1x. That context matters when you look at QuantumScape’s current P/B of 4.87x compared with the Auto Components industry average of about 1.61x and a peer average of about 1.75x.

Simply Wall St also uses a proprietary “Fair Ratio” for P/B, which is the multiple it would expect given factors such as earnings growth profile, margins, industry, market cap and company specific risks. This Fair Ratio aims to be more tailored than a simple comparison to peers or industry averages because it adjusts for differences in quality and risk. In this case, the Fair Ratio is not available, so we cannot draw a firm conclusion on whether 4.87x looks elevated, low, or approximately in line with what those fundamentals might justify.

Result: ABOUT RIGHT

P/B ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1418 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your QuantumScape Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which simply means writing the story you believe about a company and tying that story directly to numbers like future revenue, earnings, margins and a fair value estimate. On Simply Wall St’s Community page, you can pick or create a Narrative for QuantumScape that links its solid state battery story to a clear financial forecast, then to a fair value that you can compare with the current share price to help you decide whether it looks attractive or stretched. Narratives on the platform update as new information comes in, such as fresh earnings or major news, so your view does not stay frozen. For example, one QuantumScape Narrative might assume strong adoption of its technology and a higher fair value, while another might assume slower commercial progress, more modest margins and a lower fair value, giving you a quick way to see how different views stack up against the same market price.

Do you think there's more to the story for QuantumScape? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QuantumScape might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:QS

QuantumScape

Focuses on the development and commercialization of solid-state lithium-metal batteries for electric vehicles and other applications in the United States.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Palantir: Redefining Enterprise Software for the AI Era

Microsoft - A Fundamental and Historical Valuation

The Oncology Anchor: Why Merck’s 46% Discount Defies the Keytruda Cliff

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

AMZN: Acceleration In Cloud And AI Will Drive Margin Expansion Ahead

Trending Discussion

<b>Reported:</b> Revenue growth: 2024 → 2025 sharp increase of approx. 165%. Assuming moderate annual growth of 40%, a fair value in three years would be approx. $170. Given the customer base and the story, this should be possible. I find the most valuable “property” particularly interesting, as it solves the electricity problem.