- United States

- /

- Auto Components

- /

- NasdaqGS:MBLY

Mobileye Global (MBLY) Is Down 5.4% After Raising 2025 Revenue Outlook and Cutting Loss Forecasts

Reviewed by Simply Wall St

- Mobileye Global Inc. recently reported second-quarter 2025 earnings, showing sales rising to US$506 million from US$439 million a year ago, with net loss narrowing to US$67 million compared to US$86 million in the prior year period.

- An important insight from the announcement is that Mobileye has raised its full-year 2025 revenue guidance and reduced projected operating losses, citing higher demand and shipment volumes for its EyeQ and SuperVision products along with improved operational margins.

- We'll examine how Mobileye's upward revision of its revenue outlook and operating loss guides the company's ongoing investment narrative.

Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

Mobileye Global Investment Narrative Recap

To be a Mobileye Global shareholder, you likely believe that rising adoption of advanced driver-assistance and autonomous vehicle technology will drive long-term demand for its systems, despite current unprofitability. The revised 2025 revenue and operating loss guidance points to stronger order momentum and operational improvements, which may support the short-term catalyst of increased EyeQ and SuperVision shipments, but ongoing uncertainty in global vehicle production and customer decision-making remains a significant risk for the business right now.

The recent announcement of higher full-year revenue guidance and narrower expected operating losses is especially relevant and reinforces the significance of shipment growth for Mobileye’s core products. Sustained demand for advanced driver-assistance features is clearly underpinning management’s confidence, but investors should also assess how supply-chain and industry volatility could affect future visibility and margins.

By contrast, investors should be mindful that a major risk, namely, the potential impact of tariffs and global trade frictions on top customer volumes, ...

Read the full narrative on Mobileye Global (it's free!)

Mobileye Global's outlook suggests $2.8 billion in revenue and $50.9 million in earnings by 2028. This is based on a projected 14.2% annual revenue growth and a $3.05 billion increase in earnings from the current -$3.0 billion.

Uncover how Mobileye Global's forecasts yield a $19.97 fair value, a 32% upside to its current price.

Exploring Other Perspectives

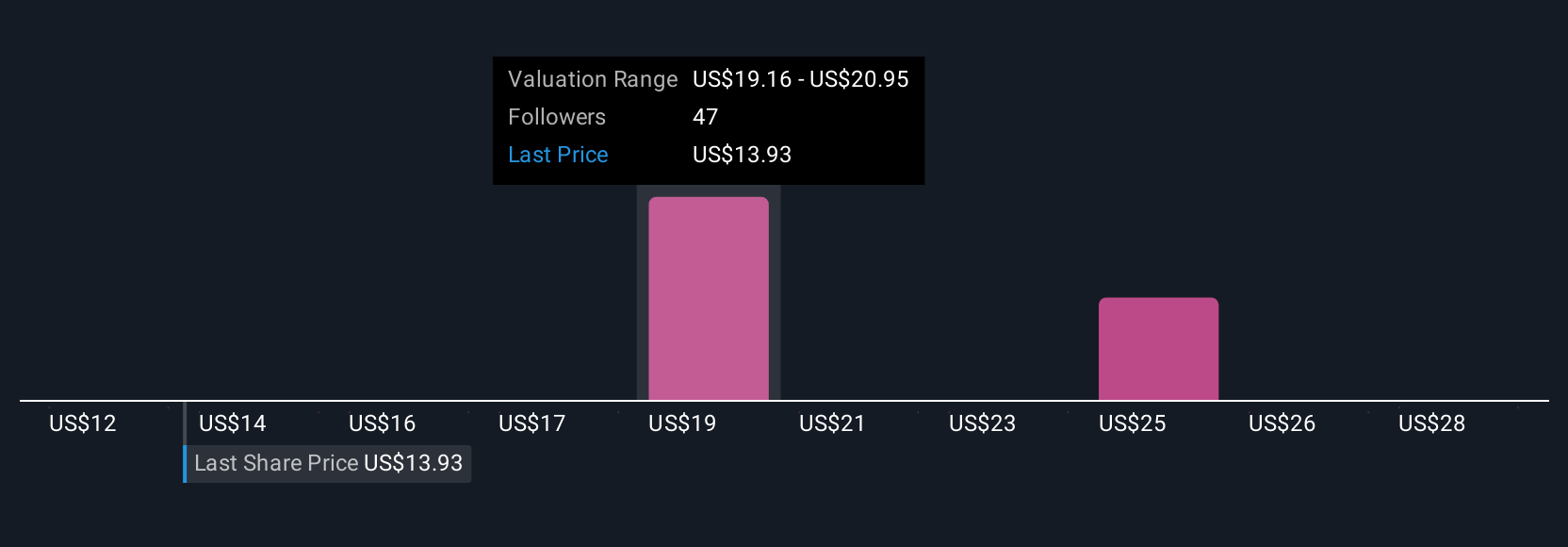

Four members of the Simply Wall St Community provided fair value estimates for Mobileye Global, ranging widely from US$12 to nearly US$30 per share. With new guidance based on stronger shipments, you might consider how shifting global demand and supply-chain risks could influence future revenue and margins, so be sure to explore different viewpoints before forming your own outlook.

Explore 4 other fair value estimates on Mobileye Global - why the stock might be worth as much as 97% more than the current price!

Build Your Own Mobileye Global Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mobileye Global research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Mobileye Global research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mobileye Global's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MBLY

Mobileye Global

Develops and deploys advanced driver assistance systems (ADAS) and autonomous driving technologies and solutions worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives