- United States

- /

- Auto Components

- /

- NasdaqGS:MBLY

Will Mobileye Global’s (MBLY) Latest Strategy Updates Redefine Its Long-Term Growth Ambitions?

Reviewed by Sasha Jovanovic

- Mobileye Global Inc. recently presented at the Baird 55th Annual Global Industrial Conference, held at The Ritz-Carlton in Chicago on November 11, 2025, offering updates on its business and technology strategy.

- This event highlighted the company's ongoing engagement with industry stakeholders, fueling anticipation around its future plans and technological advancements.

- We'll examine how Mobileye Global's direct updates to investors and industry leaders may shape its investment narrative and growth outlook.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Mobileye Global Investment Narrative Recap

To invest in Mobileye Global, you need to accept the case for rapid growth in driver assistance and autonomous vehicle technologies, powered by strong design wins and automotive partnerships. The recent presentation at the Baird Global Industrial Conference reinforced Mobileye’s commitment to these industry drivers, but it did not materially alter the near-term catalyst of scaling advanced driver-assistance shipments, nor did it address the most immediate risk: geopolitical and trade-related headwinds that could affect demand or margins.

Of the recent announcements, Mobileye’s agreement with VVDN Technologies to bring its ADAS technologies to Indian automakers stands out as most relevant. This expansion shows how Mobileye is pursuing volume growth through geographic diversification, potentially counterbalancing volatility in more established regions, a catalyst that remains essential as the company strives to increase recurring revenue and reduce exposure to single-market risks.

Yet on the other hand, investors should be aware that ongoing trade frictions could lead to unexpected revenue volatility if key auto markets soften or tariffs disrupt supply chains...

Read the full narrative on Mobileye Global (it's free!)

Mobileye Global's narrative projects $3.0 billion in revenue and $111.5 million in earnings by 2028. This requires 15.6% yearly revenue growth and an earnings increase of about $3.1 billion from current earnings of -$3.0 billion.

Uncover how Mobileye Global's forecasts yield a $19.35 fair value, a 57% upside to its current price.

Exploring Other Perspectives

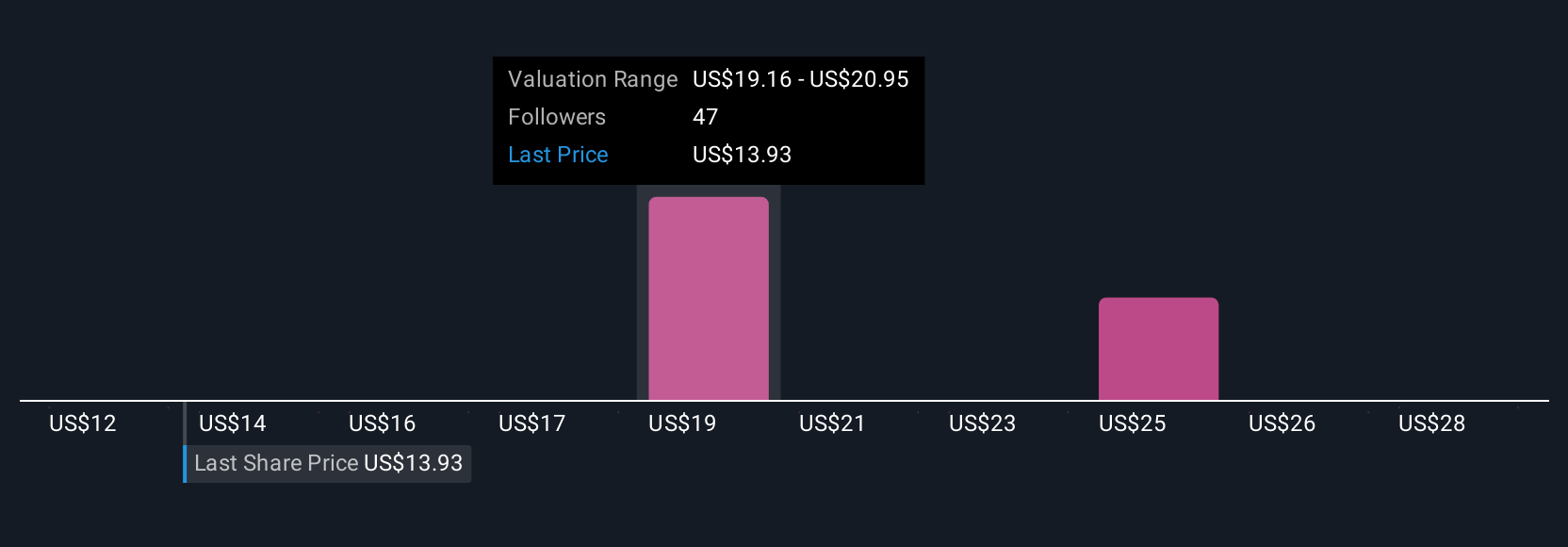

Simply Wall St Community members provided four fair value estimates for Mobileye Global ranging from US$12 to US$21.34, illustrating wide valuation opinions. Amid this, the company's push to expand partnerships and geographic reach may prove critical in the face of shifting global demand and customer risks, explore how investor viewpoints can meaningfully diverge.

Explore 4 other fair value estimates on Mobileye Global - why the stock might be worth just $12.00!

Build Your Own Mobileye Global Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mobileye Global research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Mobileye Global research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mobileye Global's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MBLY

Mobileye Global

Develops and deploys advanced driver assistance systems (ADAS) and autonomous driving technologies and solutions worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives