- United States

- /

- Auto Components

- /

- NasdaqGS:MBLY

Mobileye (MBLY): Evaluating Valuation After Robust Q3 Results and Raised Outlook

Reviewed by Simply Wall St

Mobileye Global (MBLY) delivered third quarter results that exceeded expectations, fueled by rising sales of its EyeQ systems as automaker demand picked up with normalized inventories. The company also raised its full-year revenue and income forecasts.

See our latest analysis for Mobileye Global.

Mobileye's focus on ADAS innovation and its recent contract wins have not translated to a rally just yet, with the stock's latest share price closing at $13.44 and posting a year-to-date share price return of -32.87%. Even so, long-term shareholders are slightly ahead, notching a 6.1% total shareholder return over the past year, which shows some underlying strength despite recent pressures in tech stocks and sector headwinds.

If you're interested in seeing what other auto innovators are doing, check out the full landscape of possibilities with our auto manufacturers screener. It's the smartest next step for curious investors. See the full list for free.

With shares trading well below analyst targets despite solid growth and improved guidance, the real question is whether Mobileye is an overlooked value or if the current price fully reflects its future potential.

Most Popular Narrative: 30% Undervalued

Mobileye Global’s most widely followed narrative points to a fair value estimate that is significantly ahead of the last close price. This signals a substantial gap between market sentiment and consensus projections, setting up a debate about whether the current valuation truly captures Mobileye’s future prospects.

Mobileye's success in rapidly achieving design wins in Q1 showcases robust forward demand for single-chip front camera systems and future volume expansion. This indicates potential revenue growth. There is strategic alignment with OEMs to integrate Mobileye's advanced technology and software for future safety features, forecasting enhanced long-term earnings given the sustained demand for multi-camera setups and highway hands-free driving systems.

Eager to uncover what’s powering that bold fair value? You might be surprised which financial forecasts are key here—consider ambitious margin targets and revenue leaps. The blueprint for this valuation reveals growth assumptions and market leaps that diverge from the crowd. Dive into the full narrative to see the proof behind the optimism.

Result: Fair Value of $19.28 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, key risks remain, including potential tariffs on auto components and uncertainty in global vehicle production. These factors could dent Mobileye's revenue outlook.

Find out about the key risks to this Mobileye Global narrative.

Another View: How Market Multiples Stack Up

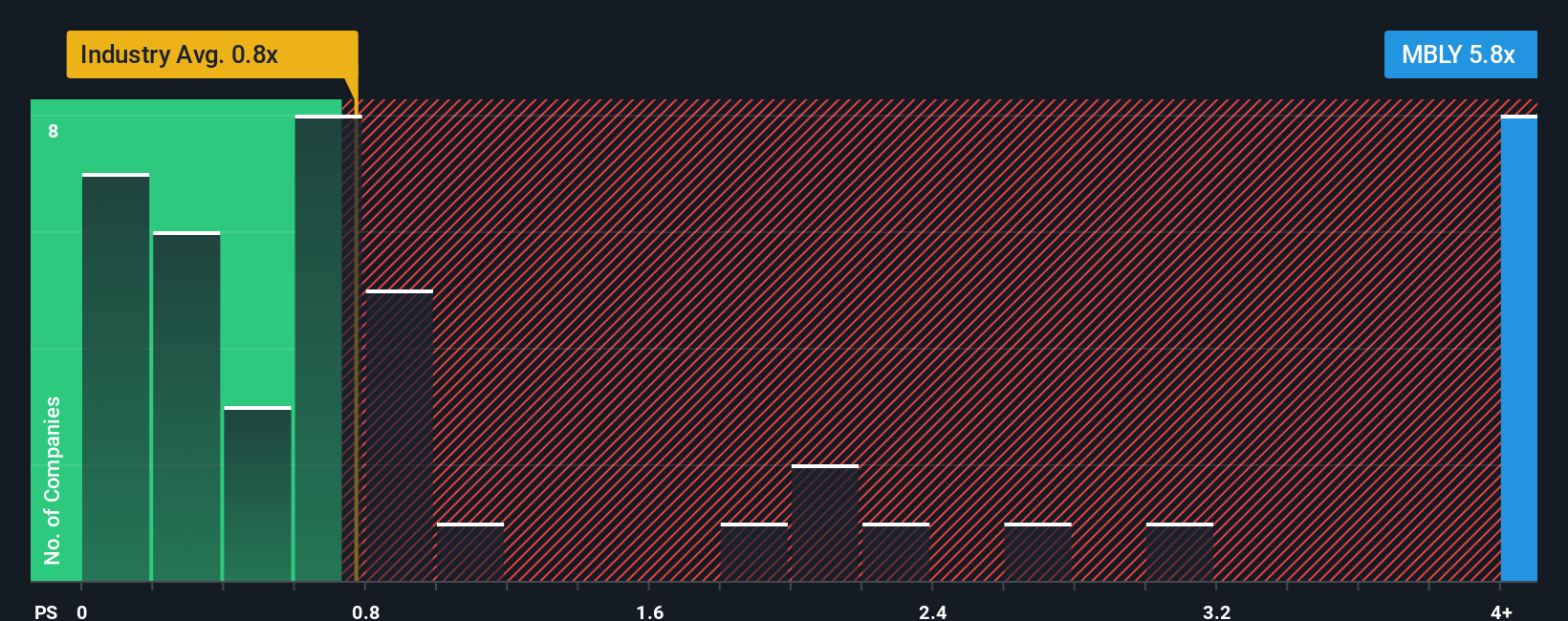

While one model points to Mobileye being undervalued, the price-to-sales ratio tells a different story. Mobileye trades at 5.6 times sales, which is far above its industry average of 0.7 times and also above its fair ratio of 4.6. This suggests the stock is expensive compared to its peers. Will market momentum bridge or widen that gap?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mobileye Global Narrative

If you want to chart your own course or question the story so far, you can dive in and craft your own perspective in just a few minutes: Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Mobileye Global.

Looking for more investment ideas?

Put yourself ahead of the curve by uncovering unique investments you won’t find on every shortlist. Don’t look back wishing you’d seized these opportunities first.

- Uncover growth potential in the next wave of artificial intelligence innovation by accessing these 27 AI penny stocks right now.

- Target hidden gems trading for less than their future cash flows with these 877 undervalued stocks based on cash flows and sharpen your edge against the market.

- Secure your portfolio against volatility while earning attractive returns using these 17 dividend stocks with yields > 3% to spot the most promising yield opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MBLY

Mobileye Global

Develops and deploys advanced driver assistance systems (ADAS) and autonomous driving technologies and solutions worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives