- United States

- /

- Auto

- /

- NasdaqGS:LI

Can Li Auto’s (LI) Trim Simplification Reflect a Deeper Shift in Its Competitive Strategy?

Reviewed by Simply Wall St

- Li Auto recently streamlined its new i8 electric SUV lineup from three trims to a single version, responding to consumer feedback and weak initial sales after its July 29 launch.

- This rapid adjustment reflects both intense competition in China’s electric vehicle market and the importance of product simplicity for attracting customers.

- Next, we'll examine how Li Auto's swift product realignment in response to customer preferences may impact its investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Li Auto Investment Narrative Recap

To invest in Li Auto, you must believe the company can maintain its growth and defend profit margins amid fierce competition and pricing pressure in China's electric vehicle market. The recent move to simplify the i8 lineup may help address customer confusion and slow initial sales, but the primary short-term catalyst, the company’s ability to regain sales momentum, remains unchanged. The biggest risk continues to be margin pressure from lower average selling prices and possible loss of market share in an aggressive market.

The latest delivery report is directly relevant, highlighting a 39.7% year-on-year drop in July 2025 after the i8 launch. This underlines how vital it is for Li Auto to convert product improvements into stronger sales to support growth forecasts and bolster investor confidence. In contrast to positive innovation headlines, recent trends in unit deliveries illustrate how quickly changing consumer sentiment can weigh on earnings.

However, with competition and discounting intensifying, investors should also be aware of...

Read the full narrative on Li Auto (it's free!)

Li Auto's outlook anticipates CN¥251.3 billion in revenue and CN¥17.4 billion in earnings by 2028. This assumes a 20.2% annual revenue growth rate and an earnings increase of CN¥9.3 billion from the current CN¥8.1 billion.

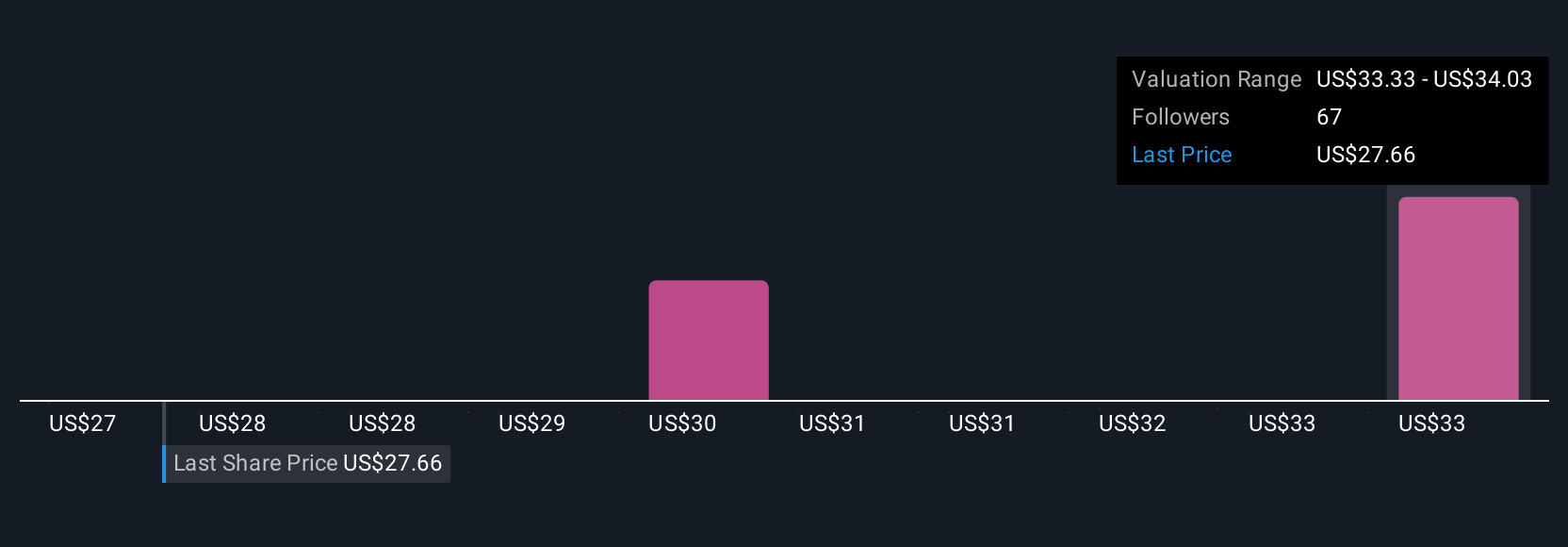

Uncover how Li Auto's forecasts yield a $33.55 fair value, a 30% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community estimated Li Auto’s fair value between CN¥26.99 and CN¥33.55 per share. Yet, with recent delivery declines and margin compression, these views highlight how much perspectives can differ across the market.

Explore 5 other fair value estimates on Li Auto - why the stock might be worth as much as 30% more than the current price!

Build Your Own Li Auto Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Li Auto research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Li Auto research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Li Auto's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LI

Li Auto

Operates in the energy vehicle market in the People’s Republic of China.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives