- United States

- /

- Auto Components

- /

- NasdaqGS:MBLY

Exploring Mobileye (MBLY) Valuation as Modest Share Price Gains Spark Investor Interest

Reviewed by Kshitija Bhandaru

Shares of Mobileye Global (MBLY) have edged higher in the past week, catching some attention from investors interested in the company’s performance as autonomous driving technology continues to evolve. The stock’s recent moves open up discussion around valuation and growth prospects.

See our latest analysis for Mobileye Global.

Mobileye’s share price has made only modest gains in the past week, but it’s worth noting that momentum has been a bit uneven. The 1-year total shareholder return sits just above zero. The stock’s move seems to reflect ongoing debate among investors about how quickly autonomous driving will go mainstream and how that growth outlook compares to current valuation.

If you’re interested in discovering more advanced players in automotive technology, check out the full lineup with our auto manufacturers screener. It’s a great way to spot opportunities beyond the usual names. See the full list for free.

With shares still trading well below most analyst price targets, the question remains: is Mobileye’s current valuation signaling a hidden discount, or is the market already accounting for all future upside?

Most Popular Narrative: 25.8% Undervalued

Mobileye Global’s most cited narrative estimates a fair value far higher than the last closing share price of $14.60. Investors are watching to see if bold assumptions on future profits will play out.

The partnership with leading platforms like Uber and Lyft for the integration of Mobileye Drive is positioned to significantly enhance Mobileye’s revenue streams through upfront sales and recurring license fees tied to utilization rates. Expansion in partnerships, such as the new engagement with a European OEM after 8 years, portrays increasing market share and potential uplift in revenue due to wider adoption of Mobileye's technology.

Want to know the growth blueprint behind this premium valuation? One daring financial assumption transforms future prospects into a striking price tag. What could possibly underpin these bullish forecasts for profit and revenue? Seek out the drivers behind this high-conviction scenario by clicking to see what’s fueling the optimism.

Result: Fair Value of $19.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including global trade frictions and slower OEM decision-making. Both of these factors could impact Mobileye’s revenue trajectory going forward.

Find out about the key risks to this Mobileye Global narrative.

Another View: Is Multiples-Based Valuation Pointing to a Premium?

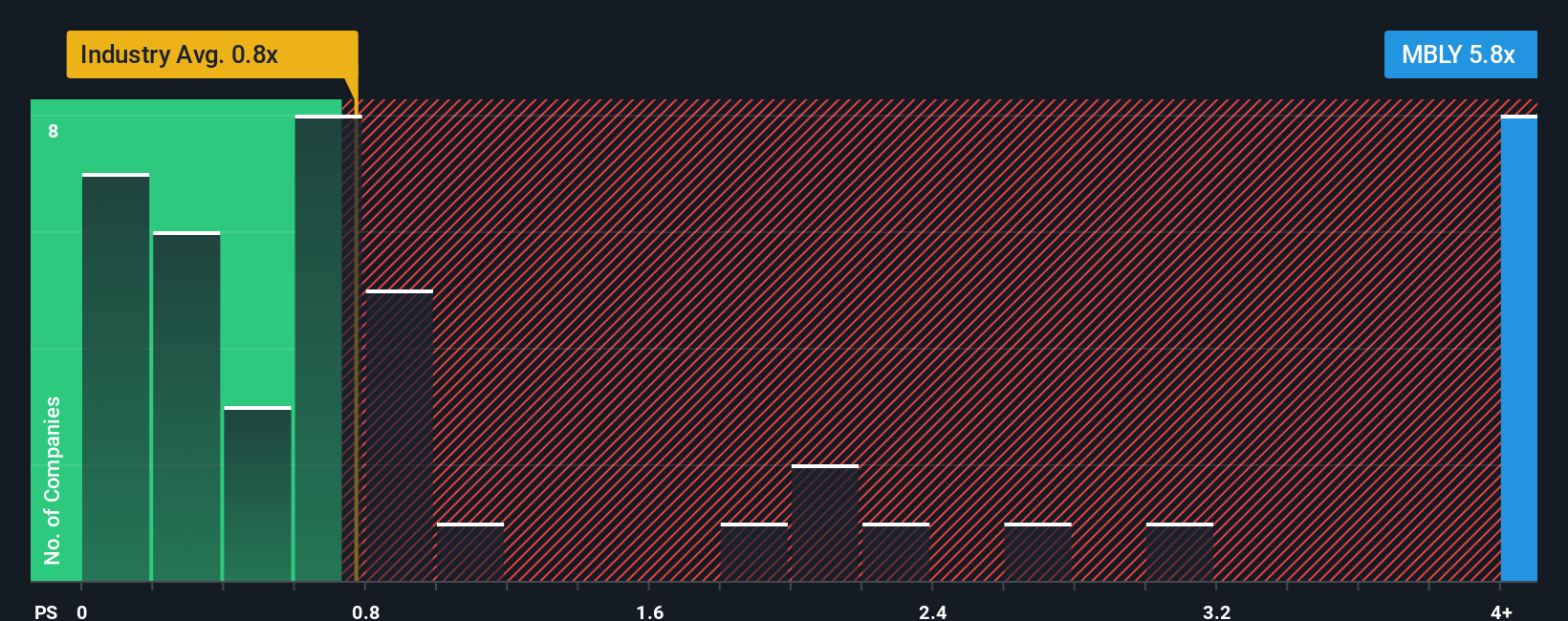

While the SWS DCF model presents Mobileye as undervalued compared to its future cash flows, a look through the price-to-sales lens suggests a different story. Mobileye trades at a price-to-sales ratio of 6.2x, well above the US Auto Components industry average of 0.7x and a peer average of 1.4x, as well as its own fair ratio of 4.5x. This signals that the market is assigning a much higher value to its revenues than the broader sector or its closest peers. Does this multiple reflect future potential, or is there over-optimism present?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mobileye Global Narrative

If you’d rather dive into the numbers and build out your own viewpoint, you can craft a personal analysis faster than you might think. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Mobileye Global.

Looking for More Smart Investment Ideas?

Seize your next opportunity with Simply Wall Street’s screeners. These tools are designed to help you pinpoint standout stocks and trends that others might overlook.

- Boost your portfolio potential by targeting these 910 undervalued stocks based on cash flows with strong cash flow fundamentals that are poised for growth.

- Tap into tomorrow's innovators by seeking out these 24 AI penny stocks focused on advancements in artificial intelligence and automation.

- Collect consistent income with these 19 dividend stocks with yields > 3% that deliver reliable yields above 3 percent for steady returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MBLY

Mobileye Global

Develops and deploys advanced driver assistance systems (ADAS) and autonomous driving technologies and solutions worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026