- United States

- /

- Auto

- /

- NasdaqGS:LI

Li Auto (NasdaqGS:LI) Valuation in Focus After EV Fire Incident and Sales Challenges

Reviewed by Simply Wall St

Li Auto (NasdaqGS:LI) is under fresh scrutiny after a Li Mega electric MPV ignited and was destroyed in China, reportedly involving the CATL battery pack. This event comes at a time when the company faces sales declines and shifting industry expectations.

See our latest analysis for Li Auto.

Heading into 2024, Li Auto’s share price has lost momentum, with a 30-day share price return of -10.02% and a year-to-date decline of -8.74%. Recent safety incidents and sales struggles have only reinforced the caution, as the 1-year total shareholder return stands at -23.86%. However, looking further back, the three-year total shareholder return is a much stronger 53.72%. This indicates the company’s long-term growth story remains intact despite current headwinds.

If you’re curious about what else is trending in the automotive sector, take the next step and discover See the full list for free.

Given this backdrop of heightened scrutiny, ongoing safety concerns, and a share price still significantly below analyst targets, investors are now weighing whether the dip in Li Auto’s valuation signals an attractive entry point or if recent headwinds are already reflected in the current price.

Most Popular Narrative: 24.1% Undervalued

With Li Auto’s fair value estimate set at $28.87 per share, and the stock last closed at $21.92, the market is pricing in a meaningful discount. The narrative points to a gap driven by expected technological and market gains.

The company's ongoing transition from extended-range vehicles (EREVs) to pure battery electric vehicles (BEVs), including successful launches of the Li MEGA and Li i8 and the upcoming Li i6, positions Li Auto to capture expanding market share as Chinese middle-class consumers upgrade and EV adoption accelerates. This directly supports long-term revenue growth and total addressable market expansion.

Curious which bold assumptions power this valuation? The narrative is driven by projections for future sales, high-margin tech, and aggressive market expansion. Want to see what’s fueling analyst enthusiasm? Uncover the numbers and the logic behind this forecast to see where the next leap could come from.

Result: Fair Value of $28.87 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cash burn and mounting competition could quickly undermine these bullish projections, particularly if sales or profit margins fall short of expectations.

Find out about the key risks to this Li Auto narrative.

Another View: What Do Multiples Say?

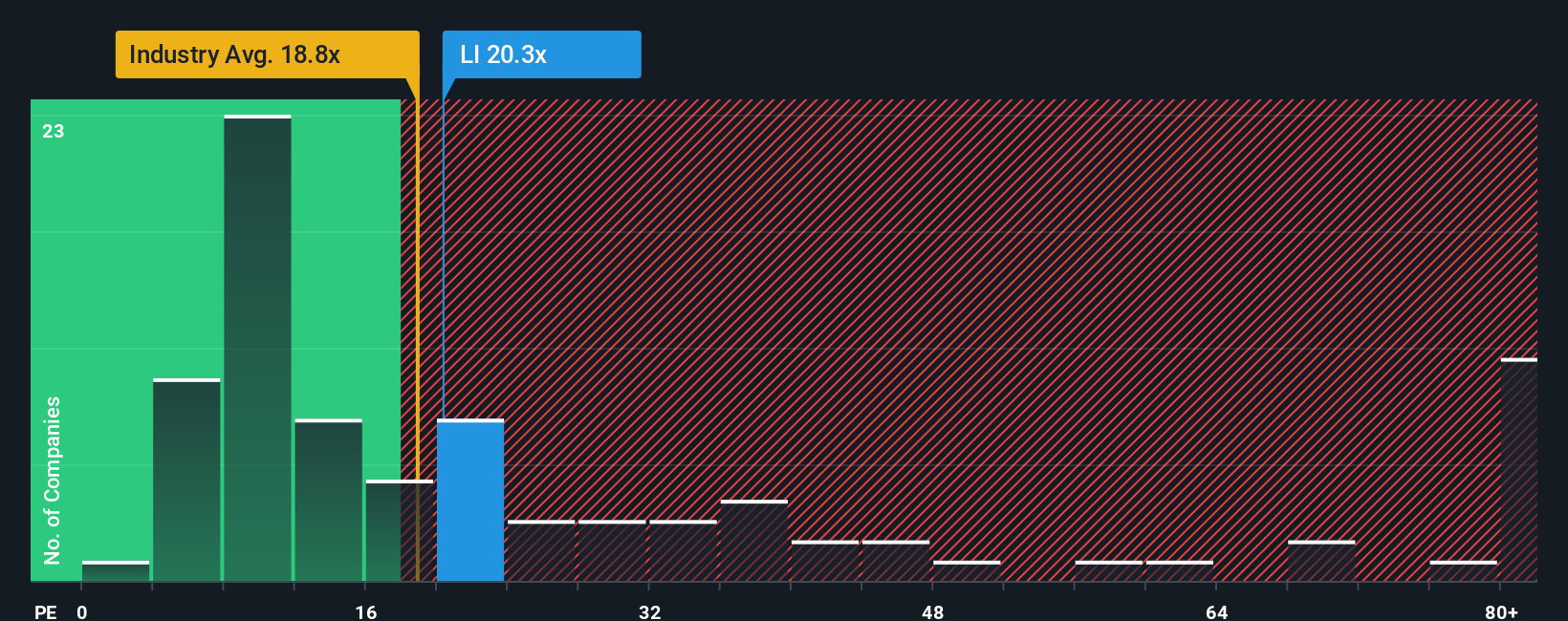

Looking at Li Auto through its price-to-earnings ratio, the stock trades at 19.5x. This is slightly above the global auto industry average of 18.8x, but below the peer average of 23x. Interestingly, this is also lower than the fair ratio of 25.1x, suggesting the market might recognize some risk but could also offer potential upside. Does this make the current price point a value opportunity, or could there be reasons the market stays cautious?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Li Auto Narrative

If you see things differently or want to dig into the numbers yourself, you can quickly craft your own take in just a few minutes, so why not Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Li Auto.

Looking for more investment ideas?

Why stop at just one opportunity? Give yourself the edge by checking out standout stocks built around fresh growth stories and emerging trends today.

- Pounce on growth by scouting these 877 undervalued stocks based on cash flows, where the financials are stacked in their favor and there is potential for real upside.

- Unlock tomorrow’s breakthroughs by scanning these 28 quantum computing stocks, which are blazing a trail in quantum computing technologies and next-gen applications.

- Boost your income potential by targeting these 17 dividend stocks with yields > 3%, offering attractive yields and the potential for sustainable dividends above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LI

Li Auto

Operates in the energy vehicle market in the People’s Republic of China.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives