- United States

- /

- Auto Components

- /

- NasdaqGS:MBLY

Mobileye (MBLY): Losses Worsen Yet Revenue Forecasts Outpace US Market Ahead of Earnings Season

Reviewed by Simply Wall St

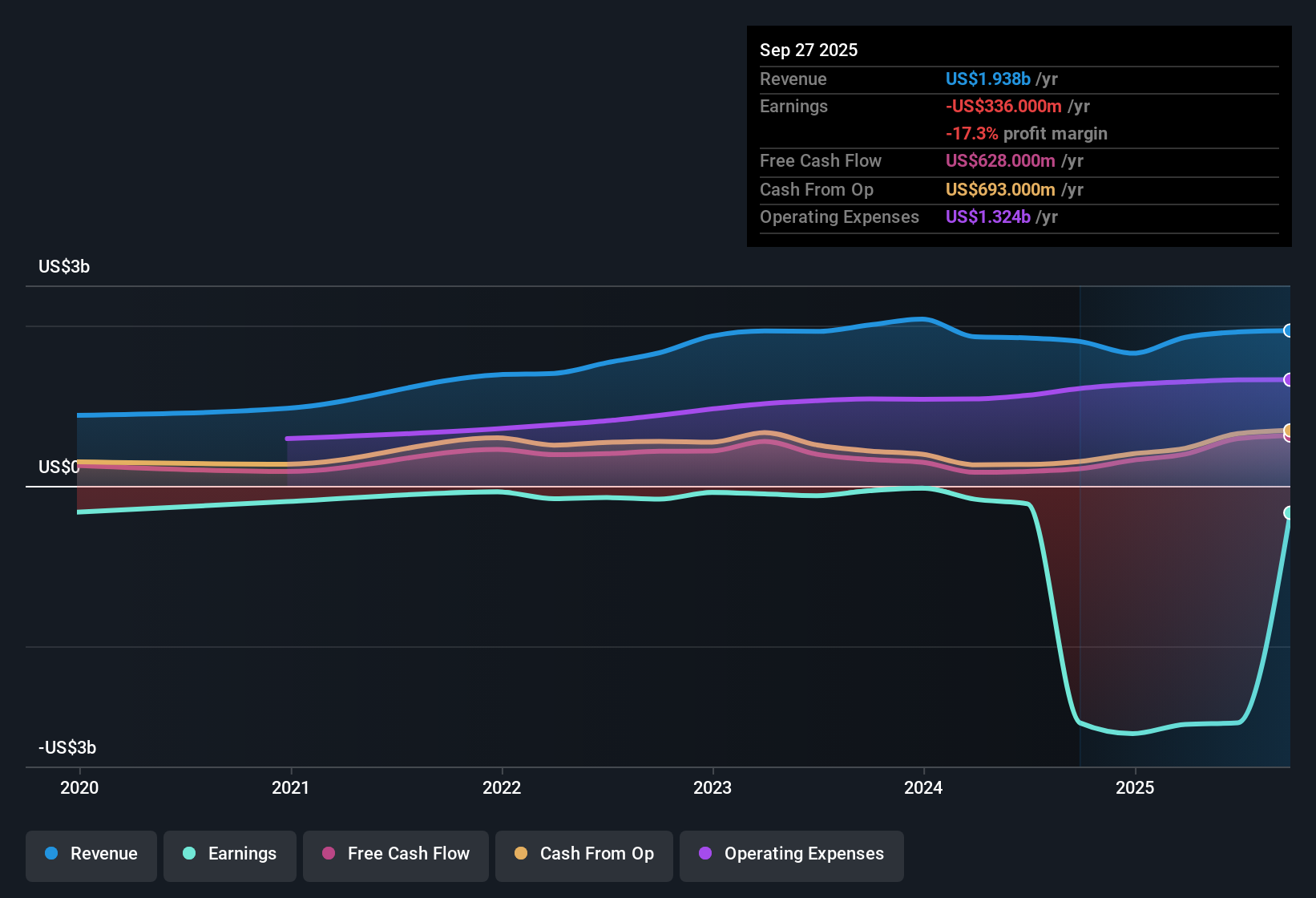

Mobileye Global (MBLY) remains unprofitable, having seen its losses worsen by an average of 84.8% per year over the past five years. Still, revenue is forecast to grow at 22.4% per year, which is more than double the broader US market’s expected 10% pace. Earnings are anticipated to climb at 74.46% annually, and the company is projected to reach profitability within three years. For investors, this growth story comes with the promise of rapid expansion, but also the reality of ongoing losses and no improvement in net margins so far.

See our full analysis for Mobileye Global.Now, let’s see how this latest set of numbers stacks up against some of the most widely followed narratives for Mobileye Global, and whether the story on Wall Street is shifting as a result.

See what the community is saying about Mobileye Global

DCF Fair Value Gap Remains Wide

- Mobileye trades at $14.09 per share, which is 39% below its DCF fair value of $23.18. This suggests that despite unprofitability and margin pressures, the market is pricing in a significant discount relative to long-term cash flow estimates.

- Analysts' consensus view notes that while strong projected revenue growth and design wins with major OEMs support a higher fair value,

- the lack of profitability and no recent improvement in net margins creates tension with bullish expectations for a rapid re-rating,

- and analysts also highlight that, for the current price to close this gap, investors must be confident about the company hitting its 2028 profit and margin targets.

- For a deeper breakdown of how consensus sees this valuation playing out relative to Mobileye’s tech partnerships and scaling plans, see the full analysts’ narrative and scenario breakdown. 📊 Read the full Mobileye Global Consensus Narrative.

Profit Margins Projected to Swing Positive

- Profit margins are forecast to move from -153.9% today to 3.8% in three years, reflecting expectations for a major operational turnaround if execution matches analyst models.

- Consensus narrative points to market share expansion in robotaxi and ADAS segments as potential catalysts for this margin uplift,

- but also notes that any delays from OEM partners or setbacks from trade disruptions could push these goals further out,

- and that high forecasted profit growth is contingent on successful rollout and scaling of new multi-camera and hands-free driving technologies.

Valuation Multiples Far Above Industry

- With a Price-to-Sales ratio of 5.9x, Mobileye is valued sharply above both its peer average of 1.4x and the US Auto Components sector average of 0.7x. This highlights the market’s willingness to pay a premium for future growth despite persistent losses.

- According to analysts’ consensus view, this premium can only be justified by sustained top-line momentum and rapid advancement towards profitability,

- while any disappointment in scaling, adoption rates, or margin improvement could pressure the valuation back towards sector norms,

- making execution risk especially important for new investors comparing the growth story with current multiples.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Mobileye Global on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on Mobileye’s growth and valuation? Build your own view and contribute your perspective in just a few minutes with us: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Mobileye Global.

See What Else Is Out There

Mobileye’s steep losses, lack of margin improvement, and elevated valuation multiples highlight ongoing uncertainty about when profitability and financial stability will be achieved.

If you prefer dependable growth and want to avoid the volatility of turnarounds, use stable growth stocks screener (2090 results) to target companies delivering consistent and steady performance year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MBLY

Mobileye Global

Develops and deploys advanced driver assistance systems (ADAS) and autonomous driving technologies and solutions worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives